Can you polish a brick?

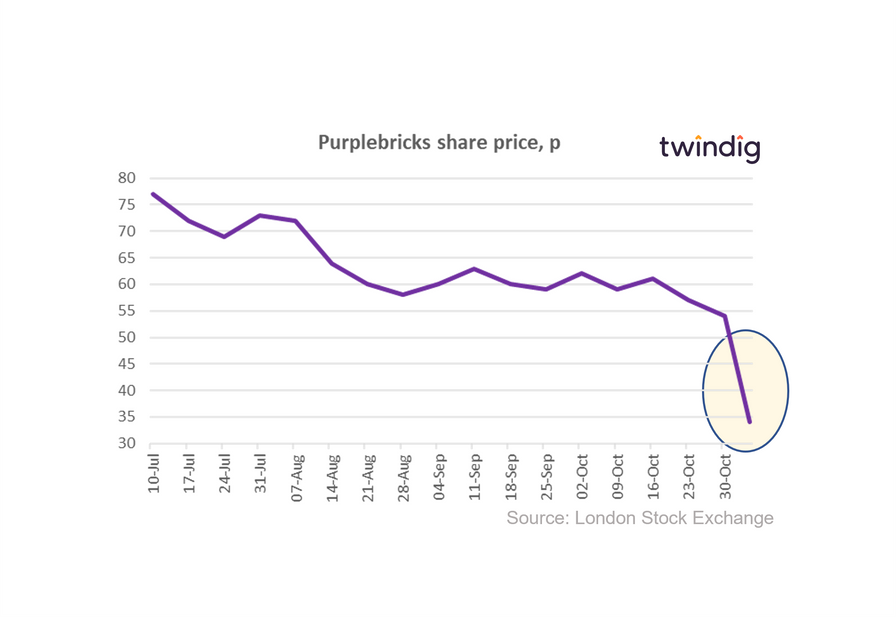

Purplebricks latest trading update sent shockwaves through its share price. Coming just one week after a confident, front footed trading update from Foxtons, Purplebrick’s statement was barely on its back foot. This leads to the question is Purplebrick's model being challenged by changes in the wider housing market or is it just challenged?

What happened to the Purple patch?

Purplebricks enjoyed an exceptionally strong housing market in FY2021 (the year to 30 April 2021), which was buoyed by the Stamp Duty Holiday. We are surprised that Purplebricks has found the last six months more challenging, because the Stamp Duty Holiday was in force for five of those six months.

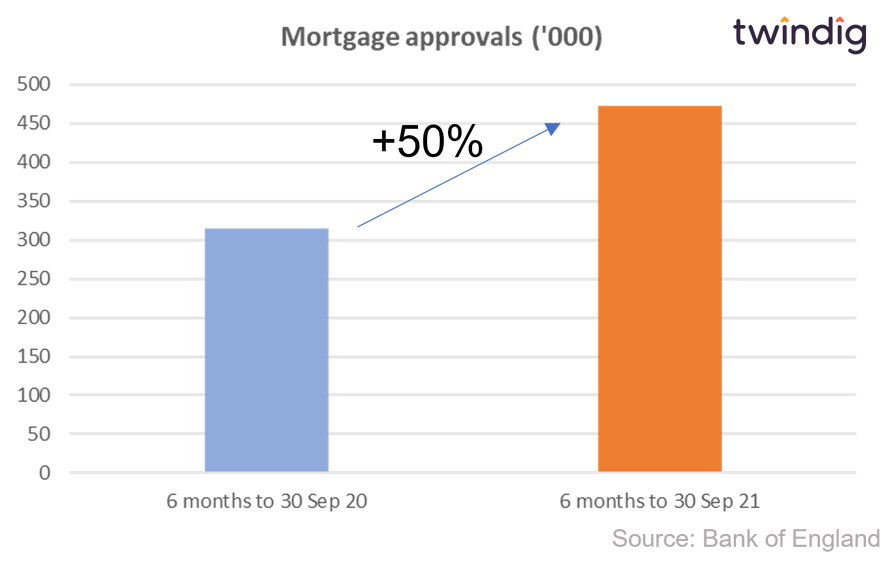

In the six months to 30 September 2021, the six months leading up to the end of the Stamp Duty Holiday there were 474,000 mortgage approvals up from 315,000 in the same period last year.

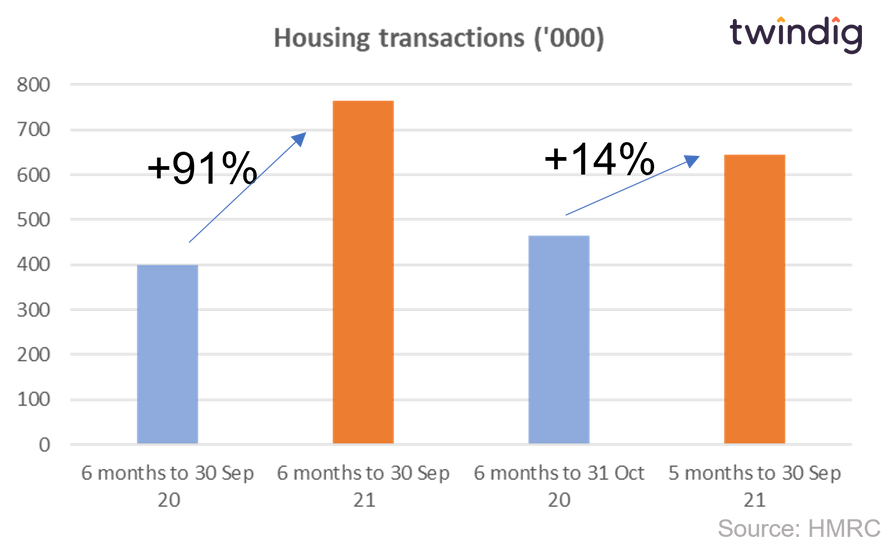

Turning to completed housing transactions in the six months to 30 September 2021, there were 765,570 completed housing transactions, up from 400,200 in the same period last year.

Mortgage approvals are up 50% and housing transactions are up 91%.

We do not yet have the market data for October 2021, but even if we assume there were no housing transactions in October 2021, the number of housing transactions in the five months to 30 September 2021 will still have significantly trumped the six months to 31 October 2020.

Against this backdrop of a very strong housing market, Purplebricks expects to report around 13,000 fewer instructions (unlucky for them) in the six month period to 31 October this year when compared to last, a reduction of 38%. A very big swing in the opposite direction.

Macro vs microeconomics?

There are two themes in the Purplebricks trading update. The housing market is more challenging and that the Group’s strategic transformation is gaining momentum.

Has the group confused the macro with the micro, isn’t it more of a case that the housing market gained momentum and the strategic transformation is more challenging?

Strategic change is never easy and the Group must be congratulated for both appreciating that its original model was not working and trying to change it (although we are not commenting on the efficacy of the changes).

In our view, the housing market is being blamed for the Group’s internal growing or strategic transitioning pains. It will not be the first or the last to point to macro issues to explain micro-challenges (Brexit, COVID and the weather have all been blamed for things that are not their fault).

Looking forward

Estate agents would always like to win more instructions and sell more houses, we would be surprised if they did not, and it is too early to tell if Purplebricks new model has fixed old problems. Taking the trading statement at face value the market has disrupted the disruptor more than it has disrupted the market. However, digging a little deeper we believe that internal disruption and change has led to significant underperformance. If Purplebricks trading update tells us anything it is perhaps that in both strong and weak markets homeowners currently prefer to pay estate agents upon the successful sale of their home rather than before it is sold.