Houselungo 12 December 21

House prices rise for fifth month in a row

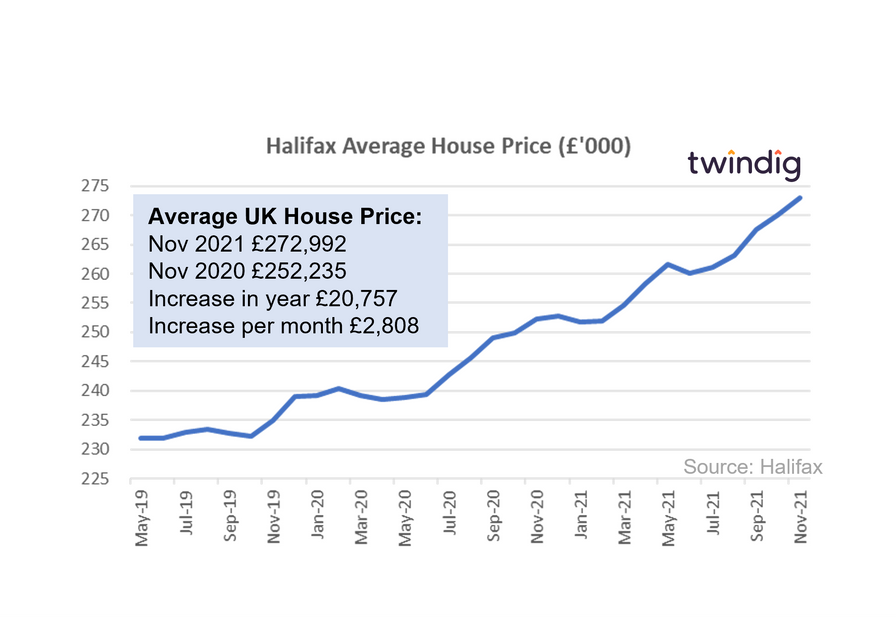

The Halifax published their November House Price Index this morning.

What they said

Average UK Property price hits record high of £272,992

Quarterly house price inflation at its strongest level since 2006

Race for space starting to wane

Twindig take

House price growth continues to be underpinned by a shortage of homes for sale, a competitive mortgage market and a strong labour market. The latest data from the Halifax suggests that House prices have risen for the five month in a row.

The Halifax data also suggests that the 'race for space' may be waning as annual house price inflation for detached properties at 6.6% is eclipsed by that of flats at 10.8%. Increased mortgage availability for first-time buyers may be aiding house price inflation on the lower rungs of the ladder.

Housing demand continues to outstrip supply

The Royal Institution of Chartered Surveyors published their latest UK Residential Market Survey today

What they said

Lack of new listings continues to restrict sales

House price growth remains firm

Shortage of rental properties expected to drive up rents

Twindig take

The November survey is a story of the haves and the have nots with those owning property either as owner-occupiers or landlords gaining at the expense of tenants and homebuyers and both market dynamics make bleak mid-winter reading for aspiring house buyers.

The lack of new instructions is not a surprise as we are still feeling the impact of the ending of the Stamp Duty holiday, we would also expect December to be a quiet month due to both the Christmas holiday season and ‘Plan B’ and the spread of the Omicron variant.

RICS reported a net balance of -18% of respondents reporting a deterioration in the flow of new instructions and the volume of market appraisals a net balance of -20%, which suggests the pipelines are not currently building.

Are mortgage rates on the turn?

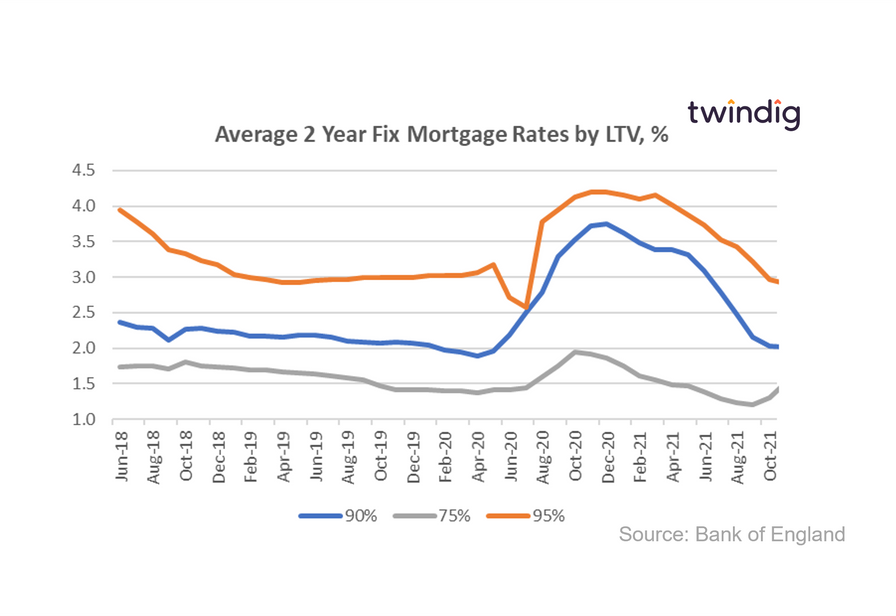

The Bank of England released data today about mortgage rates by Loan To Values (LTVs)

What they said

Average mortgage rate for 75% LTV mortgages 1.52%

Average mortgage rate for 90% LTV mortgages 2.02%

Average mortgage rate for 95% LTV mortgages 2.91%

Twindig take

The average mortgage rate for a two year fixed rate 75% LTV mortgage has risen for the second month in a row, whilst mortgage rates for higher LTV products continue to fall, the rate of decline has reduced significantly. Many commentators believe that an increase in Bank Rate is now inevitable and perhaps the latest rate movements indicate that mortgage rates are on the turn. However, with the added economic uncertainty caused by Omicron, the timing of a rise in Bank Rate may not be as inevitable as some believe.

What does this mean for house prices?

Falling mortgage rates support further house price growth as a lower mortgage rate means the cost of a mortgage is cheaper and therefore you can afford to take on a bigger mortgage. Falling mortgage rates also imply that lenders are more optimistic about the future direction of house prices - because lower mortgage rates suggest that the risks attached to the mortgage are lower than they were and by offering lower mortgage rates lenders will expect to do more business.

Should mortgage stress tests be less stressful?

According to the Telegraph, the Bank of England is considering making the mortgage stress tests less stressful. Many housing market commentators expressed concern that the Bank of England the bastion of reason could consider such a move. However, considering does not mean doing, and we think that this type of 'considering' may just be a form of signalling.

What is the current mortgage rate stress test?

Since June 2014 borrowers have had to pass a mortgage rate stress test before a mortgage can be approved. The standard mortgage rate stress test requires mortgage lenders to apply an interest rate stress test that assesses whether borrowers could still afford their mortgages if, at any point over the first five years of the loan, Bank Rate were to be 3 percentage points higher than the prevailing rate at origination.

This had led to the significant growth in popularity of five-year fixed-rate mortgages, where it is guaranteed that the mortgage rate will not change over the entire stress test period.

Why do we need mortgage rate stress tests?

The stress tests introduced in June 2014 were part of the post-Credit Crunch Mortgage Market Review, which was written to usher in a period of responsible lending and to reduce the risks that homebuyers would get caught by rising mortgage rates in the future.

Leading up to the credit crunch the mortgage market was very competitive and there was big business to be had and money to be made from ‘teaser rates’. A teaser rate is a very low mortgage rate that attracts the homebuyer and allows them to afford a larger mortgage. However, the teaser rate period was often quite short, after which time the interest rate charged on the mortgage increased and for too many people this caused financial stress and mortgage repayment problems.

In the lead up to the Credit Crunch mortgage books were often securitised, which means the lender ‘sold’ the mortgages to another party who was then responsible for collecting the mortgage payments, this means that it was often the case that the original lender never had to deal with the fallout and difficulties caused after the end of the teaser rate period.

The stress tests were therefore put in place to reduce the harm caused by teaser rates.

What would happen if the mortgage stress test is softened?

Borrowers would be able to secure a larger mortgage, because the cost of servicing the debt would be lower, allowing them to borrow more.

Will lower stress tests lead to higher house prices?

Not necessarily. Whilst a lower mortgage rate stress test will allow homebuyers to borrow more, the Bank of England is not considering loosening the cap on mortgage income multiples (loan to income).

Currently, no more than 10% of mortgages sold in a twelve-month rolling period can be based on more than 4.5x income and we believe that this is a bigger constraint on house prices than stress tests. The average full-time wage is around £32,000 – this implies a mortgage capacity of £144,000, some £126,000 below the average UK house price. Lowering the bar on the mortgage rate stress test will not raise the bar on the ultimate amount a homeowner can borrow.

Twindig Housing Market Index

The Twindig Housing Market Index rose by 1.6% this week to 91.3 in the week that the Halifax reported that house prices had increased for five months in a row, housing demand continues to outstrip supply and it seems that mortgage rates might be on the turn.

The imbalance of housing supply and demand appears to be rather entrenched as we settle into the advent season. Taking away the stamp duty holiday has done little to cool demand and whilst supply remains constrained the outlook for house prices continues to point in an upward direction.

RICS reported this week that buyer demand is actually increasing at the moment, another pointer that perhaps the stamp duty holiday was not required.

However, could mortgage rates be on the rise? For the second time in as many months mortgage rates on 75% LTV mortgages has nudged up, whilst higher LTV mortgage projects continue to fall. Is this a case of lenders raising prices to cool demand or are they preparing for broader rate rises in the near future? We would be surprised if the Bank of England lifted Bank Rate in December, but rises next year look very likely, in our view.