Should mortgage stress tests be less stressful?

According to the Telegraph, the Bank of England is considering making the mortgage stress tests less stressful. Many housing market commentators expressed concern that the Bank of England the bastion of reason could consider such a move. However, considering does not mean doing, and we think that this type of 'considering' may just be a form of signalling.

What is the current mortgage rate stress test?

Since June 2014 borrowers have had to pass a mortgage rate stress test before a mortgage can be approved. The standard mortgage rate stress test requires mortgage lenders to apply an interest rate stress test that assesses whether borrowers could still afford their mortgages if, at any point over the first five years of the loan, Bank Rate were to be 3 percentage points higher than the prevailing rate at origination.

This had led to the significant growth in popularity of five-year fixed-rate mortgages, where it is guaranteed that the mortgage rate will not change over the entire stress test period.

Why do we need mortgage rate stress tests?

The stress tests introduced in June 2014 were part of the post-Credit Crunch Mortgage Market Review, which was written to usher in a period of responsible lending and to reduce the risks that homebuyers would get caught by rising mortgage rates in the future.

Leading up to the credit crunch the mortgage market was very competitive and there was big business to be had and money to be made from ‘teaser rates’. A teaser rate is a very low mortgage rate that attracts the homebuyer and allows them to afford a larger mortgage. However, the teaser rate period was often quite short, after which time the interest rate charged on the mortgage increased and for too many people this caused financial stress and mortgage repayment problems.

In the lead up to the Credit Crunch mortgage books were often securitised, which means the lender ‘sold’ the mortgages to another party who was then responsible for collecting the mortgage payments, this means that it was often the case that the original lender never had to deal with the fallout and difficulties caused after the end of the teaser rate period.

The stress tests were therefore put in place to reduce the harm caused by teaser rates.

Why consider reducing the difficulty of the mortgage rate stress tests?

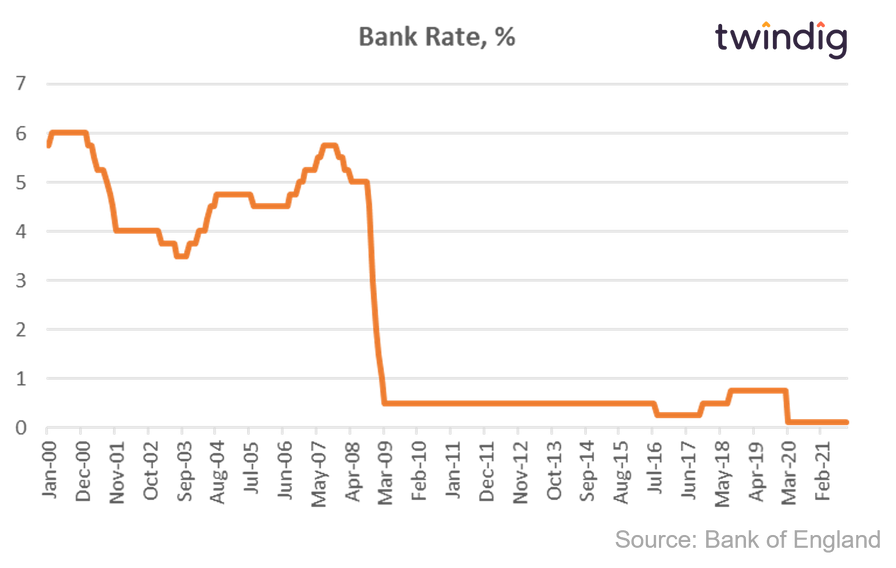

We are currently living in a very low-interest environment, which may well last for some time. Perhaps the Bank of England is not really looking to reduce the stress test but to signal or message that it does not expect Bank Rate to increase by 3 percentage points for a long time and therefore the stress test is testing for a scenario that is very unlikely to occur. Currently, Bank Rate is 0.1% the current stress test works on the basis that Bank Rate will rise to 3.1% an increase of 30 times.

What would happen if the mortgage stress test is softened?

Borrowers would be able to secure a larger mortgage, because the cost of servicing the debt would be lower, allowing them to borrow more.

Will lower stress tests lead to higher house prices?

Not necessarily. Whilst a lower mortgage rate stress test will allow homebuyers to borrow more, the Bank of England is not considering loosening the cap on mortgage income multiples (loan to income).

Currently, no more than 10% of mortgages sold in a twelve-month rolling period can be based on more than 4.5x income and we believe that this is a bigger constraint on house prices than stress tests. The average full-time wage is around £32,000 – this implies a mortgage capacity of £144,000, some £126,000 below the average UK house price. Lowering the bar on the mortgage rate stress test will not raise the bar on the ultimate amount a homeowner can borrow.

Would the Bank of England consider raising the LTI bar?

This would be unlikely, in our view. Analysis of the impact of the credit crunch revealed that those homeowners who faced the most financial stress were those who had a Debt Service Ratio (DSR)of more than 40% (ie their mortgage payment was more than 40% of their wages). Raising the maximum Loan to Income Ratio would also increase a borrower's DSR and we do not think the Bank of England would want to create an environment where DSR’s were allowed to increase significantly from their current levels.

How do you bridge the mortgage/deposit gap?

It is very difficult to buy a home in the UK based on income alone. Homebuyers typically need a very large deposit to bridge that gap. Unfortunately, house prices have become divorced from wages and we do not see an easy path to reconciliation. We believe that the answer is fractional home ownership and you can read our case for fractional homeownership here.