Mortgage Market Snapshot

Whilst not the most riveting read, this week’s ‘Mortgage Lenders and Administrators Return MLAR’ a statistical quarterly release on mortgage lending did include some interesting insights into the mortgage market and the housing market it serves (well perhaps only if you are a numbers geek..).

Despite mortgages being one of our biggest monthly outgoings, the UK mortgage market is surprisingly smaller than you think.

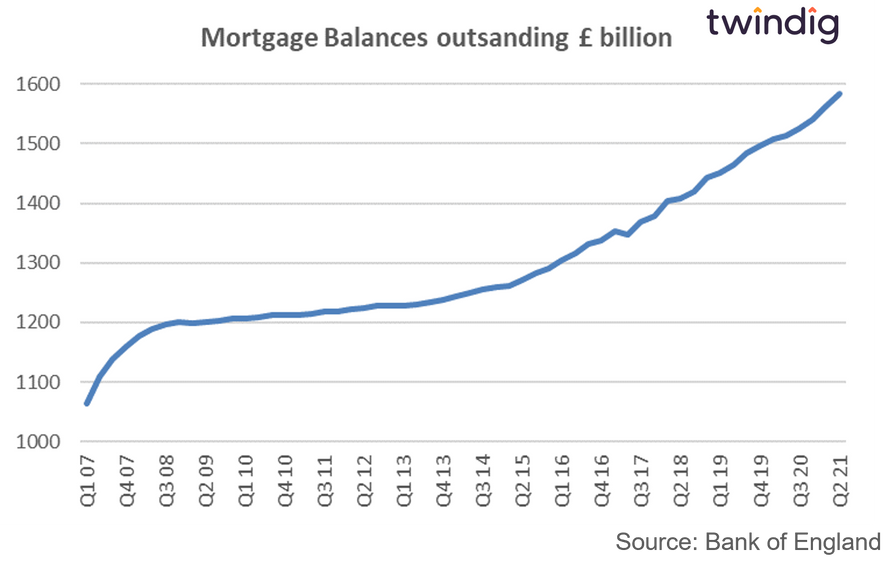

How big is the UK mortgage market?

The value of outstanding residential mortgage loans in the UK was £1,584 billion at the end of 2021. The value of mortgages outstanding has grown almost continuously since 2007. Growth paused for breath during the credit crunch and tripped over early Brexit concerns, before returning to a strong growth trajectory.

What is the Loan to Value of the UK mortgage market?

With balances outstanding of £1,584 billion funding a UK housing market worth around £7,440 billion, the overall Loan to Value of the UK housing market is just 21.3%, which might cause highly geared first-time buyers to choke on their cornflakes

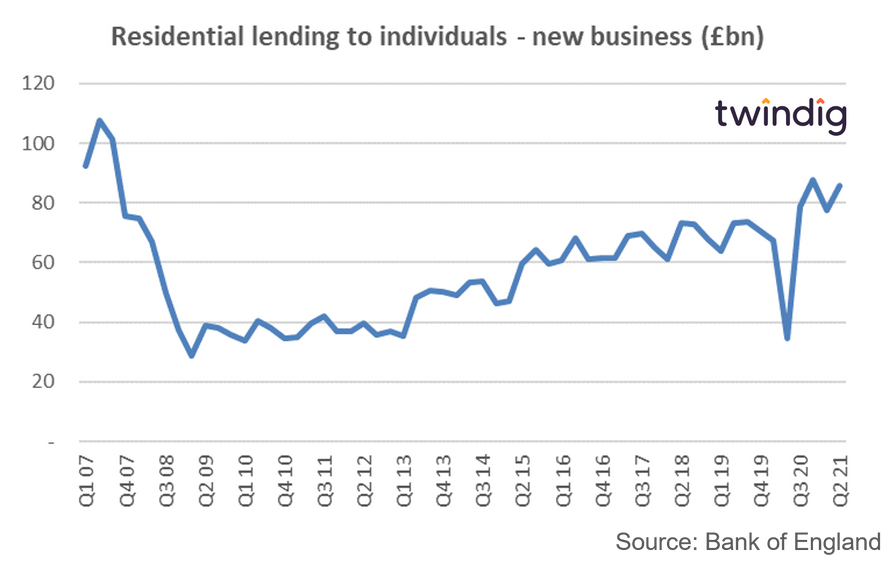

How active is the UK Mortgage market right now?

We show in the graph below the level of new lending to individuals. The impact of the Global Financial Crisis is very clear to see. Mortgage lending volumes have yet to return to their pre-Credit Crunch levels, however, the lending trajectory is one of growth.

The immediate impact of the COVID-19 pandemic is also very clear, but short-lived with mortgage market growth returning more quickly than most of us would have thought possible.

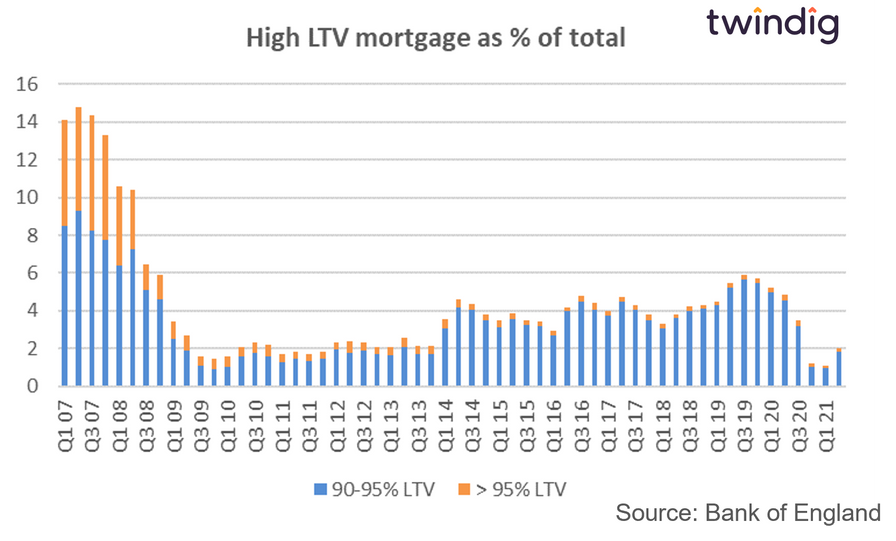

How many mortgages have a high loan to value?

There is much talk about the availability of high loan to value mortgages as discussed in our article Metaphysical mortgages, however, very few mortgage sales are at high loan to value ratios. In Q1 21 less than 1% of mortgages sold were at LTVs of 90-95% and only 0.15% at 95% or higher, in Q2 21 these figures were 1.8% and 0.2% respectively.

High Loan to Value mortgages have never returned to their pre-Credit Crunch levels, it is not so much that credit remains crunched, more that we are in a period of much more responsible lending. Banks and Building Societies are also more aware that house prices can go down as well as up and the regulator has toughened up mortgage lending via the 2014 Mortgage Market Review.

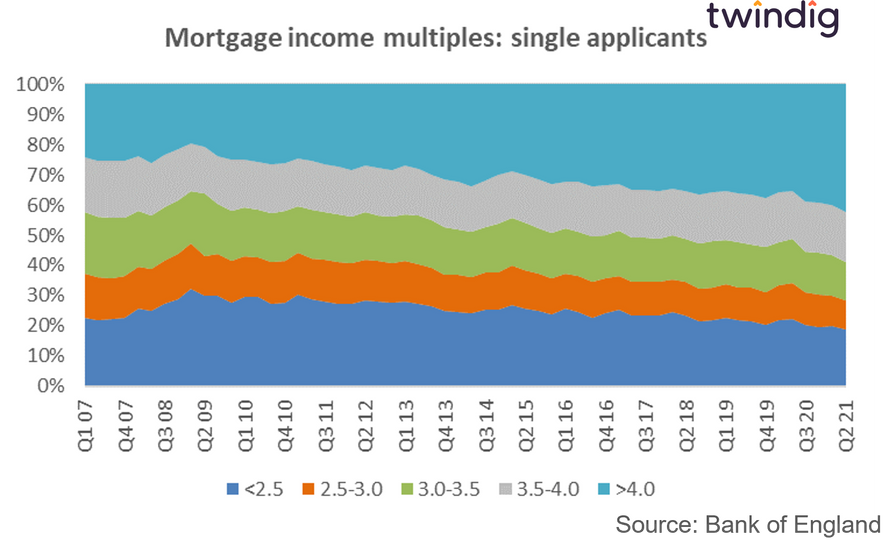

How much can I borrow for mortgage?

The main determinant of a borrowers mortgage capacity is their income. Lenders look at lending in terms of multiples of income and loan to values. Income (and disposable income) determines how much you can borrow for your mortgage and the Loan-to-Value (LTV) determines the price. The higher the LTV the higher the cost of the mortgage.

What will not come as a surprise to anyone who has either bought a house or thought about buying a house is that homebuyers typically borrow as much as they can.

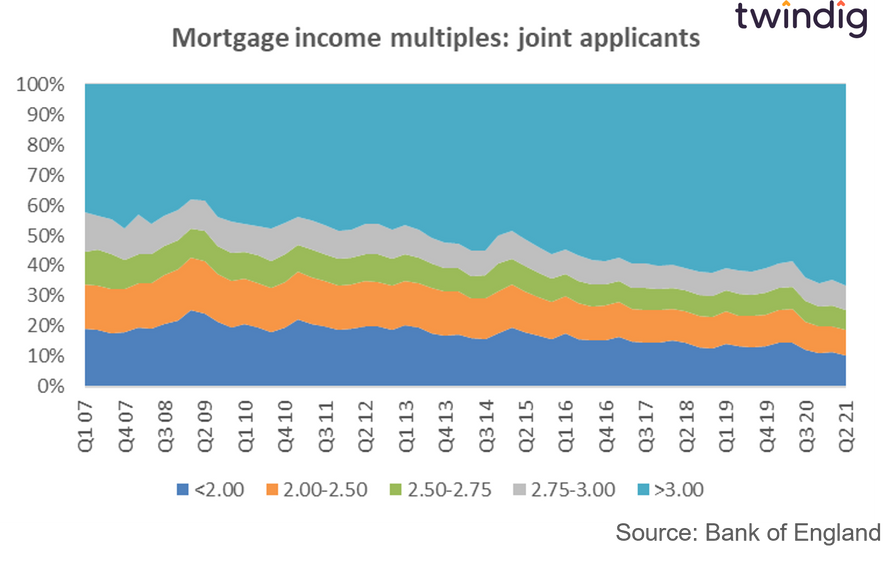

We show in the charts below the mortgage lending multiples for both single and joint mortgage applications. What will not come as a surprise is that people tend to borrow as much as they can. Far more single applicants borrow more than 4.0x their income than 3.0x.

The same is true for joint applicants, where the majority borrow more than 3.0x their joint income as illustrated in the mortgage income multiples chart below

Am I paying too much for my mortgage?

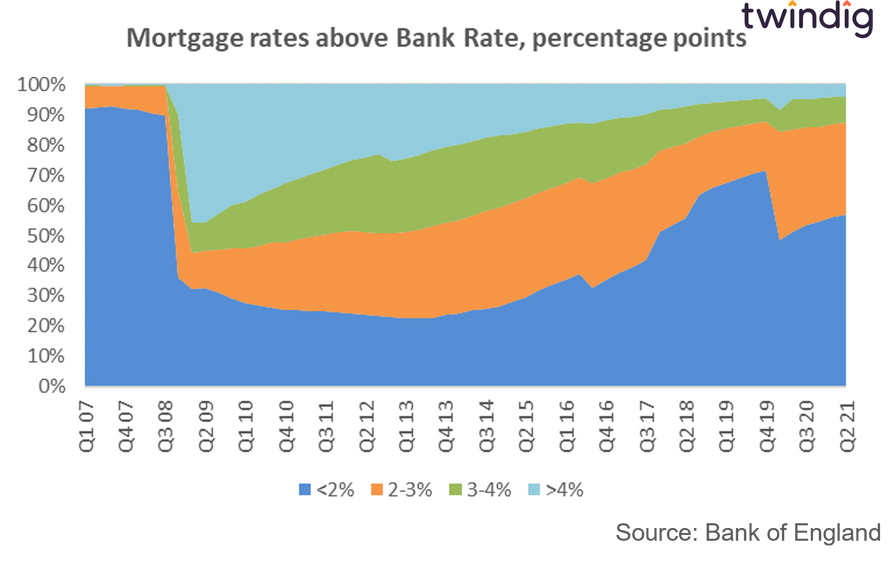

There is always a worry that someone has a better mortgage deal than you, however, to put your mind at rest we show in the chart below the spread of mortgage rates, so you can see how many are paying how much.

How to read this graph. The deeper blue line shows the percentage of mortgages with a mortgage rate less than 2% line above Bank Rate. UK Bank Rate is currently 0.1%, therefore you are in the blue category if your mortgage rate is between 0.1% and 2.00%. Currently just over 57% of outstanding mortgages fall into this category, whereas only 4% of mortgages have a mortgage rate above 4.1%.

If you are not doing as well as you might have hoped it is worth checking your mortgage paper work to see when your current deal ends and then having a play with a price comparison website to see if you can land a better deal.