Housepresso 8 August 21

All you need to know about the housing market this week in one quick hit

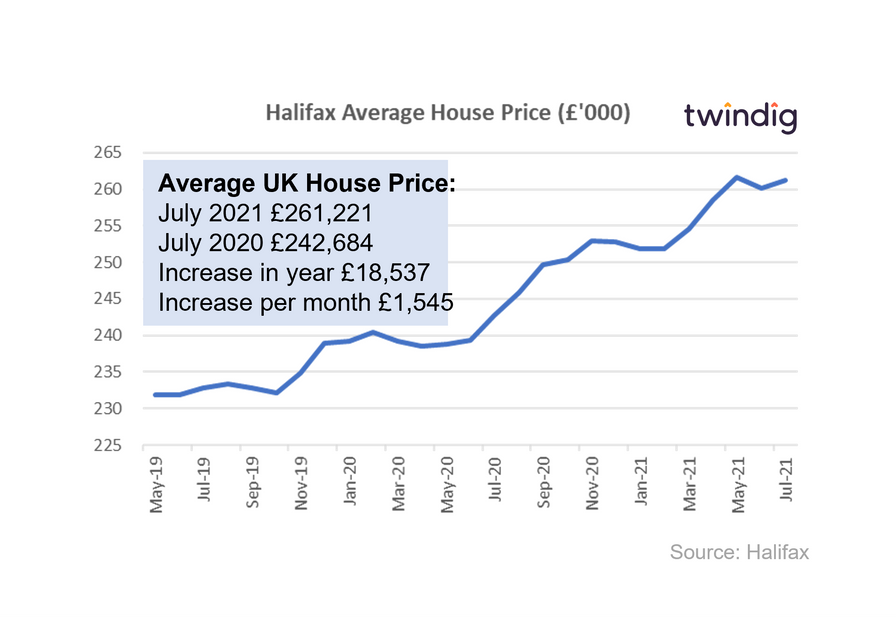

House prices up, but house price inflation slowing

The Halifax reported this week that house price inflation is slowing, but that the strength of the recovery is deepening. As the froth of the stamp duty holiday starts to subside the strength of the housing markets foundations are being revealed. Stock levels might be lower and new instructions are harder to be found, but macroeconomic risks are receding, and consumer confidence is improving. This is good news as it appears that the housing market recovery is a marathon not a sprint, slow and steady often wins the long game and housing market returns are best viewed from a longer-term perspective.

Is there a two-speed housing market ahead?

The housing market is currently firing on all cylinders, but, in the future, this might not be the case. The new-build sector is both laying and making hay (life is good now and expected to be good in the future), whereas estate agents are enjoying the present, but are cautious about the future. How can housebuilders and estate agents view the same housing market so differently? Are we about to see a two-speed housing market?

Is the rise of Joint Borrower Sole Proprietor mortgages a good thing?

What looks like a helping hand for some may well tie others hands behind their backs...

Taylor Wimpey breaking records

National housebuilder Taylor Wimpey delivered a strong set of half-year results this week and raised profit expectations for the full year, demonstrating that there will be life in the housing market after the end of the Stamp Duty holiday.

The high levels of homebuyer demand are driven by low-interest rates, good mortgage availability and a shortage of stock in the second-hand market. Looking further ahead, canny land buying during lockdown will allow Taylor Wimpey to accelerate its growth plans in the medium term to deliver more of the homes the country desperately needs.

Connells, number one for a reason

Connells is the UK's largest estate agent for a reason, it knows how to execute both the buying and selling of homes and the buying and selling of businesses. Its first-half results have been boosted by the acquisition of Countrywide's 600 branches and 60 brands, but more importantly, no batons have been dropped or hamstrings pulled as the integration takes place.

Once the stamp duty holiday is over there is plenty of work still to be done putting Connells and Countrywide's operations together and plenty of opportunities to turn the performance of Countrywide around. If it didn't drop the baton during the heat of the stamp duty holiday it is unlikely to as the temperature of the UK housing market drops by a few degrees.

Stamp Duty boost for LSL

LSL is one of the UK's biggest estate agency chains with brands such as Your Move and Reeds Rains. Their results this week demonstrate that the stamp duty holiday provided a powerful shot in the arm for the UK housing market, helping LSL deliver record revenues, record operating profits, however, performance improvements in 2022 will be driven by self-help rather than stamp duty booster jabs.