Houselungo 6 Nov 2022

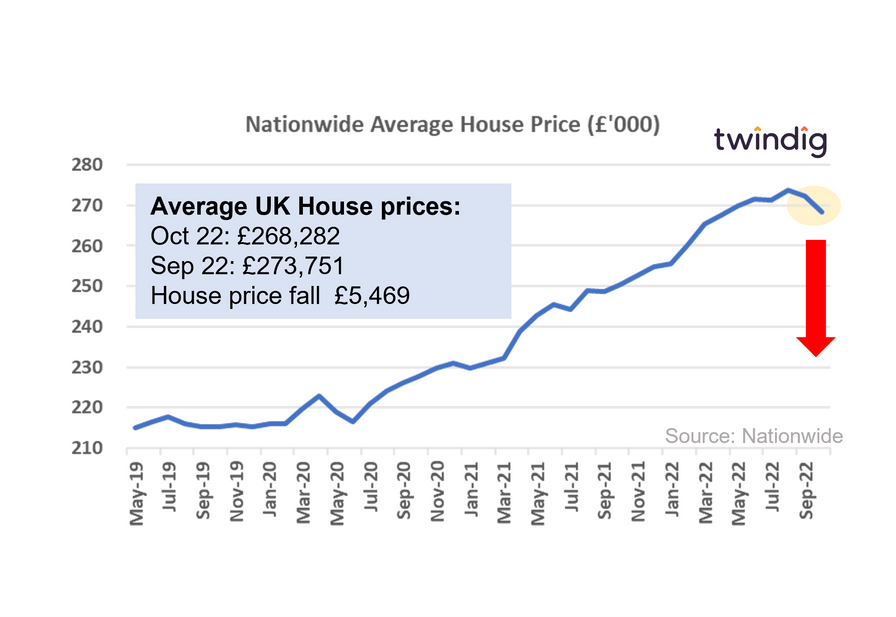

House prices fall by £5,500 in October

The Nationwide released its house price index for October this week

What Nationwide said

Average house price in October 2022 was £268,282

House prices fell by 1.5% or £5,469 in October (although the fall was 0.9% after tracking into account seasonal factors)

Annual house price inflation 7.2%

Twindig Take

After Lloyds Bank suggested that house prices may fall by 8% next year, the Nationwide reported today that house prices fell by 1.5% in October alone, the biggest fall since June 2020 (the fall that led the then Chancellor Rishi Sunak to launch the COVID-19 Stamp Duty holiday).

The question on many people's lips: was the fall caused by the now reversed mini-budget, or is this the start of a much larger downward house price slide?

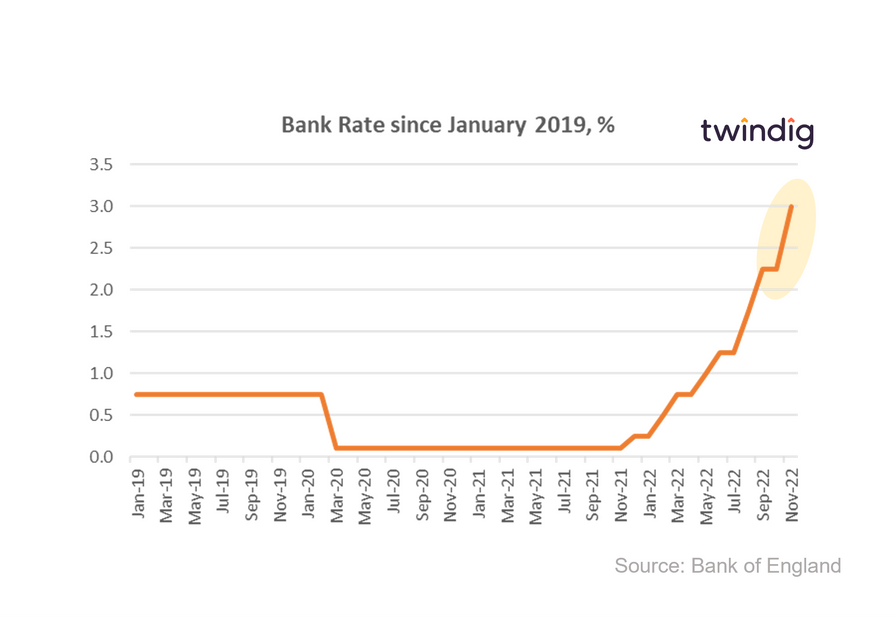

Biggest rise in Bank Rate for 30 years

The Bank of England increased Bank Rate by 75 basis points to 3.00% on Thursday this week

What the Bank of England said

Bank Rate increased from 2.25% to 3.00 %

The MPC voted by a majority of '7-2' for a 75 basis point increase

The rest of the MPC was split with one member voting for a 50bp rise and the other voting for a 25bp increase.

Twindig take

This week's rise in Bank Rate was the largest increase for 30 years (September 1992), a big rise yes, but it could have so easily been bigger. The reversal of much of the Kwarteng mini-budget has helped stabilise the financial markets and whilst the MPC describe the outlook for the UK economy as challenging, they believe that uncertainty around the outlook for UK retail energy prices has fallen following intervention from the UK Government.

Mortgage rates will go up again, and are likely to rose further in 2023, but whilst these words hold little comfort, it could have been worse.

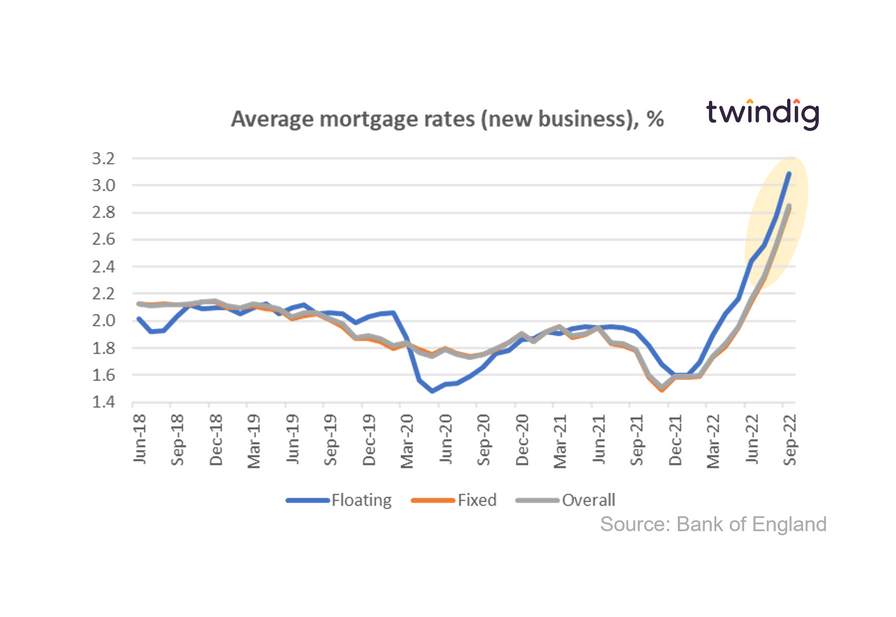

Mortgage rates up 10% in September

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in September 2022, rising by more than 10%

What the Bank of England said

The average floating mortgage rate for new business 3.09%

The average fixed mortgage rate for new business 2.83%

The average overall mortgage rate for new business 2.85%

Twindig take

Average mortgage rates for new business continued rising in September. The rates for floating-rate mortgages increased by 11.6% to 3.09% and fixed-rate mortgage rates increased by 11.0%.

Average floating rate mortgage rates for new business are now 61% higher than they were one year ago whilst average fixed-rate mortgage rates are up 59%.

We expect the increase in mortgage rates to continue, the Bank of England's Monetary Policy Committee meets this week and will announce its decision on the level of Bank Rate at midday on Thursday (3rd November). Most commentators expect to see an increase of between 75 basis points and 100 basis points, this would see Bank Rate rising from its current level of 2.25% to 3.00% or 3.25% an increase of 33% or 44% respectively.

Any increase in Bank Rate will lead to a rise in the new business rates for mortgages, most banks and building societies pass on the full increase to their customers.

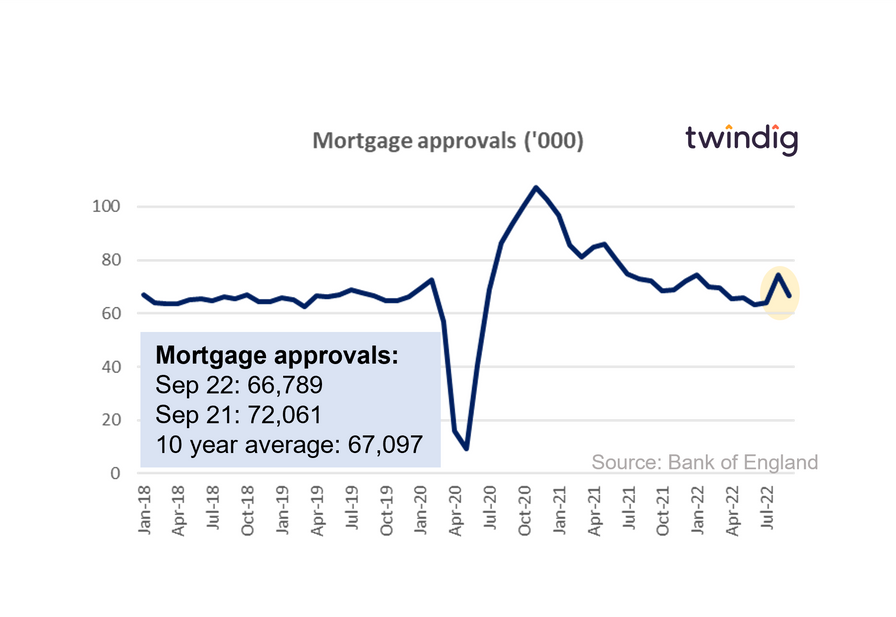

Mortgage approvals dip in September

The Bank of England released mortgage approval data for September this week

What the Bank of England said

Mortgage approvals for September 2022 were 66,789

This was 10.3% lower than the 74,422 mortgages approved in August 2022

This was 7.3% lower than the 72,061 mortgages approved during September 2021

Twindig take

After a surprise leap in August, mortgage approvals fell back to a more normal level in September. Whilst the 10% drop month on month and 7% drop year on year will grab the headlines, the key is that, in September, mortgage approvals were broadly in-line (just 308 short) with their ten-year average of 67,097.

We must also remember that in September we also gained a new Prime Minister, lost Queen Elizabeth, had a period of mourning, gained a new King, and had a 'mini-budget'. Against such a backdrop, the stability of the mortgage market is quite remarkable, especially in a period of rising mortgage rates.

After a surprise leap in August, mortgage approvals fell back to a more normal level in September. Whilst the 10% drop month on month and 7% drop year on year will grab the headlines, the key is that, in September, mortgage approvals were broadly in-line (just 308 short) with their ten-year average of 67,097.

Twindig Housing Market Index

Well, this was certainly a week to remember, as the Nationwide reported that house prices fell by £5,500 in October and the Bank of England made the biggest rise in Bank Rate for 33 years, the Twindig Housing Market Index rose by 2.8% this week to 62.8.

Residential investors were not spooked by the large 75bp rise in the Bank of England's Bank Rate, this was widely anticipated and the Bank of England was clear that rates will continue to rise for some time to come yet. Current expectations are that Bank Rate will peak at around 5.25% in the third quarter of 2023 before starting to fall. The Bank of England estimates that around 1.6 million households who are currently on fixed-rate mortgages will need to re-mortgage between now and the end of Q3 2023, and this equates to about 1 in 7 mortgages.