Housepresso 19 September 21

All you need to know about the housing market this week in one quick hit

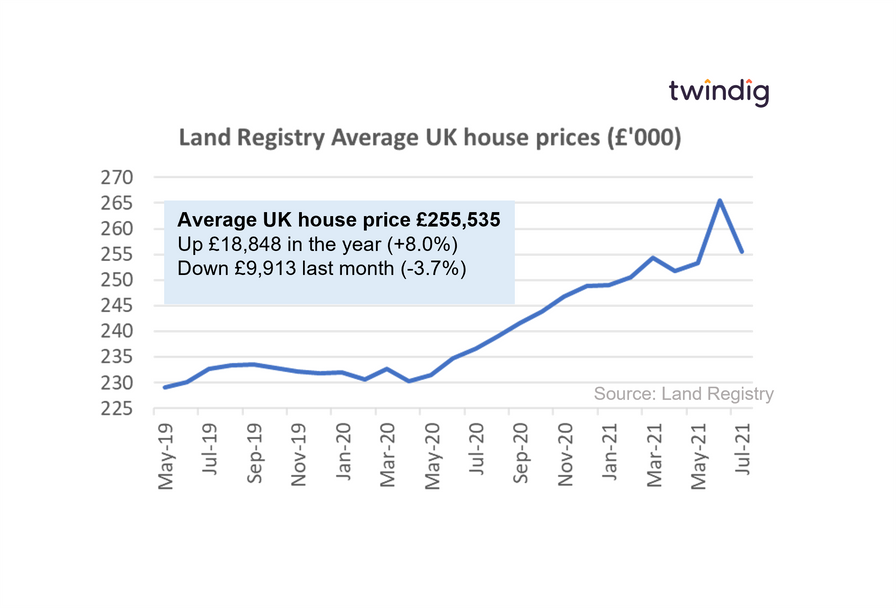

House prices fall as Stamp Duty benefit cut

According to the latest data from the Land Registry, average UK house prices fell by almost £10,000 in July, the first month following the reduction in Stamp Duty Holiday benefit. However, on average house prices are almost £19,000 higher than they were one year ago.

UK House prices: A case of what goes up must come down?

The average house price in the UK is £255,535, average prices have increased by 8.0% or (£18,848) over the last year, and decreased by 8.0% or (£9,913) last month. We note that these figures are provisional and subject to change, however, the size and the scale of these increases reflects a reduction in housing market activity following the first of two reductions in the Stamp Duty Holiday benefit threshold. The Stamp Duty Holiday benefit level reduced from £500,000 on the 30 June 2021 to £250,000 from 1 July 2021 and the stamp duty holiday will come to an end on 30 September 2021.

UK average house prices have increased by 15.2% (£35,059) since the start of the COVID-19 pandemic.

London house prices: Half of London rising, half of London falling

The latest data from the Land Registry shows that the average house price in London fell by 2.0% or £10,000 to £494,673 in July 2021. House prices fell in 17 of the 34 London boroughs.

The biggest London house price gains last month were to be found in Kensington and Chelsea up £102,995 or 8.4%, Hammersmith & Fulham up £59,138 or 7.9% and Hackney up £41,501 or 2.9%.

The biggest falls were in the City of London down 12.0% or £96,142, followed by Lambeth down £36,430 or 6.7% and Hounslow down £23,612 or 5.4%.

Energy, Efficiency, and house price inequality

We increasingly live in a world where how we live is causing our climate to change and our weather to become ever more extreme. Climate change was one of the factors recited by my insurance company as they once again raised my home insurance premium – ‘Increased flash flooding and increased subsidence caused by climate change’.

One way to help combat climate change at a global level and your wallet at a local level is to make your home more energy-efficient, a kind of save your money and save the planet win-win.

But will improving your home's energy efficiency increase its value?

Mortgage Market Snapshot

Whilst not the most riveting read, this week’s ‘Mortgage Lenders and Administrators Return MLAR’ a statistical quarterly release on mortgage lending did include some interesting insights into the mortgage market and the housing market it serves (well perhaps only if you are a numbers geek..).

Despite mortgages being one of our biggest monthly outgoings, the UK mortgage market is surprisingly smaller than you think.

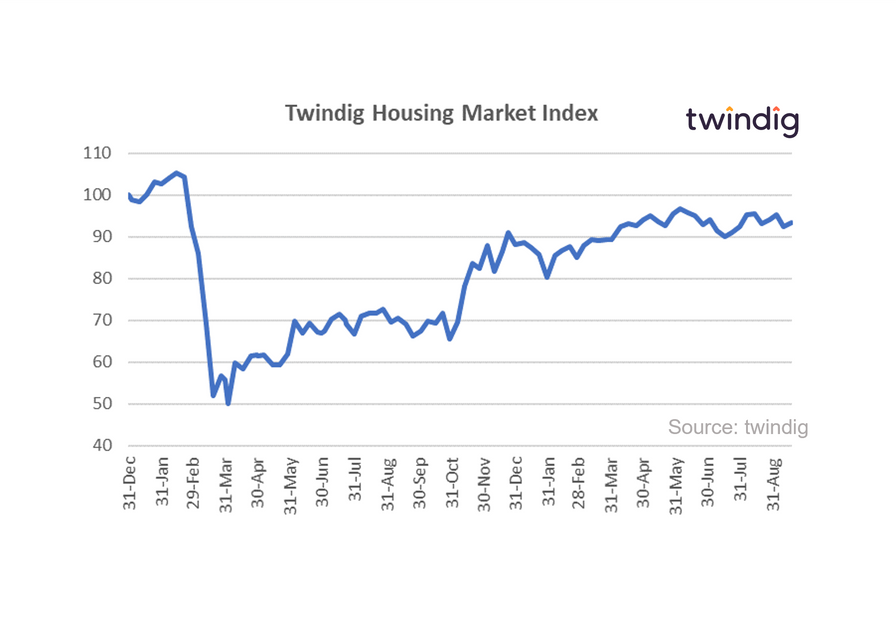

Twindig Housing Market Index

The Twindig Housing Market Index rose by 1.0% to 93.3 this week. Strong performance and bulging forward orderbooks reported by housebuilder Redrow this week and continued competition in the mortgage market led to an increase in investor confidence in the UK housing market. Confidence did, however, reduce in the estate agency due to concerns that continued stock shortages today may impact financial results tomorrow, although many were mindful that the shortages in homes for sale continue to underpin house prices. We also suspect that Michael Gove, the new housing minister will have a vested interest in seeing higher rather than lower house prices.