New Stamp Duty Rules

Half-day holiday…

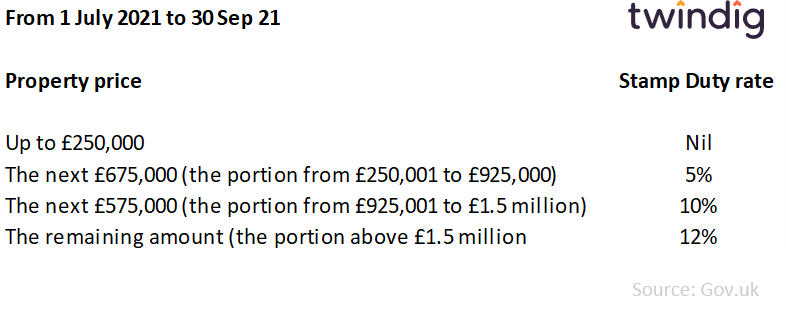

Today (1 July 2021) marks a change in the Stamp Duty Holiday rules. Housing transactions completing between 1 July 2021 and 30 September 2021 pay no stamp duty on the first £250,000 for those buying their primary residence.

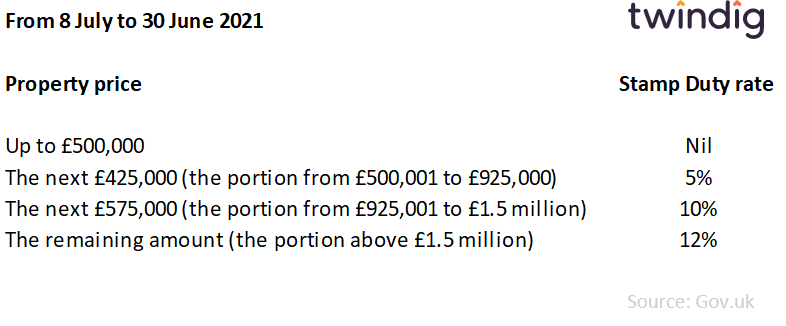

This means that the maximum benefit of the Stamp Duty Holiday halved on 1 July 2021. Between 8 July 2020 to 30 June 2021, there was no stamp duty to pay on the first £500,000 for those buying their primary residence.

Back to school in October

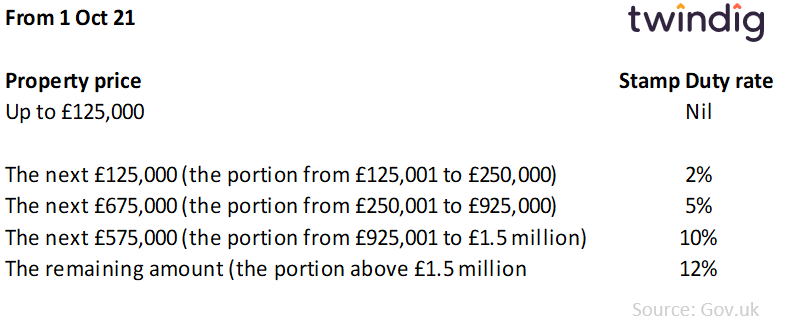

From 1 October 2021 Stamp Duty the stamp duty holiday comes to an end and becomes payable on house purchases costing more than £125,000 as the Stamp Duty rates and thresholds go back to their pre-pandemic levels.

Stamp Duty Calculator

You can calculate the stamp duty you will have to pay using our stamp duty calculator

What are the new Stamp duty Rates?

We show in the table below the stamp duty rates effective from 1 July 2021

The Table below shows the Stamp Duty Tax rates from 1 October 2021

The Table below shows what Stamp Duty Tax rates were between 8 July 2020 and 30 June 2021, which was the main part of the Stamp Duty Holiday