Houselungo 31 October 21

A lungo length look at this week's housing market news

The Bank of Mum and Dad says YES!

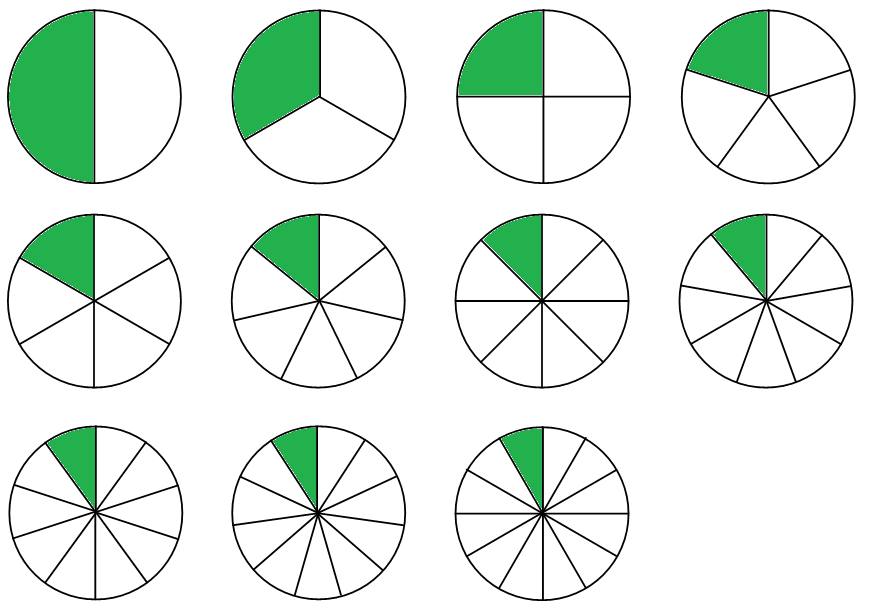

Even whilst interest rates are at or near record lows, few lenders can beat the rates offered by the Bank of Mum and Dad (BoMaD). For those in work and those with income, a consequence of the COVID-19 pandemic has seen savings rise and spending opportunities fell. Couple rising savings of the cash-rich with rising house prices and the doors to the Bank of Mum and Dad have been well and truly open during 2021 and Savills expect them to remain open for some time to come. Great news for those with an account with the Bank of Mum and Dad, but bad news for those without. With access to the Bank of Mum and Dad split roughly 50:50 should we aim to level up or level down?

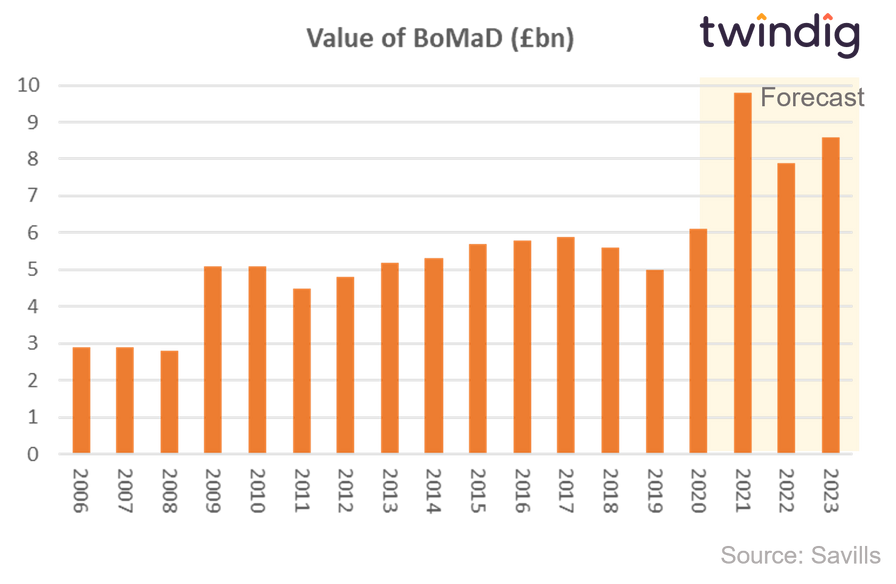

The value of the Bank of Mum and Dad is rising

Perhaps more enlightening and worrying that the share of transactions assisted by the Bank of Mum and Dad is the huge increase in the value of contributions made by the Bank of Mum and Dad, rising from £6.1bn in 2020 to an estimated £9.8bn in 2021 an increase of more than 60% and it is expected to remain at elevated levels for the next few years.

Cause and effect are difficult to determine and whilst at a micro or family level the Bank of Mum and Dad makes a lot of sense (for those lucky enough to have access) at a macro or country and society level the lending activity of the Bank of Mum and Dad puts house prices out of reach for those without access.

If we equate use with access (which we appreciate is perhaps an oversimplifying assumption) this means just over 50% (one in every two) first-time buyers are trying to buy with one financial arm tied behind their back. The playing field is not level, and we are not sure that this is an area that the UK Government is seeking to level up.

Spending Review, a case of confirmation bias?

Following the name change of the Ministry of Housing, Communities & Local Government to the Department for Levelling Up, Housing and Communities, we had hoped that today’s Spending Review would have included new initiatives to level up the access to housing.

We had hoped that Generation Rent and those without access to the Bank of Mum and Dad (one of the UK’s biggest ‘lenders’) would have been helped onto the housing ladder as part of a levelling up of our economy as we move towards higher wages and higher skills.

Confirmation Bias

However, we were disappointed. Rather than new levelling up policies, the majority of the major housing-related announcements were ‘confirmations’ of previously announced policies. Today's Spending Review was more of a confirmation bias rather than a bold start for the Department of Levelling Up. A missed opportunity to fix a broken market and perhaps a confirmation that rising house prices are more important than levelling up the housing market in some of the corridors of power.

Mr Sunak told us that:

Employment is up.

Investment is growing.

Public services are improving.

The public finances are stabilising

He went on to say that:

Let there be no doubt – our plan is working.

It is just a shame, in our view, that the plan does not seem to include levelling up the housing market.

The Case for fractional homeownership

Unfortunately, the Spending Review did little to help level up the housing market, in our view, the way to level up the UK Housing market is through fractional ownership. Level up the housing market by allowing everyone to participate as they can afford to without the need to take on debt. We also believe that fractional homeownership has the potential to both level up the housing market and solve the pension crisis.

The housing problem

It is very difficult to put money into the housing market.

It is very difficult to take money out of the housing market.

Typically, to put money into the housing market, we take on debt (a mortgage), and to take money out of the housing market (equity release) we also take on debt because traditional equity release is really taking on debt not releasing equity.

The UK is also facing a pension crisis. Too many people have too small a pension to fund their retirement.

The solution: Fractional ownership of property

We believe that you should be able to put money into the housing market as you can afford to, and to take money out as you need it. Fractional ownership of residential property will allow it to be bought and sold one brick at a time without the need to take on debt.

Why do we believe fractional ownership is the answer?

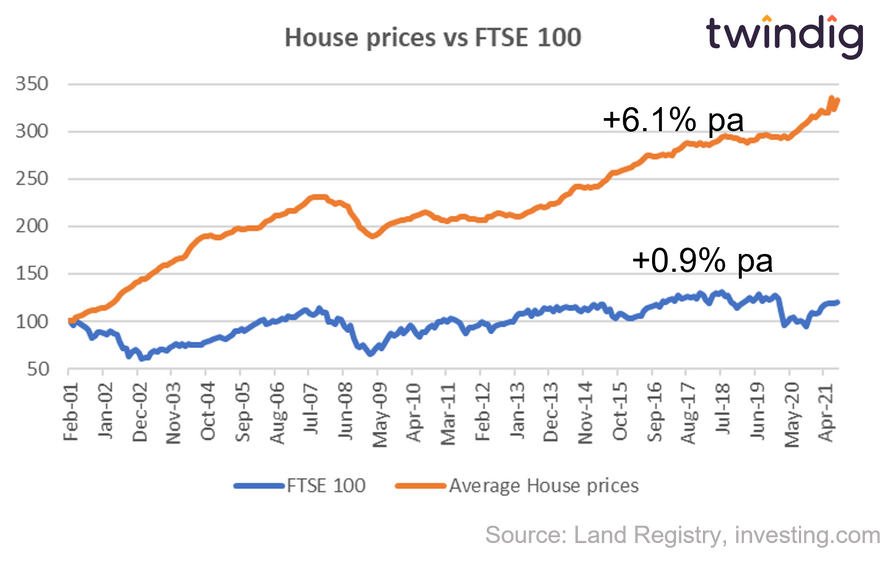

Residential property is one of the biggest, most understood and stable asset classes in the country and yet many are unable to access it to accumulate wealth. The growth in house prices consistently outperforms the performance of the FTSE 100 share price Index.

Mortgage approvals back from holiday

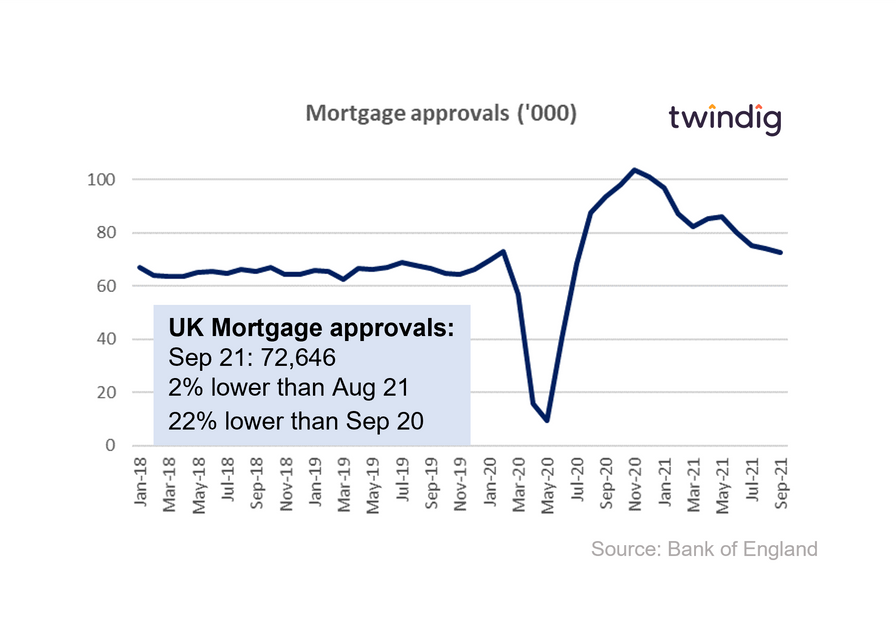

The Bank of England released its mortgage approval data for September on Friday

What they said

Mortgage approvals for September 2021 were 72,646

This was 2.1% lower than the 74,214 in August

This was 22% lower than the 93,409 in September 2020

Twindig take

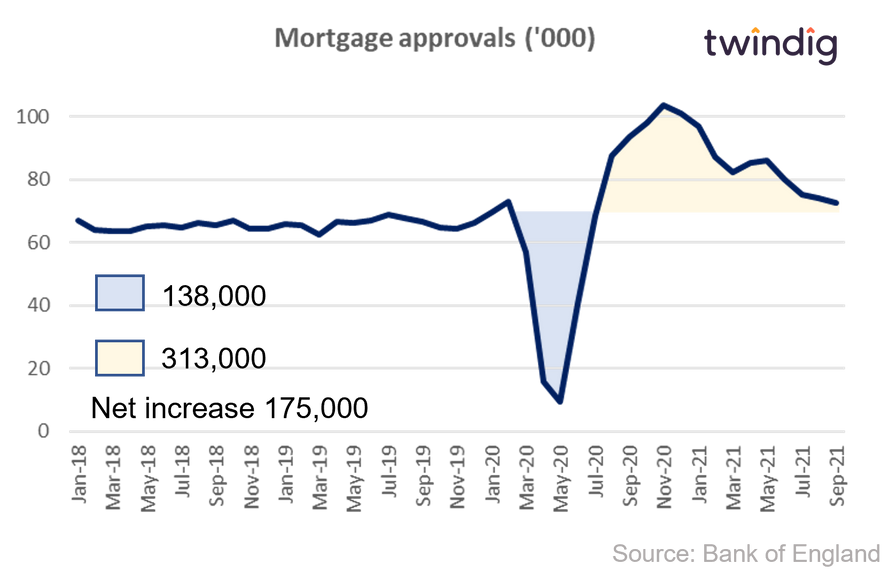

The mortgage approvals chart tells the story of the pandemic and the stamp duty holiday, in our view. A dramatic fall as we entered lockdown 1 and during the period where UK housing market was effectively shut, followed by a surge in approvals during the stamp duty holiday.

It seems to us that mortgage approvals are returning to their normal levels, a case of mean reversion, as the stamp duty holiday drew to a close. Mortgages approved in September would have been very unlikely to have been used to finance house purchases also completing in September and therefore were approved against a backdrop of normal stamp duty thresholds.

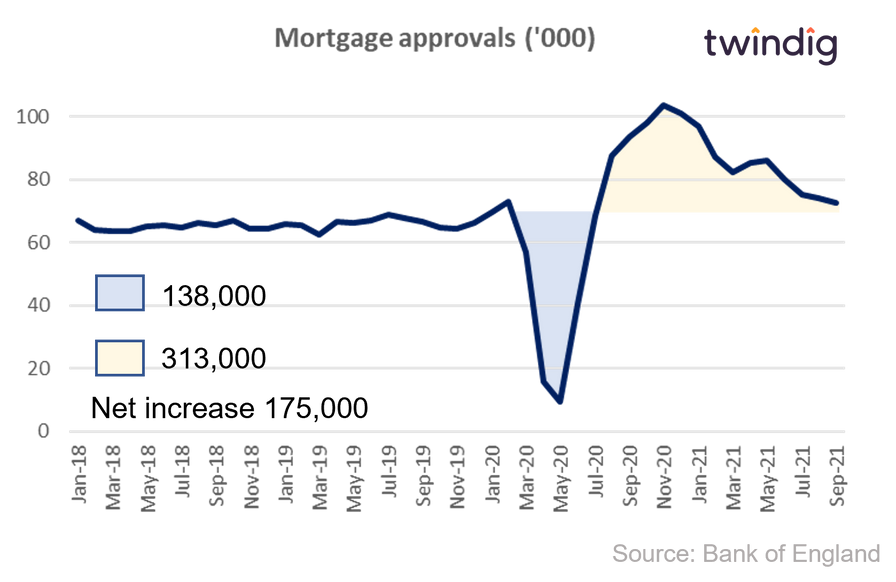

Whilst optically it looks as if the Covid dip is matched by the stamp duty rise if we look at how mortgage approvals since the start of the COVID-19 pandemic have varied from the 10 year monthly average we see that there was a 'fall' of 138,000 approvals followed by a 'gain' of 313,000 during the Stamp Duty Holiday as homebuyers pulled forward their home-buying plans or raced to but during the Stamp Duty Holiday.

Twindig Housing Market Index

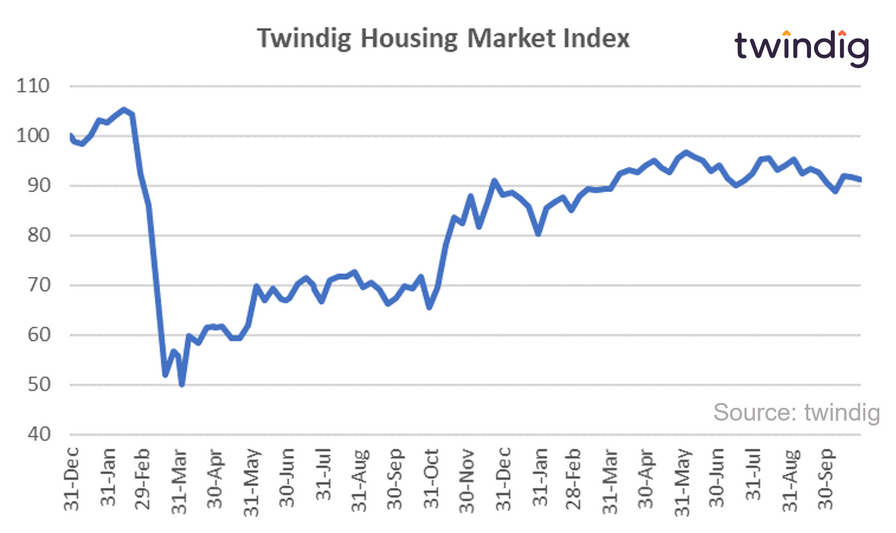

In a week where the Spending Review was a missed opportunity, investor confidence in the housing market nudged down a touch. With the Stamp Duty Holiday fully behind us and post-holiday data points starting to come through, it seems that the housing market will take a pause for breath. Some believe it will be a short pause, others that the market will be quieter now for the rest of the year as the market readies itself for the next spring selling season.

The seller's market appears to be over and, for now, at least, we may see the return of a buyer's market, which will be welcomed by all those who were either priced out or missed out on the stamp duty holiday.

Mortgage approvals were quick to start returning to more normal levels and a measure of the size Stamp Duty Holiday stimulus can be taken from the number of 'above trend' mortgage approvals since the start of the COVID-19 pandemic. A net increase of 175,000. Not all of those approvals will end in a completed housing transaction, but the stamp duty holiday certainly encouraged more to think about moving or accelerate their moving plans.