Housepresso 4 July 21

All you need to know about the housing market this week in one quick hit

House prices partying like it's November 2004

The latest house price data released today from Nationwide is a case of lucky 13 for owners (house prices hitting yet another all-time high), but unlucky 13 for first-time buyers (houses have never been so expensive) as annual house price inflation exceeds 13% in June 21.

Why First Time Buyers are susceptible to long covid

Despite a buoyant UK housing market, first-time buyers have not fared as well as next-steppers (those selling a home and buying another one), second home buyers and buy-to-let landlords. The gap between existing homeowners and those who are struggling to get onto the property ladder has widened. The impact of the pandemic on first-time buyers is a case of homebuying long COVID.

In the article below, we look at the virulent combination of factors that have led us to believe that first-time buyers are acutely susceptible to 'homebuying long COVID'.

New Stamp Duty Rules

New Stamp Duty rules came into effect from 1 July 2021. Housing transactions completing between 1 July 2021 and 30 September 2021 pay no stamp duty on the first £250,000 for those buying their primary residence.

This means that the maximum benefit of the Stamp Duty Holiday halved on 1 July 2021. Between 8 July 2020 to 30 June 2021, there was no stamp duty to pay on the first £500,000 for those buying their primary residence.

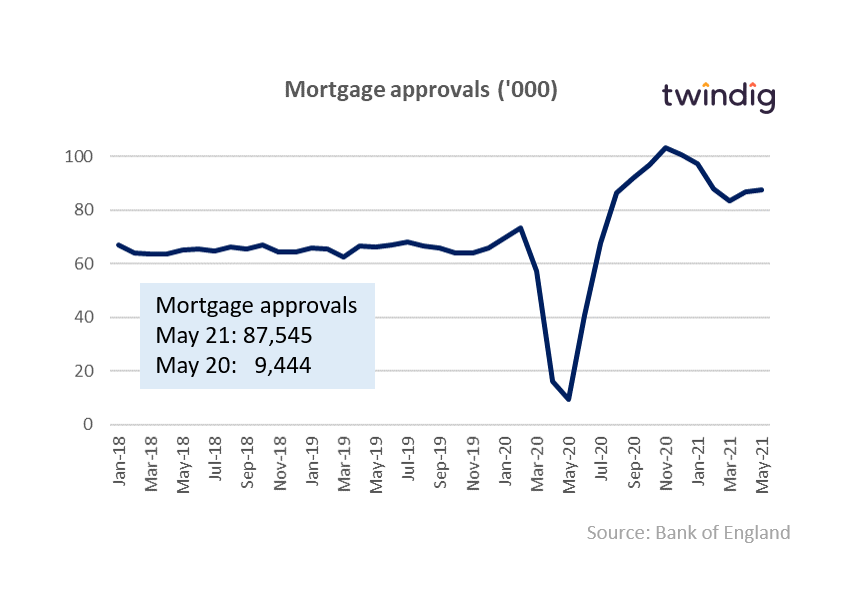

Mortgage approvals up 827% in May

It is not often we get to see mortgage approvals increase by 827%, but in May 2021 they did, coming in 827% ahead of their May 2020 level. Yes, May 2020 marked the low point, lower than the credit crunch lows as the UK Government shut the housing market, but, mortgage approvals in May 2021 were 36% above their 10-year average as a combination of pent up demand, working from home, and the stamp duty holiday gets Britain moving.

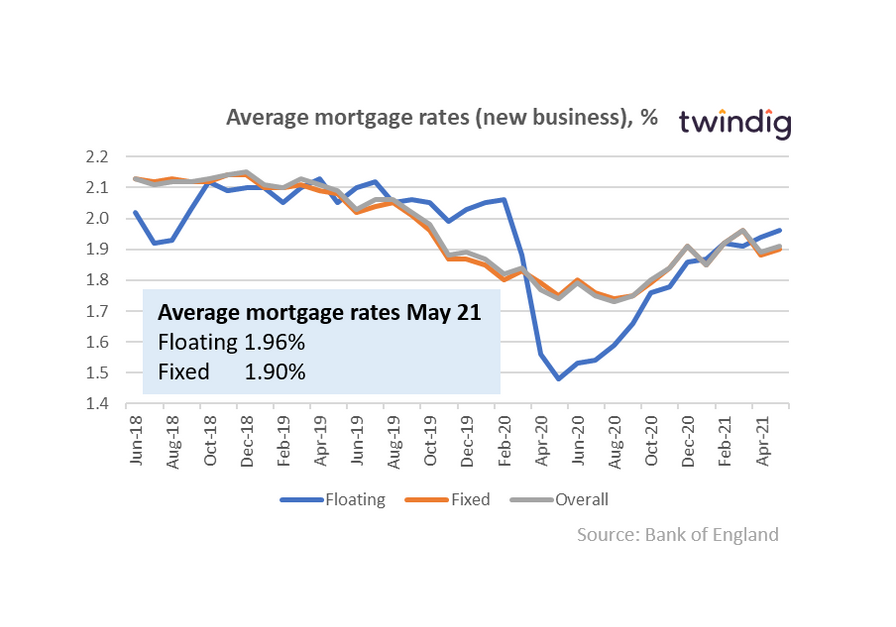

Mortgage rates, like house prices, moving on up

Mortgage rates for new mortgages ticked up in May 2021. Mortgage rates still remain low from a long-term view, but the direction of travel, much like house prices is up. Mortgage rates are lowest for those with the biggest deposits, which of course makes sense from the lender's point of view as these mortgages are less risky, however once again those aspiring first-time buyers with a smaller deposit face an uphill struggle to get a foot on the housing ladder.