Houselungo 13 March 22

Halifax house prices another record high

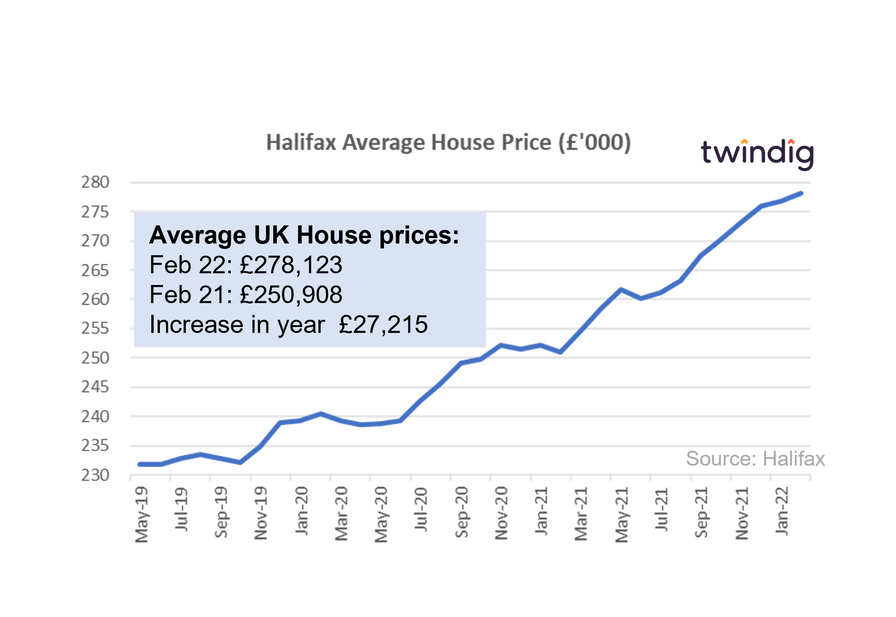

The Halifax released their house price index for February this week

What they said

Average UK house prices £278,123

Increase over the last year £27,215

Annual house price inflation 10.8%, its highest level since June 2007

Twindig take

According to the latest Halifax house price index, UK house prices rose for the eighth successive month in February, rising by another 0.5% or £1,478. The rate of annual house price inflation was 10.8%, which is the highest level since June 2007. The rise of £27,215 is the biggest one year increase recorded by the Halifax house price index in its 39-year history.

Lack of supply continues to underpin house prices, but for how much longer can house price records be broken each month? Surely at some point, the rising house price music must stop...?

Mortgage rates also on the rise

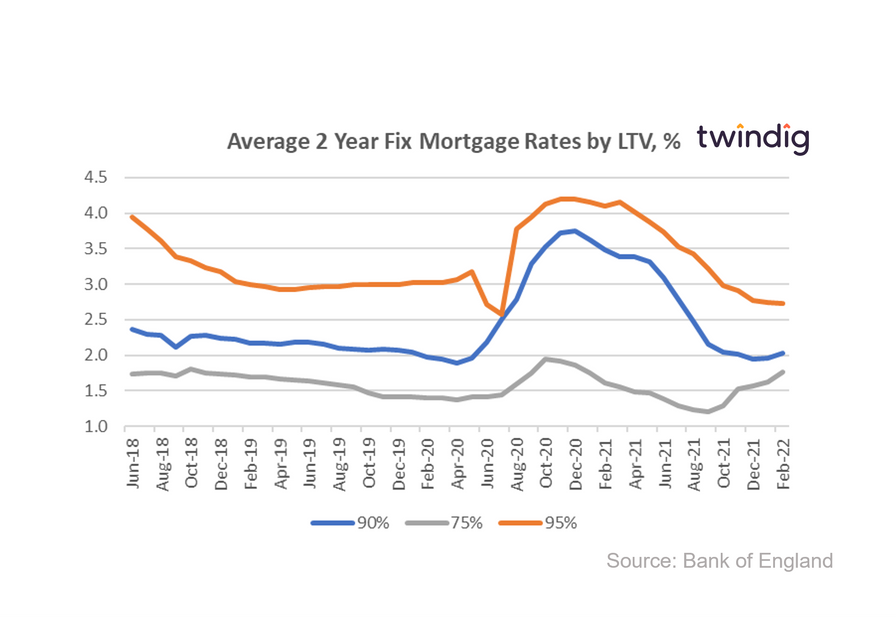

The Bank of England released average mortgage rates by Loan to Value (LTV) this week

What they said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 1.76%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 2.03%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 2.73%

Twindig Take

We mentioned last month that it appeared to us that mortgage rates were bottoming out and the mortgage rate data for February adds weight to our view. The average mortgage rate for a 75% LTV 2 year fixed rate mortgage is now 1.76% up from 1.62% in January 2022.

The average mortgage rate for a 90% 2-year fixed-rate mortgage also increased in February to 2.03%, up from 1.96% the month before.

However, once again the mortgage rates for 95% LTV 2-year fixed-rate mortgages bucked the trend, falling slightly from 2.75% in January 2022 to 2.73% in February. The average rate for these 95% fixed-rate mortgages has now fallen every month since March 2021 when the average rate was 4.16%. These rates are therefore very attractive in our view.

Disappearing mortgages, should I be worried?

Mortgages pulled from the shelves

According to the money comparison website Moneyfacts, as mortgage rates start to rise the number of mortgages available in the market has started to fall.

There were 518 fewer mortgage products available at the start of March compared to the beginning of February, according to Moneyfacts. They said that this was the biggest monthly reduction in the number of mortgage available since May 2020, when 626 products were pulled as a result of uncertainty and disruption caused by the pandemic.

Should I be worried?

At one level there appears to be a dizzying choice of mortgage products available, almost five thousand (4,838), and if you are like us and struggle to choose food from a one-sided, one-page menu on an evening out, you may be asking what is all the fuss about?

It all comes down to risk appetite and signalling. When a lender is feeling confident about the housing market they tend to increase the number of products they have on sale, to increase the appeal and demand for their mortgages across highly differentiated mortgage customers. Some may target dual-income first-time buyers with a small deposit, others may target re-mortgaging households with one income, looking for a 60% LTV mortgage.

However, as the level of uncertainty increases, and for 'level of uncertainty' read 'risk' increasing lenders are likely to reduce the number of mortgage products for sale to reign in demand.

The hottest and coldest housing markets in Wales right now

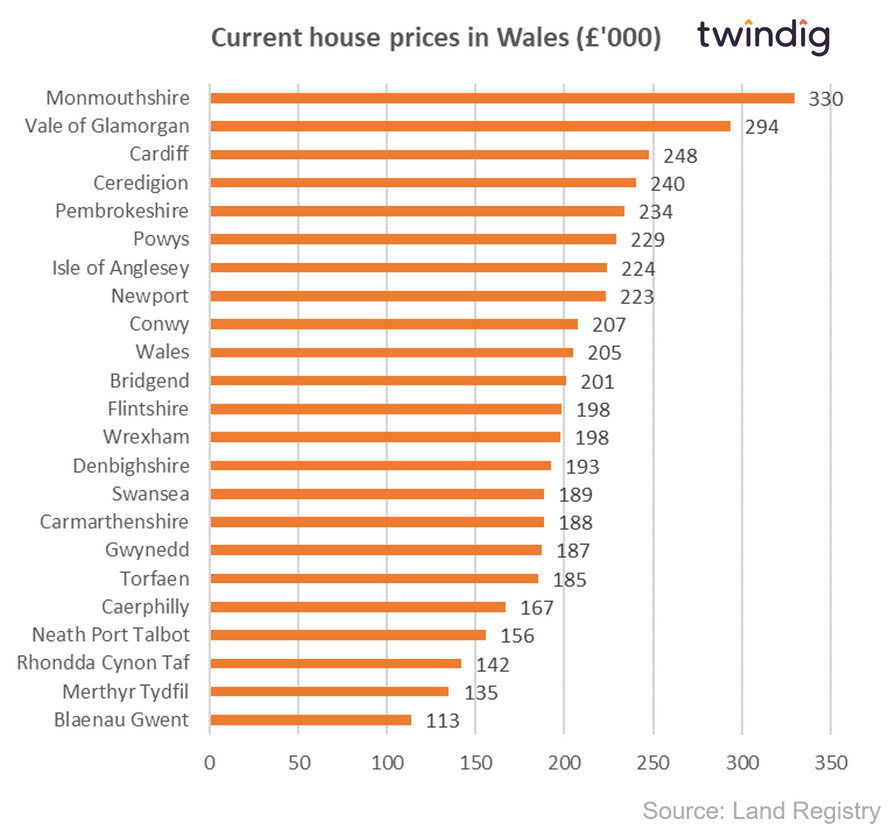

The latest data from the Land Registry reveals that the average house price in Wales is currently £205,000.

On average house prices in Wales increased by 2.0% or £4,060 over the last month

Over the last year (last 12 calendar months) average house prices in Wales increased by 13% or £23,560

However, across Wales, there is a big spread of house prices at the Local Authority level ranging from £113,000 in Blaenau Gwent to £330,000 in Monmouthshire.

The three most expensive areas for house prices in Wales are:

Monmouthshire where average house prices are £330,000

The Vale of Glamorgan where average house prices are £294,000, and

Cardiff, where average house prices are £248,000

The three least expensive areas for house prices in Wales are:

Blaenau Gwent where average house prices are £113,000

Merthyr Tydfil with average house prices of £135,000, and

Rhonda Cynon Taf where average house prices are £142,000

To see the house price winners and losers over the last month and last year, click read more:

Twindig Housing Market Index

n the week that saw another record high for house prices, record results from Savills, a reassuring trading update from Berkeley Group mortgage products taken off the shelves and mortgage rates start to rise, the Twindig Housing Market Index fell for a fourth week in a row to 76.0, its lowest level since 6 November 2020.

Investor confidence in the housing market seems to be at odds with the underlying health of the housing market. We attended two housing conferences this week:

The Guild of Property Professionals, and

Fine and Country

At both conferences, estate agents and suppliers to estate agents had a spring in their step. We spoke to agents from Exeter to Edinburgh, and from Highgate to the Highlands, all were surprised by the continued strength of the housing market following the end of the stamp duty holiday