Deposit still biggest barrier for First Time Buyers

The Nationwide released a special report this morning reaffirming that raising a deposit was still the biggest hurdle for first-time buyers. If anything, the bar has been raised higher still as house prices have risen faster than wages over the last year.

Andrew Harvey, Nationwide’s senior economist said

House price growth has exceeded earnings growth over the past year and the ratio of house prices to average earnings (HPER) has increased to a record high. In the third quarter of this year, the UK First Time Buyer (FTB) house price to earnings ratio stood at 5.5, above the previous high of 5.4 in 2007, and well above the long-run average of 3.8.

Twindig take

In our view, rising house prices since the pandemic have only made a bad problem worse for first-time buyers. The Stamp Duty Holiday may have been launched with the best intentions, but unfortunately, it added fuel to the fire of house prices leading to a stampede of homebuyers set on beating the stamp duty deadline.

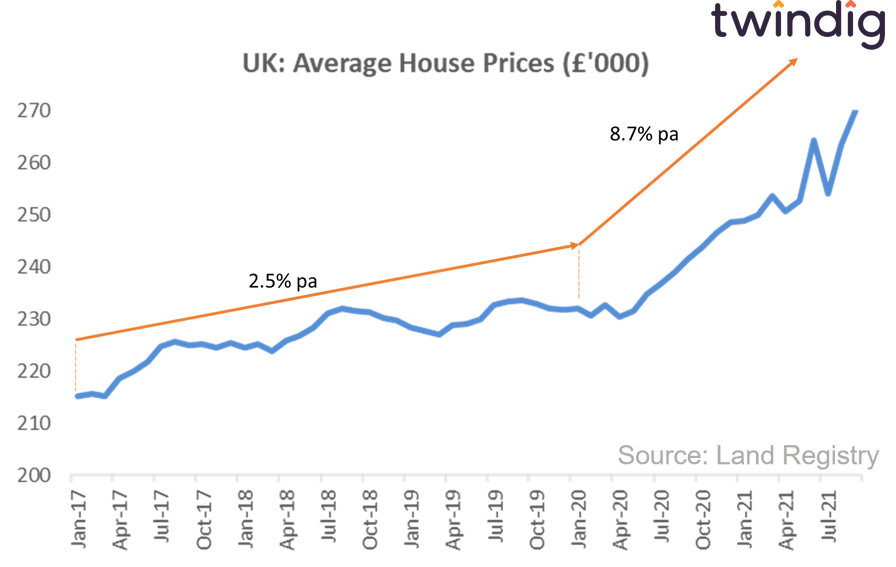

We show in the graph how house price inflation accelerated from a manageable 2.5% pa in the lead up to the COVID-19 pandemic to an annual run rate of 8.7% as the pandemic took hold.

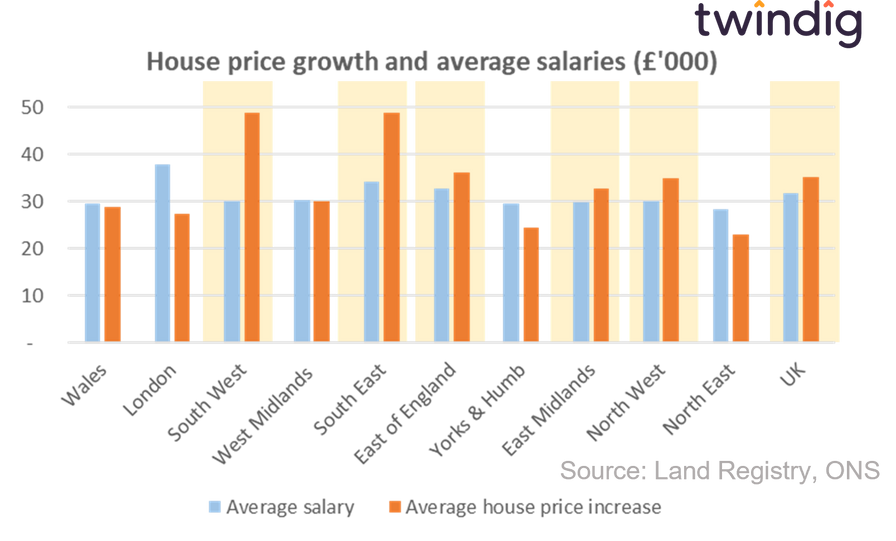

The upshot of this rapid rise in house price inflation is that since the COVID-19 stamp duty holiday house prices in five regions of the UK have risen by more than the median full-time wage, and when mortgages are based on salary multiples that creates multiple problems.

Home buying maths

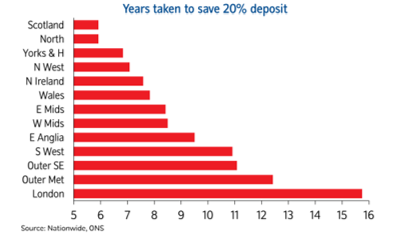

The Nationwide published a useful chart showing how long, on average it would take a first-time buyer to save a 20% deposit based on current first-time buyer house prices assuming that they save 5% of their monthly take-home pay. It ranges from around 6 years in Scotland to almost 16 years in London.

However, we believe that the situation is worse than Nationwide imply. Whilst we do not doubt their arithmetic, we do not believe that a 20% deposit would be sufficient to buy a home.

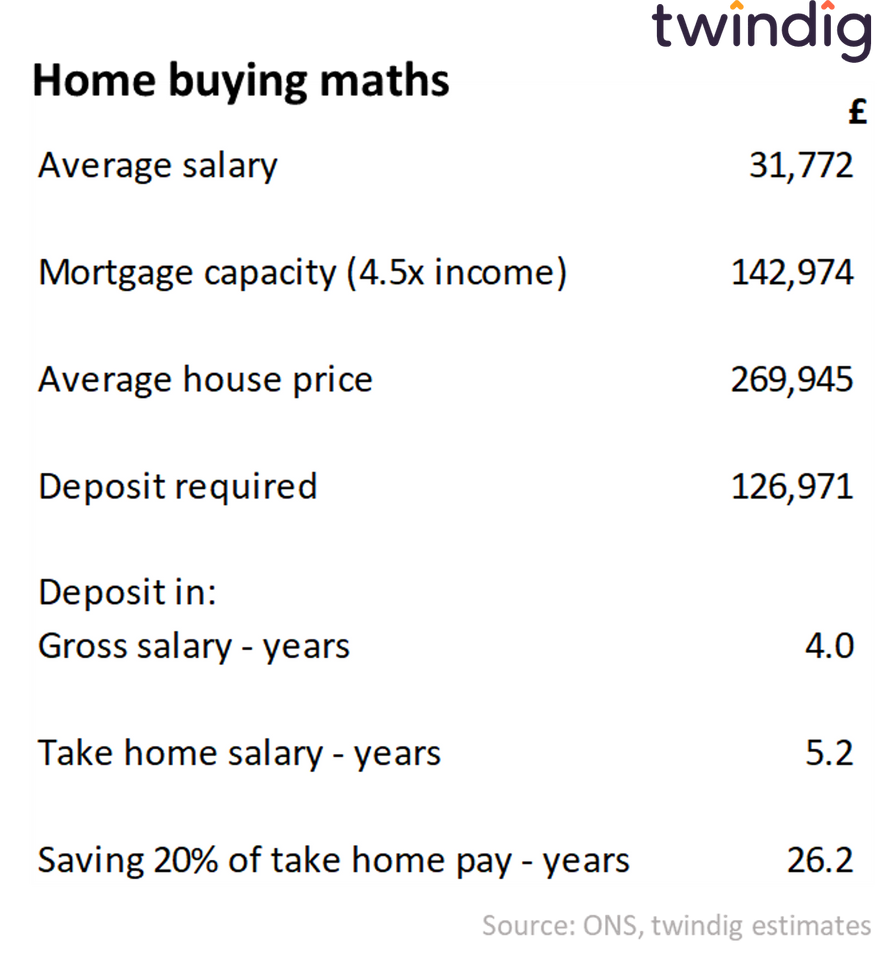

The average UK house price is £269,945 (Source: Land Registry) and the average median full-time wage in the UK is £31,772 (Source: ONS).

If we assume a 4.5x lending multiple the mortgage capacity is £142,974 which leaves a deposit gap of £126,971 or 47%, somewhat higher than 20%.

How do we solve the first-time buyer problem?

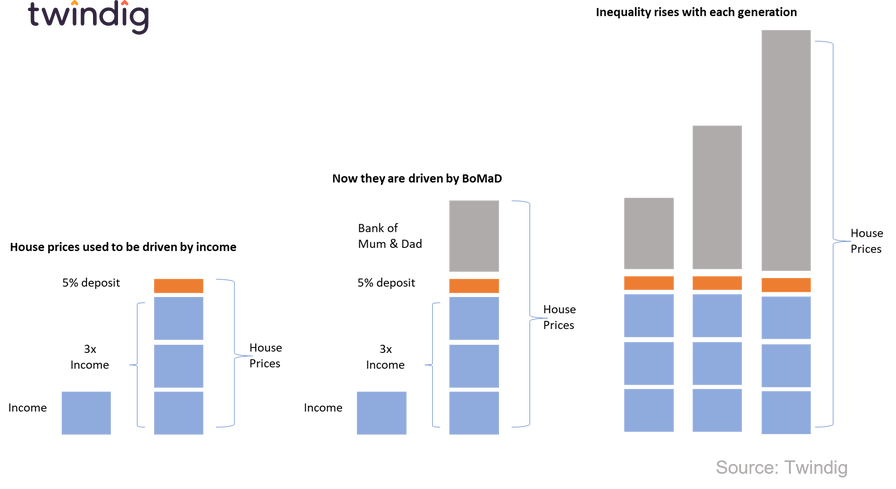

We will not be the first or the last to ask this question and it is a complex problem. The crux of the issue is that we try to buy houses based on how much we earn, but house prices have become divorced from our wages. Unless the relationship between house prices and wages is restored, it is unlikely that wage-based home buying solutions will work. We are using the wrong tool to fix the problem.

How did house prices become divorced wages?

In our view, the relationship started to become strained when we added other forms of finance to the home buying process, in particular the Bank of Mum and Dad. An unfortunate and unintended consequence of the Bank of Mum is that whilst at a family level it is a useful, helpful and very understandable transaction, at a society level it breaks the link between house prices and wages and as intergenerational wealth transfers become more common the situation will get worse. Extrapolating the trend will see an increasing inequality of housing wealth across our country and fewer and fewer people able to afford to buy a home.

Does twindig have an answer?

We are big believers in the case for fractional ownership for homes. In this model, one doesn’t need a big deposit to start getting exposure to housing wealth and the playing field is levelled up so those without access to the Bank of Mum and Dad can get access to a surrogate Bank of Mum and Dad. It also offers the possibility of buy-to-let investors helping first-time buyers to buy rather than competing against them. You can read our full case for fractional homeownership here.