Housepresso 28 November 21

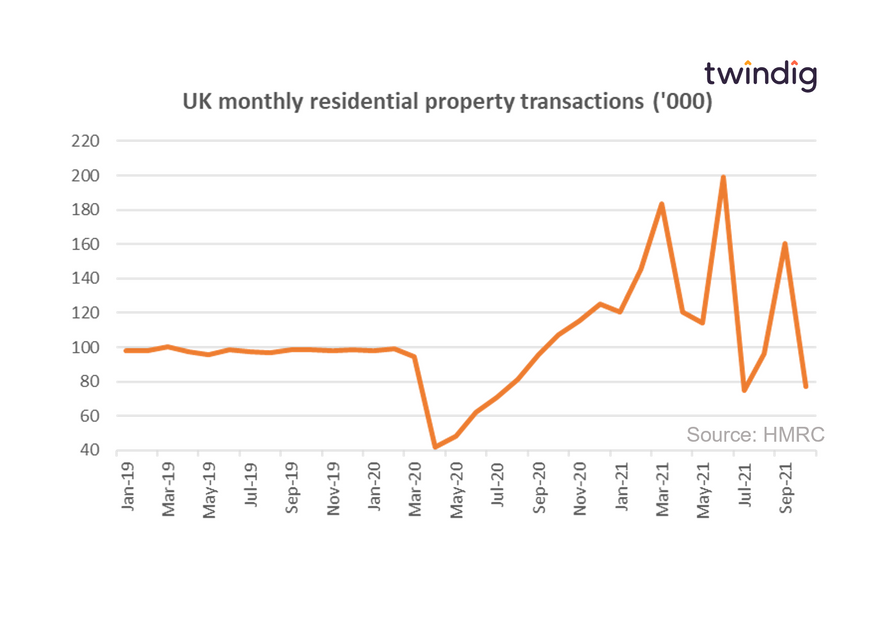

Housing transactions: the hangover after the holiday

As expected housing transactions tumbled in October as homebuyers no longer benefit from the Stamp Duty Holiday. At 76,930 housing transactions in October 2021 were, ironically, at their lowest level since the start of the Stamp Duty Holiday in July 2020 when they numbered 70,780..

Deposit still biggest barrier for First Time Buyers

The Nationwide released a special report this morning reaffirming that raising a deposit was still the biggest hurdle for first-time buyers. If anything, the bar has been raised higher still as house prices have risen faster than wages over the last year.

In our view, rising house prices since the pandemic have only made a bad problem worse for first-time buyers. The Stamp Duty Holiday may have been launched with the best intentions, but unfortunately, it added fuel to the fire of house prices leading to a stampede of homebuyers set on beating the stamp duty deadline

Meanwhile, 17 housebuilders have now signed up to Deposit Unlock

Deposit Unlock is the latest initiative launched by the housebuilding sector to help tackle the deposit gap. Deposit Unlock offers a 95% Loan to Value (LTV) mortgage where the mortgage indemnity is provided by the housebuilder on behalf of the homebuyer.

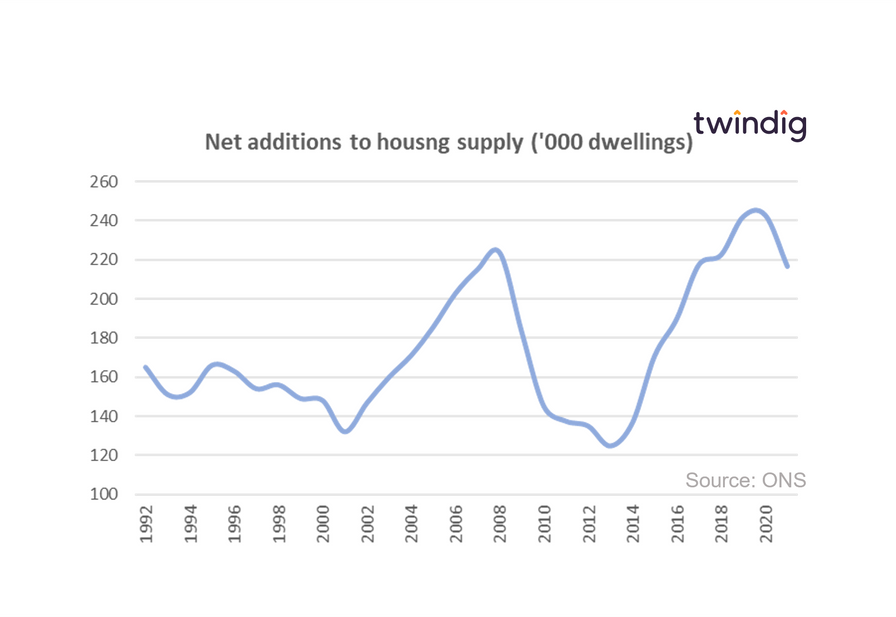

But, housing supply levelling down not up...

Twindig Housing Market Index

The new COVID-19 variant B.1.1.529 proved a sobering reminder that we are not out of the COVID woods yet, investors confidence was knocked by the news of the new variant and most reduced their appetite to invest in the UK residential housing sector. This had a knock-on effect on the Twindig Housing Market Index which fell by 3.7% this week, its biggest fall since 11 December 2021.