Is the rise of Joint Borrower Sole Proprietor mortgages a good thing?

The rise of Joint borrower sole proprietor mortgages

Mortgage broker Private Finance says it has seen a 200% rise in family assisted mortgages between Q1 and Q2 this year. In this article, we ask is this good news or bad, and if bad, is there a way to turn it into good?

Good news

On one level, friends and family helping another with their first step on the housing ladder has to be a good thing. From an early age, we are all encouraged to help others if we can and if it is possible.

Bad news

The fact that increasing numbers of homebuyers need assistance from friends and family is a worrying development. It tells us that we have divorced house prices from earnings.

The Nationwide’s Future of Home report revealed that 40% of first-time buyers used money from an inheritance, gift or loan from family or friends to help raise a deposit. That is a lot of external funding.

What about those without friends and family to help out?

Those without family assistance will have to spend longer in rented accommodation whilst they save for a deposit. Earlier this year, the Nationwide’s HPI Affordability report stated that a 20% deposit for a starter home is equivalent to 104% of pre-tax income. The average first-time buyer needs to save more than one year’s gross wages to have the required deposit.

The problem is exacerbated by the fact that the assisted homebuyer will also be saving for their deposit. It is very difficult, therefore, for the unassisted homebuyer to compete. It is a case of at least two against one. The homebuying playing field is very far from level.

The problem

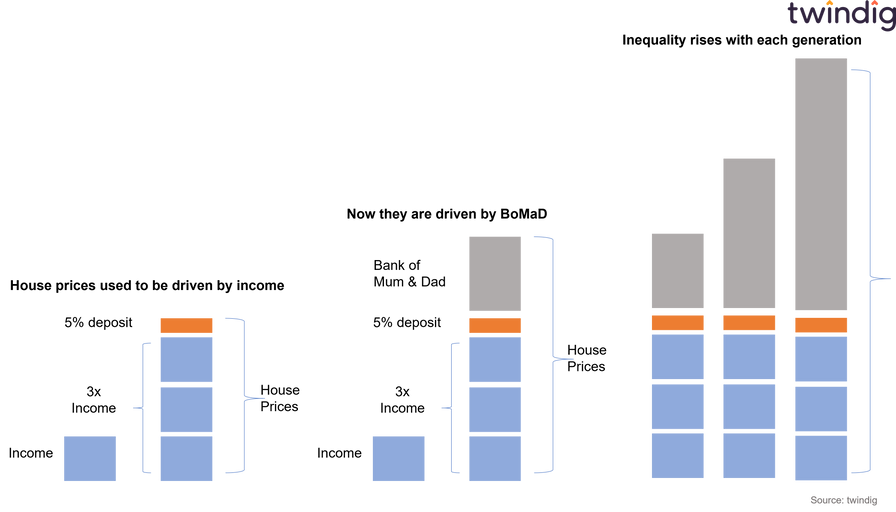

At a family level, intergenerational and interfamily wealth transfers make sense. However, at a societal level, they create wealth inequalities, and the scale of these wealth inequalities increases over time. Simply put the rich get richer at the expense of a growing majority.

Intergenerational wealth transfers are not a new phenomenon. In the UK ‘death duties’, a forerunner of inheritance tax, can be traced back to 1694 when the certainty of death and taxes combined.

However, what is new is the amount of property being inherited. Homeownership in the UK only reached 50% in 1971. We are now, therefore, seeing the first wave of mass affluent passing on their housing wealth and this is, in our view, distorting the housing market.

With every passing of housing wealth from one generation to the next the inequality grows and house prices become further and further removed from underlying wages as illustrated in our chart below

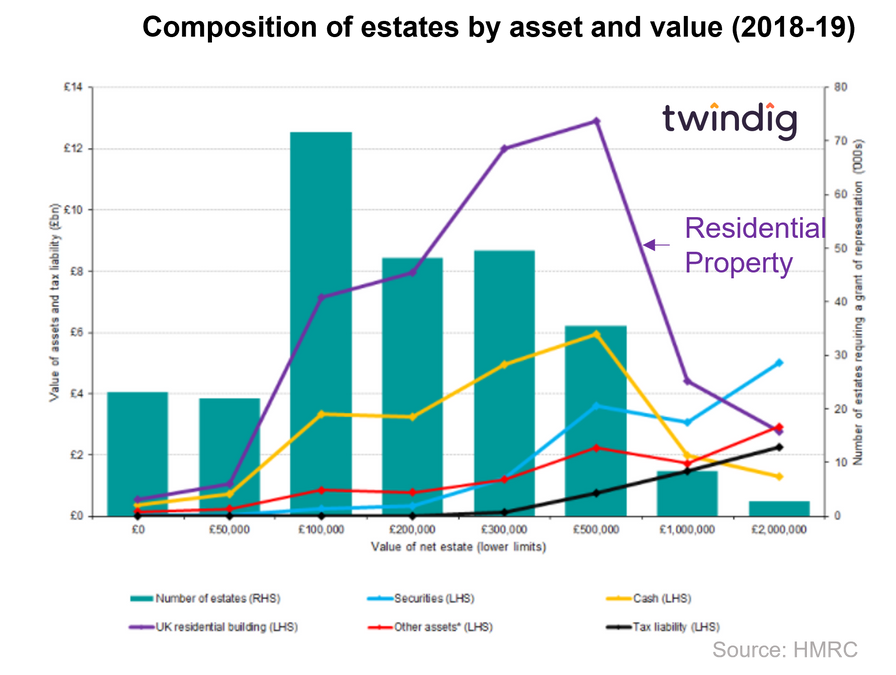

The largest constituent of inheritance is property as can be seen in the graph below which shows the composition of estates liable to Inheritance Tax by asset class and value of the estate.

The solution – broaden the network

The solution is to be found in network effects, in our view. If we broaden the definition of friends and family we can introduce unconnected parties to those without access to the Bank of Mum and Dad to help them get on the housing ladder.

We view this as a win-win. We are not trying to discourage wealth transfers that make sense at a family level, but rather broaden their reach to help level the first-time buyer playing field. Those who wish to invest more in residential property can and at the same time they are able to help aspiring homeowners get their feet onto the property ladder.

How broad is broad

In our view the helping hand can come from a very broad pool:

Those looking to increase their exposure to the UK housing market but do not have the funds to buy a whole home

Those looking for a savings or investment product that gives direct access to the UK housing market ie those saving £50 per month into an ISA

Those who are trying to build up their own deposit but want investment returns that match the housing market rather than the paltry sums available in savings accounts

Those looking for a much more diversified investment in the UK housing market without the concentration risk of putting all their housing eggs in one basket

Buy to let landlords selling up due to increased regulation and taxation

But how will 'investors' get their money out of the housing market?

One of the perennial problems of residential investments is liquidity. How do I take my money out? Usually, you have to wait for the property to be sold. This is far from ideal as it is unlikely that the homeowner will be looking to (and be able) to sell at the same time as the investor is.

Twindig has the solution to this perennial problem, but that is for another article...