House prices rise for fifth month in a row

The Halifax published their November House Price Index this morning.

What they said

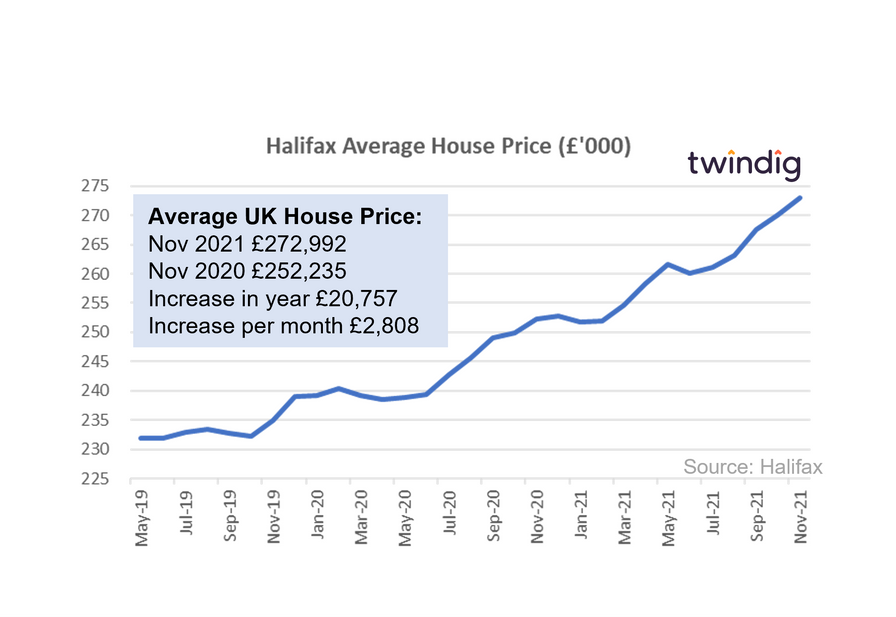

Average UK Property price hits record high of £272,992

Quarterly house price inflation at its strongest level since 2006

Race for space starting to wane

Twindig take

House price growth continues to be underpinned by a shortage of homes for sale, a competitive mortgage market and a strong labour market. The latest data from the Halifax suggests that House prices have risen for the fifth month in a row.

The Halifax data also suggests that the 'race for space' may be waning as annual house price inflation for detached properties at 6.6% is eclipsed by that of flats at 10.8%. Increased mortgage availability for first-time buyers may be aiding house price inflation on the lower rungs of the ladder.

Moneyfacts reported today that there are now 5,315 different mortgage products on offer to homebuyers, the highest it has been since March 2008, when it was 6,192. In particular, the choice is increasing for mortgages with loan to values in the 90% and 95% range, products which are popular with first-time buyers.

It will be interesting to see how the choice of mortgage products available will be impacted by any future rises in Bank Rate.

The Omicron variant does not seem to have worried house prices yet, house price inflation has been strong throughout the COVID pandemic. However, as house prices continue to rise, affordability is becoming increasingly stretched and if rising prices elsewhere (food, petrol, power) are not joined by rising wages house price inflation is likely to soften in the coming months.