Housepresso 7 November 21

All you need to know about the housing market this week in one quick hit

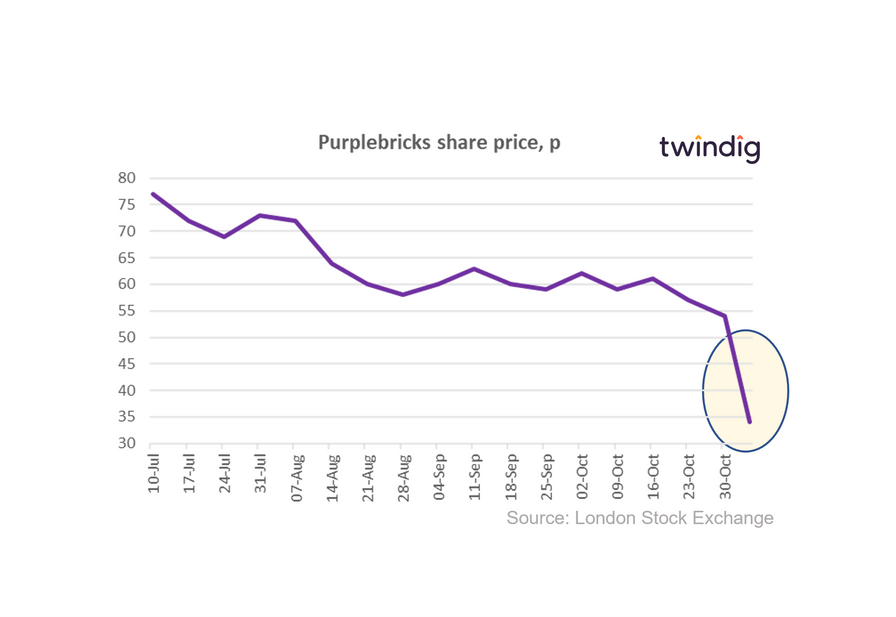

Can you polish a brick?

Purplebricks latest trading update sent shockwaves through its share price. Coming just one week after a confident, front footed trading update from Foxtons, Purplebrick’s statement was barely on its back foot. This leads to the question is Purplebrick's model being challenged by changes in the wider housing market or is it just challenged?

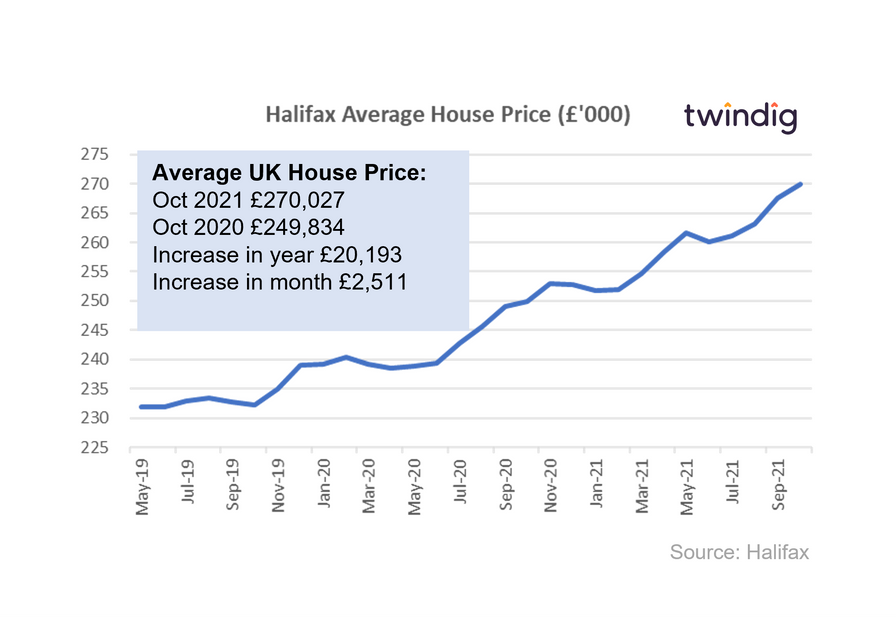

House prices set a new record high

The Halifax reported that average UK house prices hit a record high of £270,027 in October up 0.9% or £2,511 in the last month and up 8.1% or £20,193 over the last year.

Following on from the Nationwide House Price Index published earlier this week, the Halifax House Price index adds further weight to the argument that there is life after the end of the Stamp Duty holiday, and with Bank Rate remaining at its all-time low of 0.1% for at least another month the direction of travel of house prices is likely to continue upward, in our view.

Bank Rate on Hold, for now

With rising living costs and the changes announced in last week's Spending Review, a rise in Bank Rate would have added salt to the wounds and we understand why the Monetary Policy Committee was so in favour of keeping Bank Rate in check.

However, a consequence of a recovering economy (a good thing) and rising wages (another good thing) is that positive moves in the economy can lead to increases in inflation (which can become a bad thing) and it seems likely that Bank Rate will rise in 2022 to keep inflation in check, in our view.

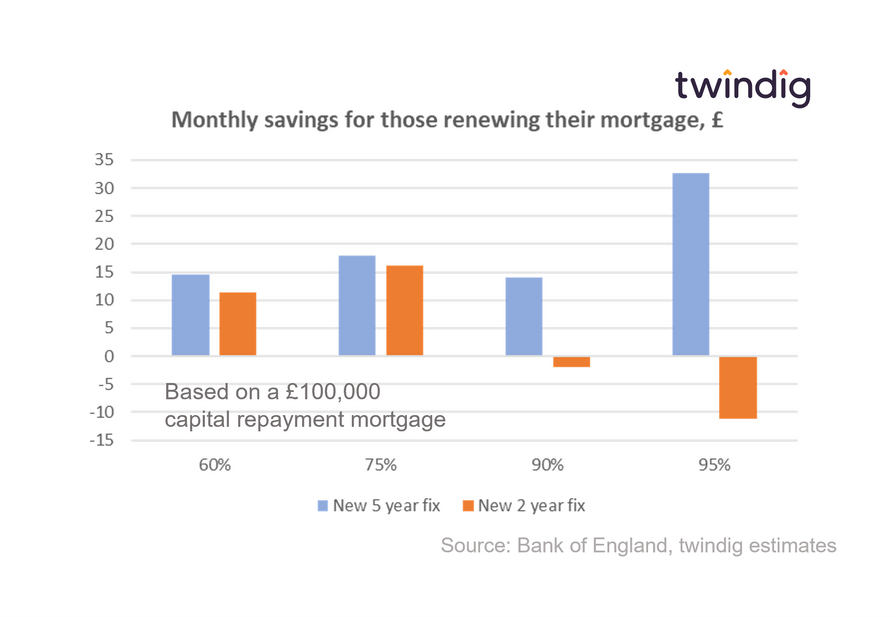

Why rising mortgage rates might not hurt you

There was a lot of speculation that the Bank of England might have increased the Bank Rate this week and further speculation that after a period of record lows, mortgage rates are about to rise. Rising mortgage rates are viewed as a bad thing, but in this article, we look at why the bark of rising mortgage rates may be worse than their bite and for many a rise in mortgage rates might not hurt at all.

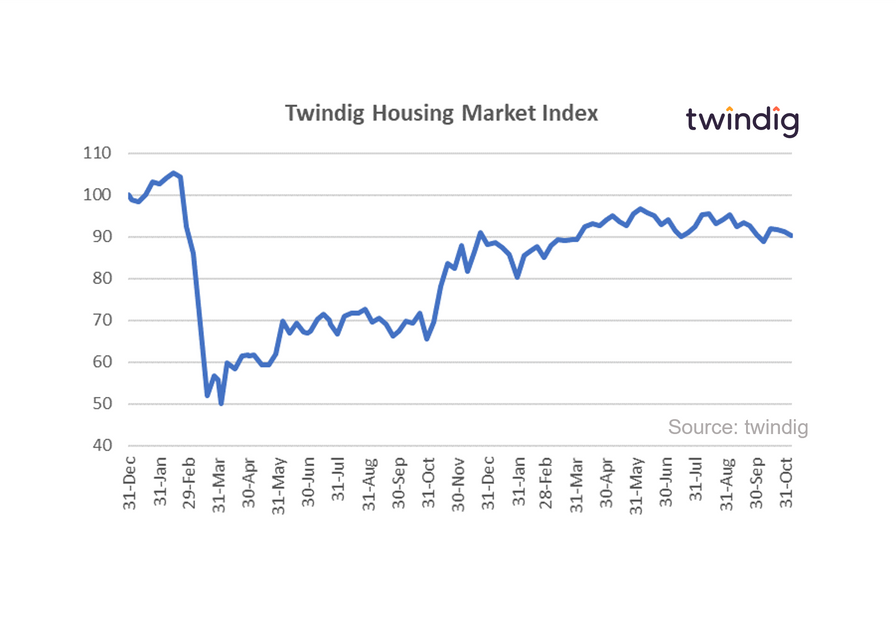

Twindig Housing Market Index

The Twindig Housing Market Index fell by 1.2% to 90.2 this week as both the Nationwide and the Halifax reported that house prices reached record highs in October and the Bank of England held Bank Rate at 0.1% for at least another month. Fear of rising mortgage rates was on the minds of some investors and they had concerns that the combination of the end of the Stamp Duty holiday, rising living costs and rising mortgage rates could lead to the softening of the housing market and house prices retracing their recent steps.