Housepresso 3 April 22

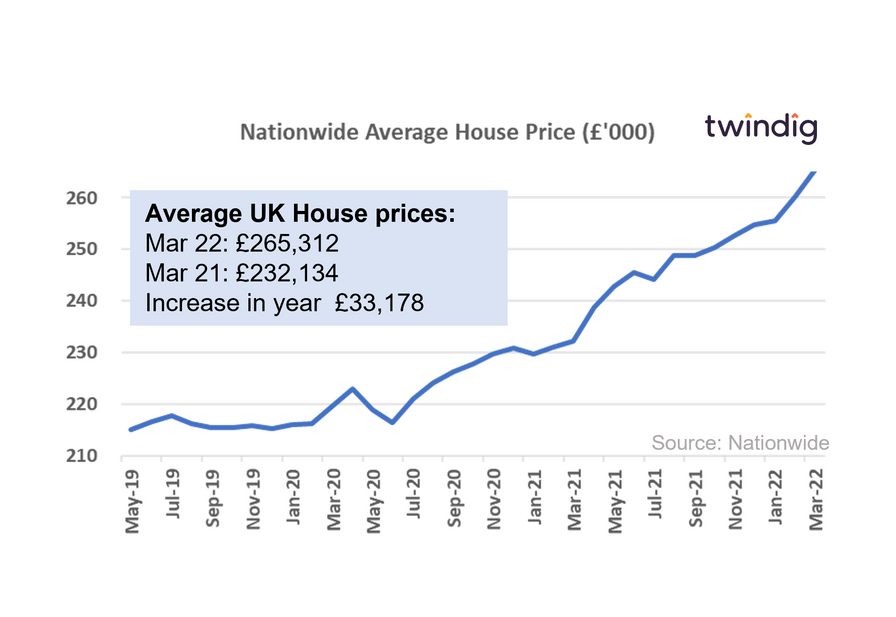

House prices rising likes it's November 2004

House prices almost broke our chart this week as the Nationwide house price index hit a new high in March 2022 of £265,312. UK house prices have now increased by £50,000 since the first lockdown as house price inflation hit its highest rate since November 2004 in March

Meanwhile, mortgage approvals dip

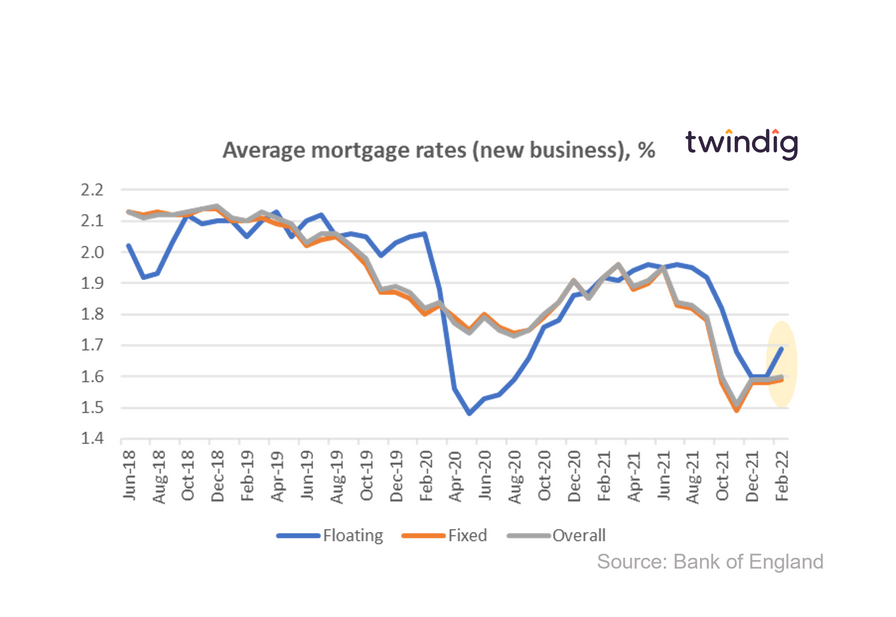

Although mortgage approvals dipped a touch in February, they are still comfortably (7.5% or 4,977 mortgages) ahead of the 10 year average of 66,016. One data point does not make a trend, but we could be seeing the start of the impact of the rising cost of living on the housing market. Mortgage rates are also starting to rise which may also be weighting on homebuyers' minds, however, in the past mortgage rates have been a very weak predictor of the level of mortgage approvals.

And mortgage rates rise

Following the recent increases in Bank Rate, it is no surprise that mortgage rates are starting to increase. The Bank of England's Bank Rate sets the tone for all other mortgage and interest rates. The days of ultra-low mortgage rates may be behind us, but in the context of history, mortgage rates will remain very low for some time to come.

Scotlands house price winners and losers

We take a look at the latest house price winners and losers, which was the local market where average house prices increased by market increased by £47,670 last month and which market saw house prices fall by £19,650...?

Twindig Housing Market Index

In the week where the Nationwide House Price Index hit another high and house price inflation reached its highest rate since November 2004, the Twindig Housing Market Index nudged up by 1.4% to 79.6.