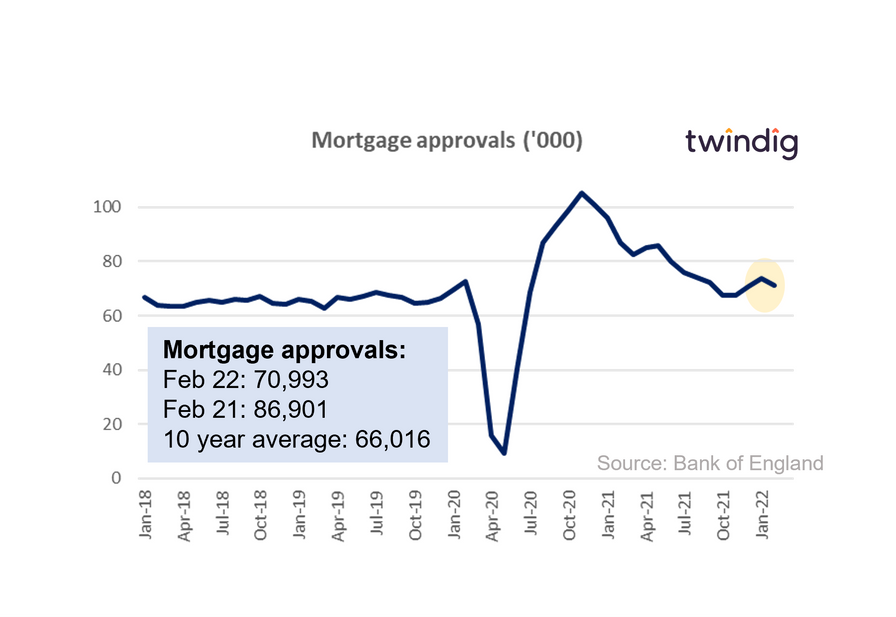

Mortgage approvals dip during February 2022

The Bank of England released the mortgage approval data for February 2022 this morning.

What they said

Mortgage approvals for February 2022 were 70,993

This was 3.9% lower than the 73,841 mortgages approved in January 2022

This was 18.3% lower than the 86,901 mortgages approved during February 2021

Twindig take

Although mortgage approvals dipped a touch in February, they are still comfortably (7.5% or 4,977 mortgages) ahead of the 10 year average of 66,016.

One data point does not make a trend, but we could be seeing the start of the impact of the rising cost of living on the housing market. Mortgage rates are also starting to rise which may also be weighting on homebuyers minds, however, in the past mortgage rates have been a very weak predictor of the level of mortgage approvals.

If mortgage approvals fell below longer-term trend levels we would start to be concerned, but this is not currently the case and as you can see from the graph above, mortgage approvals bounced back very quickly from their initial COVID-19 lows in 2020.

In our view, the UK housing market is still showing signs of good health and we expect to see a more 'normal' spring selling season this year, the first for quite a while...