First Time Buyers suffering from long Covid

Why First Time Buyers are susceptible to long covid

Despite a buoyant UK housing market, first-time buyers have not fared as well as next-steppers (those selling a home and buying another one), second home buyers and buy-to-let landlords. The gap between existing homeowners and those who are struggling to get onto the property ladder has widened. The impact of the pandemic on first-time buyers is a case of homebuying long COVID.

In this article, we look at the virulent combination of factors that have led us to believe that first-time buyers are acutely susceptible to 'homebuying long COVID'. The culprits are: a buoyant housing market, rising house prices, a long term trend of rent inflation, the pandemic boosted savings of the wealthy and a stamp duty holiday which worked against first-time buyers rather than for them.

We have not yet found a vaccine or a quick fix for homebuying long Covid and unfortunately, until we do, aspiring first-time buyers will continue to face a longer and more arduous path to homeownership than they did before the pandemic struck.

The buoyant market

Since the start of lockdown 1 according to the Nationwide Building Society, house prices have increased by more than £25,000 and have risen by just over £29,000 since the start of the Stamp Duty Holiday last year.

One step forward two steps back

It is telling that house prices have increased by more than the maximum stamp duty saving of £15,000. However, for the average house price of £245,432, the Stamp Duty Saving for a transaction completing in England and Wales before the end of September is only £2,409. The homebuyer may have saved £2,409 but has had to spend an additional £29,000 to do so. A case of one step forward and two steps back

No steps forward three steps back

However, the situation is much much worse for aspiring first-time buyers. Before the COVID-19 pandemic, first-time buyers only had to pay stamp duty if they were buying a home for more than £300,000. They have therefore seen average house prices increase by £29,000 with no saving in Stamp Duty, a grey cloud without a silver lining or just a case of three steps back.

House prices rising faster than wages

Unfortunately wage growth, even for those not impacted by furlough, has not kept pace with the growth in house prices. This means that first time buyers need to secure a bigger deposit to buy a home because the amount they can borrow is not rising in line with house prices.

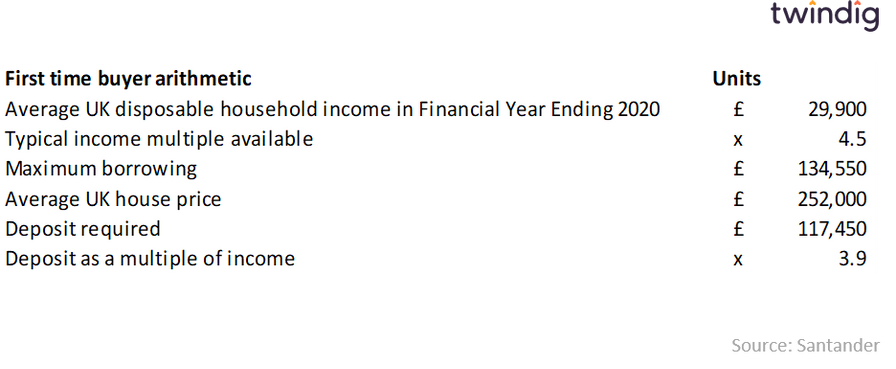

The First Time Buyer arithmetic in Santander’s Life after lockdown report makes depressing reading, suggesting that the average first time buyer needs to find a deposit of almost £120,000 and that is a lot of coins under an awful lot of sofas.

Rents are also rising faster than wages

Santander reported earlier this month that over the past five years, average rent has risen by 10%, while incomes have only risen by 7%, which further impedes aspiring first-time buyers ability to save for that critical deposit.

Deposits are no longer a hurdle but a high jump

We often talk about deposits being a hurdle to be cleared to get on the housing ladder, but as rents and house prices grow at a faster rate than wages that hurdle has become a high jump

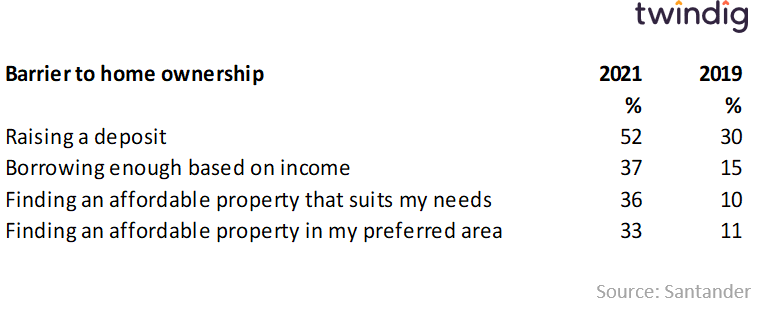

The pandemic has exacerbated the problem. In 2019 30% thought that raising a deposit was a barrier to homeownership, which has now risen to 52%.

The pandemic boosted the savings of the wealthy

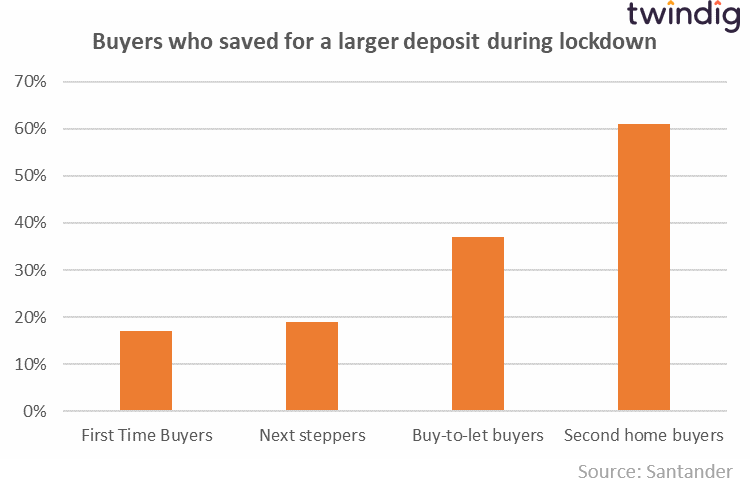

Whilst aspiring first-time buyers scrimp and save for a deposit. Homeowners have seen their savings boosted during the pandemic. According to the Bank of England and NMG household survey data, UK households saved £153bn in 2020 - almost £100bn or 180% more than in 2019 when savings grew by £55bn. As holidays, shops and restaurants were off-limits the those on higher incomes were able to save more as their disposable income was driven up by lockdown. Santander's survey reported that almost 1 in 3 of those who bought a home during 2020 said that lockdown enabled them to build up a bigger deposit.

Unfortunately the same is not true for many first time buyers who due to their age were more likely to earn less than homeowners and be more likely to be working in positions that were furloughed or laid off altogether.

Stamp Duty Holiday helped many, but not First Time Buyers…

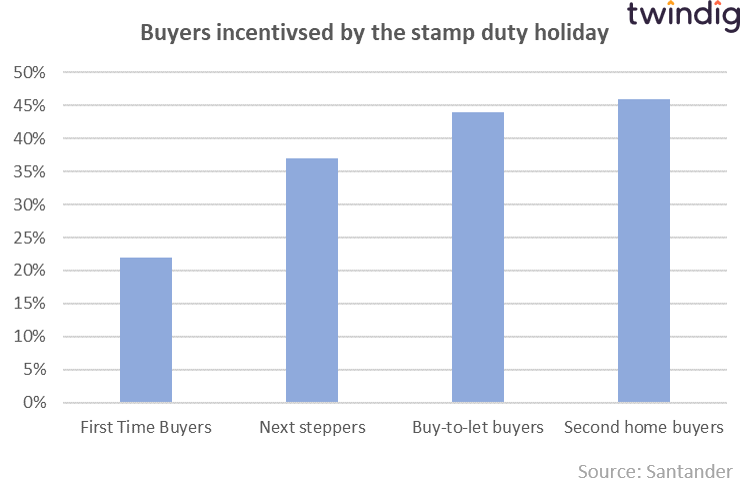

When Rishi Sunak the Chancellor of the Exchequer launched the Stamp Duty Holiday in July 2020 he cut stamp duty to catalyse the housing market and boost confidence. It certainly did that, but it incentivised home movers, buy to let investors and second-home buyers more than it did first-time buyers.

First-time buyers already did not have to pay stamp duty if buying a home for less than £300,000. The Stamp Duty holiday took this advantage away and has led to a significant increase in house prices. Wages of First-Time buyers for those lucky enough to have kept their jobs and/or not been furloughed have not kept pace with house prices meaning that they are not only having to pay more to purchase a home but will also need a bigger deposit than they did before the pandemic.