Housing Supply levelling down not up…

The Department for Levelling Up, Housing & Communities released data on housing supply for England on Thursday

What they said

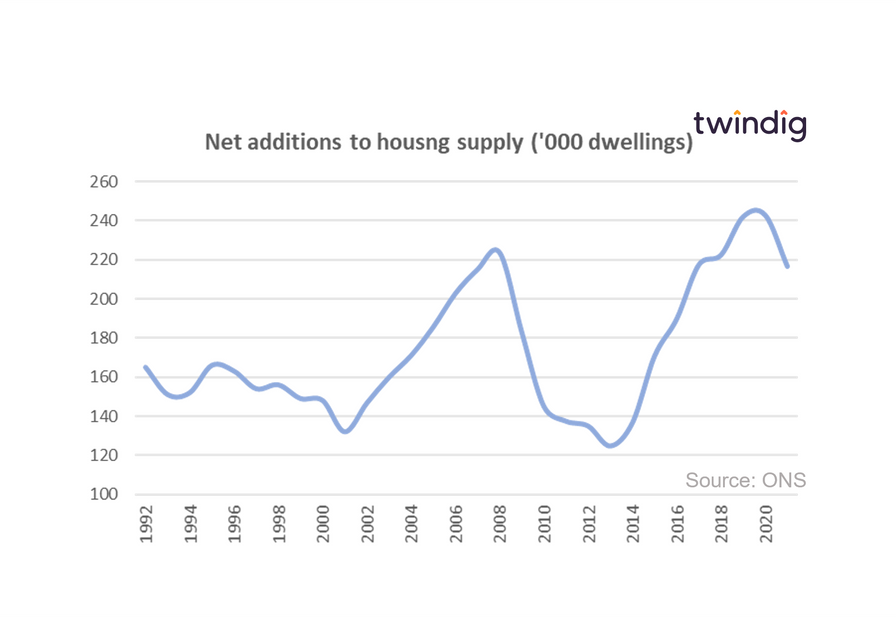

Annual housing supply (net additional dwellings) in 2020-21 was 216,490 homes

This was down 11% on the net additions for 2019-20

This was the lowest level for five years

Twindig take

These figures relate to the year to 31 March 2021 and so include the full force of the COVID-19 pandemic when the housing industry was, for a time, effectively closed for business.

In our view, the outlook for the future of the housing supply is rosy. Housebuilders are buying more, which given the long lead times between land acquisition and the selling of the homes on that land suggests that they believe the UK housing market is on a firm and stable footing.

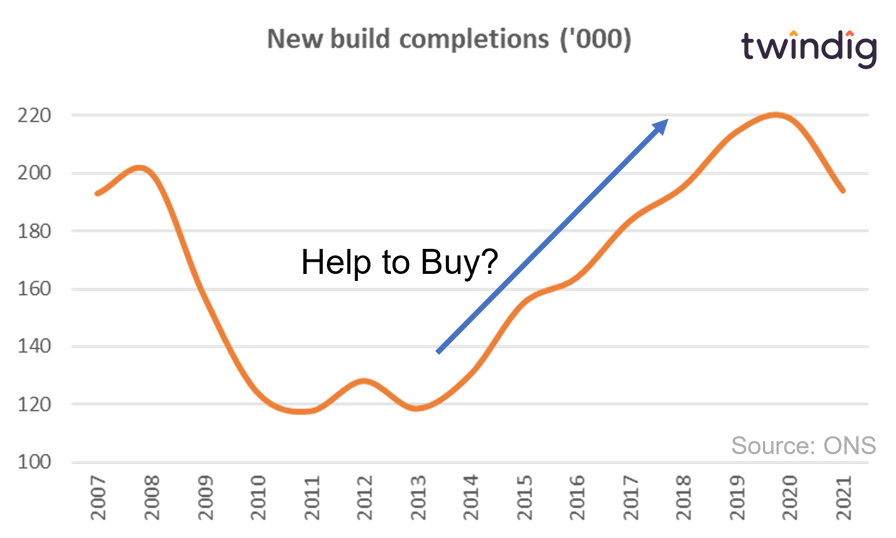

However, our one concern is Help to Buy. Whilst we are not suggesting the correlation is evidence of causation, the growth in housing supply over the last 8 years coincides with the launch and operation of the Help to Buy equity loan scheme.

Help to Buy is due to close on 31 March 2023, and the scheme was scaled back in April 2021.

The impact of Help to Buy on housing supply

It is difficult to unpick the actual impact of Help to Buy, but it is telling that homebuilding volumes have increased dramatically since the launch of Help to Buy in 2013

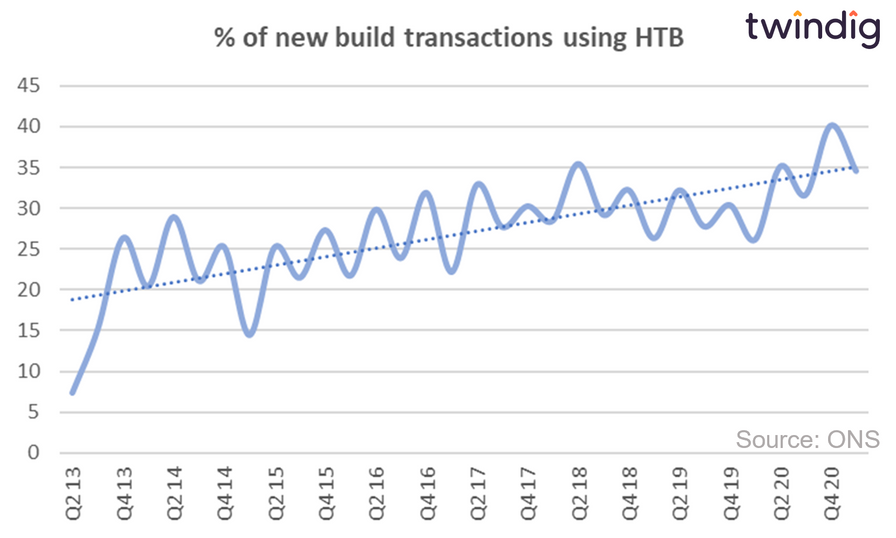

We also note that the share of new-build homes sold using Help to Buy has been steadily increasing since its launch and currently stands at 35%, which means that more than one out of every three new build homes is being sold using Help to Buy.

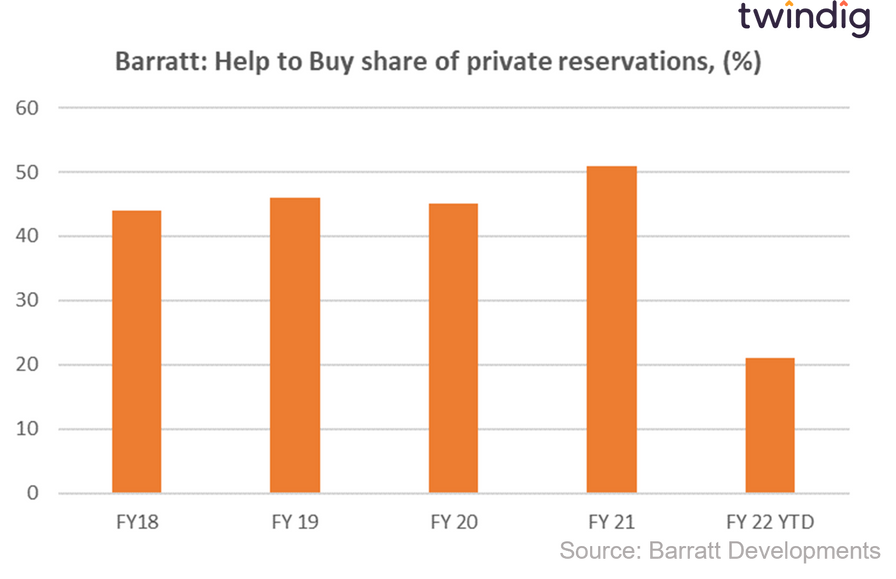

Many housebuilders are selling a higher proportion of their homes using help to buy, in particular, the larger housebuilders such as Barratt Developments, where, in its Financial Year 2021 Help to Buy accounted for just 50% (more than one in two) home sales.

This balance has dropped significantly in its current financial year. The fall was caused by the changes to Help to Buy's eligibility criteria, restricting it to first time buyers and the implementation of regional price caps. These changes came into effect in April 2021.

When does Help to Buy end?

At the time of writing Help to Buy is due to end on 31 March 2023, after which no new help to buy mortgages and equity loans will be available.

Will Deposit Unlock, unlock housing supply?

Deposit unlock is a scheme that offers 95% Loan-to-value (LTV) mortgages to the new build sector. Currently, 17 UK Housebuilders have signed up for the scheme you can read about Deposit Unlock here

95% LTV mortgages are certainly helpful and for a long time, the housebuilding industry has complained that not enough lenders support 95% LTV lending on new builds. So much so that Deposit Unlock is a scheme that was arranged by the Home Builders Federation (HBF)the representative body of the home building industry in England and Wales. The HBF’s member firms account for some 80% of all new homes built in England and Wales.

However, mortgages are typically based on 'Loan to Income' (LTI) multiples as well as loan to value ratios and often the Loan to Income ratio is the constraint on the size of the mortgage offer a lender is willing to make. A rule of thumb is that the most a lender will usually lend is 4.5x the borrowers income.

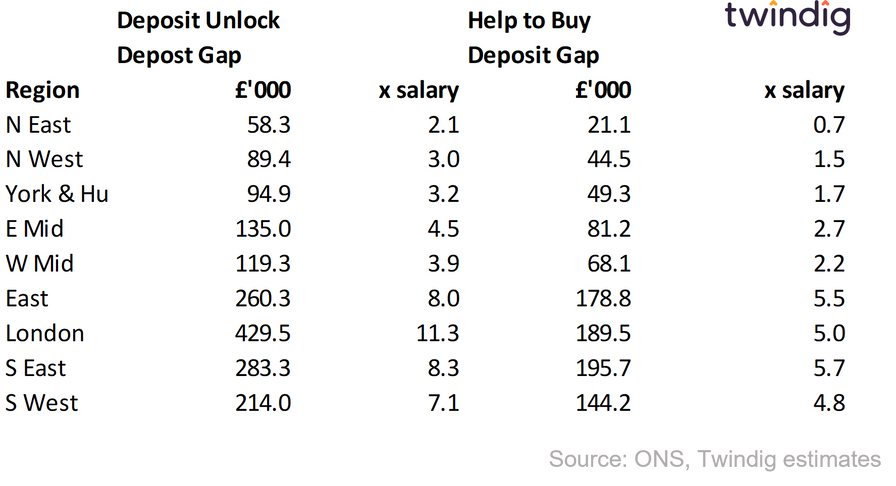

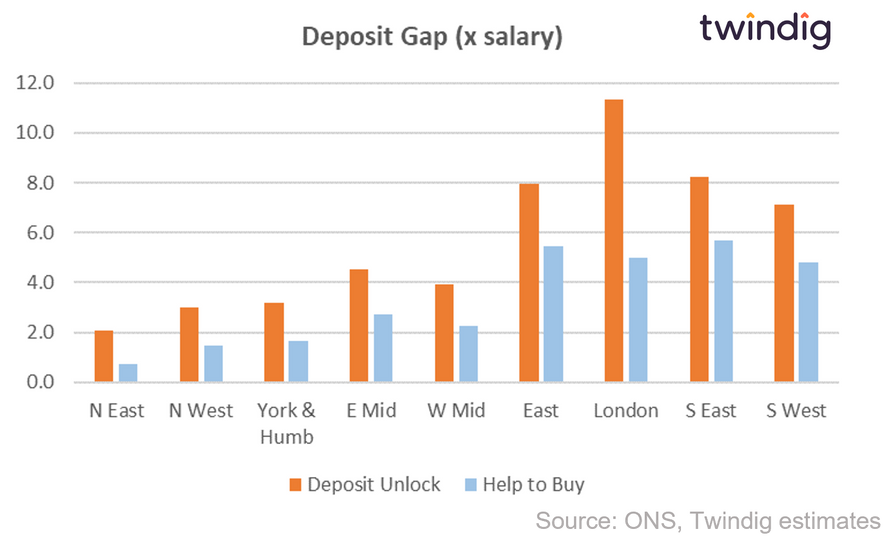

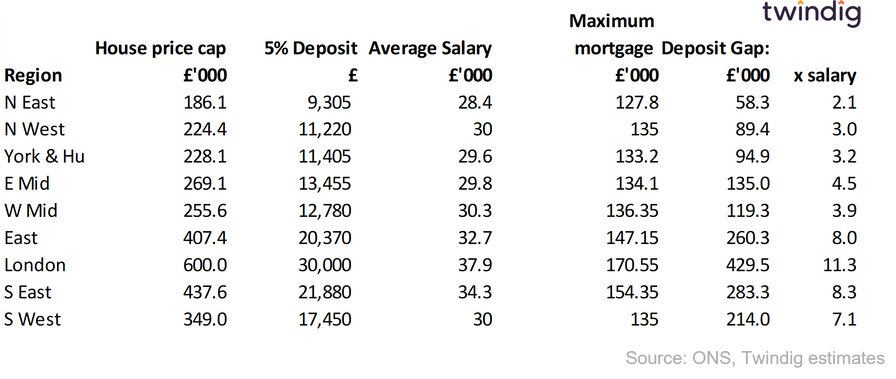

The Table below seeks to put the LTI: LTV issue into context:

In the North East, the Help to Buy cap is £186,100.

A 5% deposit equates to £9,305

The average full-time salary in the North East is £28,400, which implies a mortgage capacity of £127,800, leaving a deposit gap of some £58,300 or more than two times the average full-time salary

Help to Buy reduces the deposit gap

HElp to Buy significantly lowers the deposit gap as illustrated in the table and chart below and this is, in part, why the scheme has been so successful helping hundreds of thousands of aspiring homeowners onto the property ladder.