Mortgage rates on the rise

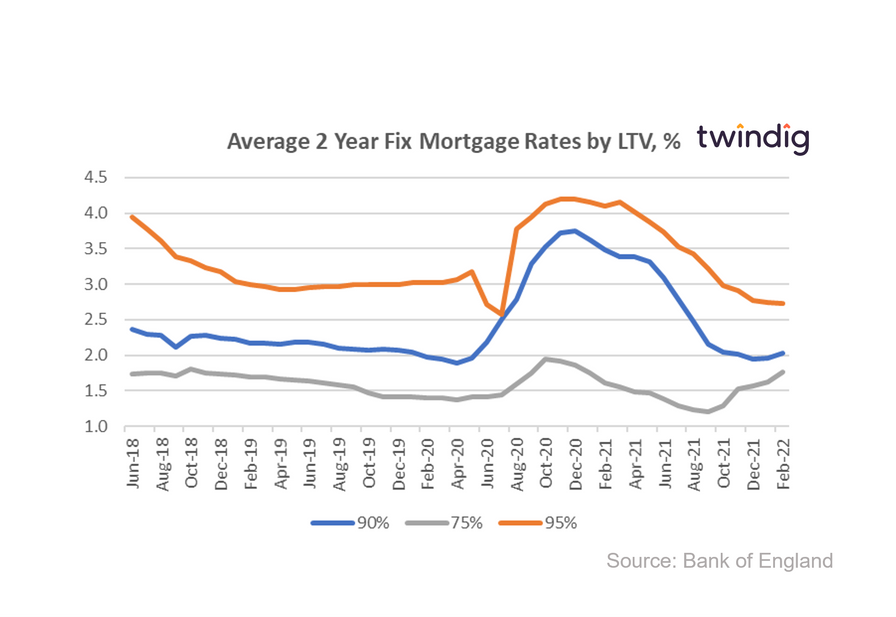

The Bank of England released average mortgage rates by Loan to Value (LTV) today

What they said

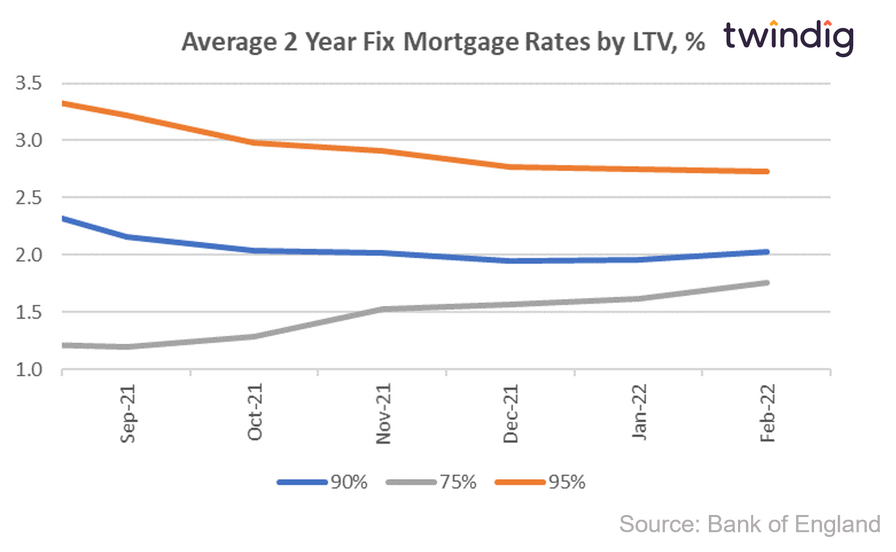

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 1.76%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 2.03%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 2.73%

Twindig Take

We mentioned last month that it appeared to us that mortgage rates were bottoming out and the mortgage rate data for February adds weight to our view. The average mortgage rate for a 75% LTV 2 year fixed rate mortgage is now 1.76% up from 1.62% in January 2022.

The average mortgage rate for a 90% 2-year fixed-rate mortgage also increased in February to 2.03%, up from 1.96% the month before.

However, once again the mortgage rates for 95% LTV 2-year fixed-rate mortgages bucked the trend, falling slightly from 2.75% in January 2022 to 2.73% in February. The average rate for these 95% fixed-rate mortgages has now fallen every month since March 2021 when the average rate was 4.16%. These rates are therefore very attractive in our view.

With Bank Rate expected to rise again in the near future we would be surprised if the higher LTV mortgage rates can continue to fall. The chart below zooms in on the more recent changes to average mortgage rates. As noted above the rates for 75% LTV mortgages have been slowly rising for some time, the rates for 90% LTV mortgages have turned and we expect those of the 95% LTV mortgages to fall in line (or is that rise in line) soon.

Mortgage rates remain very low in a historical context, so although you may have missed the very lowest rates available, the mortgage rates currently available remain attractive.