Bank of Mum and Dad the bank that likes to say 'Yes'

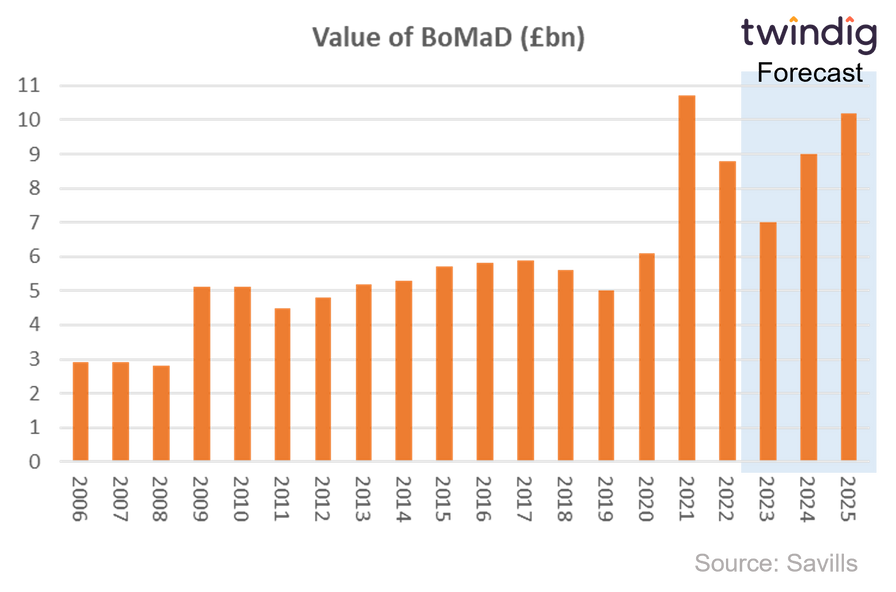

The scale of the Bank of Mum and Dad remains an important part of the UK housing market. Whilst 2022 was not as big a year for the Bank of Mum and Dad as 2021, the assistance of £8.8bn is not to be sniffed at.

Savills predict that the size and scale of the Bank of Mum and Dad will increase as we enter a world without Help to Buy and rising mortgage rates.

In 2023 the Bank of Mum and Dad is expected to assist three out of five first-time buyer house purchases, raising the question of how do those without access to this particular bank get a foot on the housing ladder?

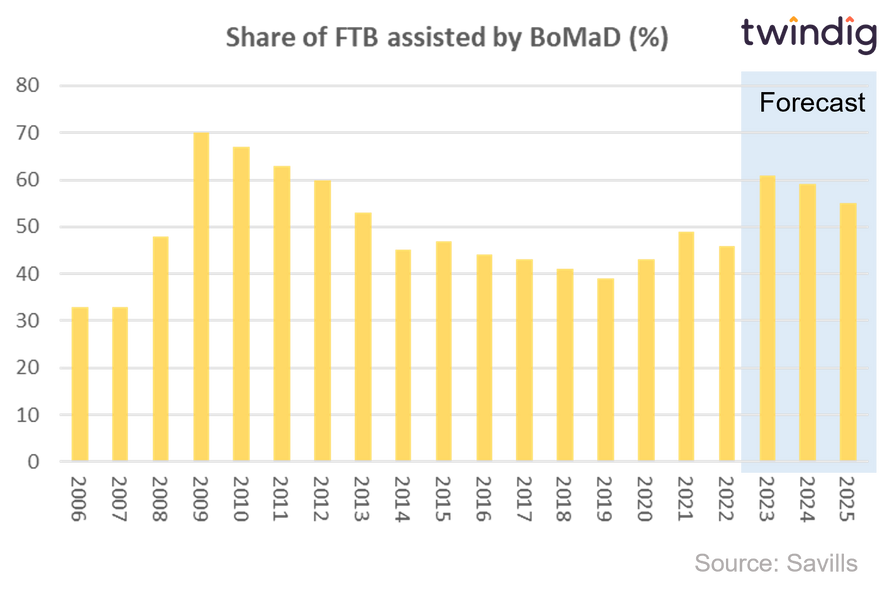

Bank of Mum and Dad funding almost 50% of house purchases

During 2022 the Bank of Mum and Dad assisted 46% of home purchases, this was down on the stamp duty holiday fuelled 2021, but still the second highest level since 2015.

The share has been higher in the past, reaching 70% (seven out of ten) in 2009 in the jaws of the Global Financial Crisis before falling steadily to around 43% by 2016.

Whilst we expect housing transactions to be lower in 2023 than they were in 2022, Savills predicts that the share of Bank of Mum and Dad assisted purchases will rise to 61% the highest since 2011 as rising mortgage rates stretch affordability and the new build market can no longer offer Help to Buy.

The value of the Bank of Mum and Dad remains high

The total value of the Bank of Mum and Dad fell in 2022 by £1.9bn to £8.8bn, but this was still the second-highest level on record. It is expected to fall again during 2023 to £7.0bn before rising in 2024 to £9.0bn and to £10.2bn in 2025.

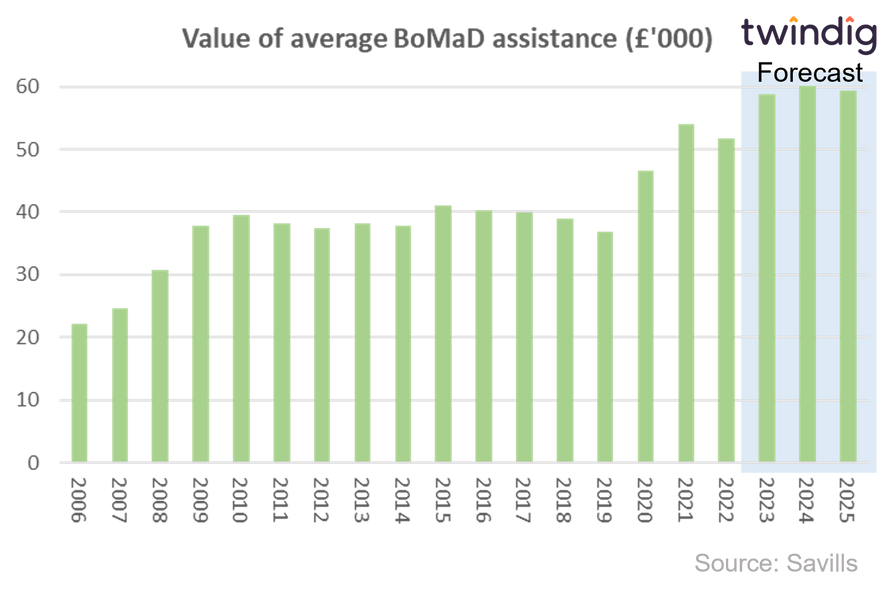

The size of BoMaD 'loans' is also remains high, with growth to come

The size of the average Bank of Mum and Dad contribution in 2022 was £51,800, down slightly from the £54,000 seen in 2021. Savills forecasts that the average Bank of Mum and Dad contribution will leap by 14% in 2023 to £58,800 and rise to over £60,000 in 2024.

It seems that after a period of relative stability between 2009 and 2019 averaging around £39,000, the average contribution has risen to a new equilibrium

The big increases in 2020 and 2021 suggest to us that the Bank of Mum and Dad are now filling the Loan to Income (LTI) gap rather than the LTV gap. The issue today, and it seems in the future will be mortgage capacity, not mortgage availability, which once again, in our view, is a consequence of the divorce between wages and house prices.

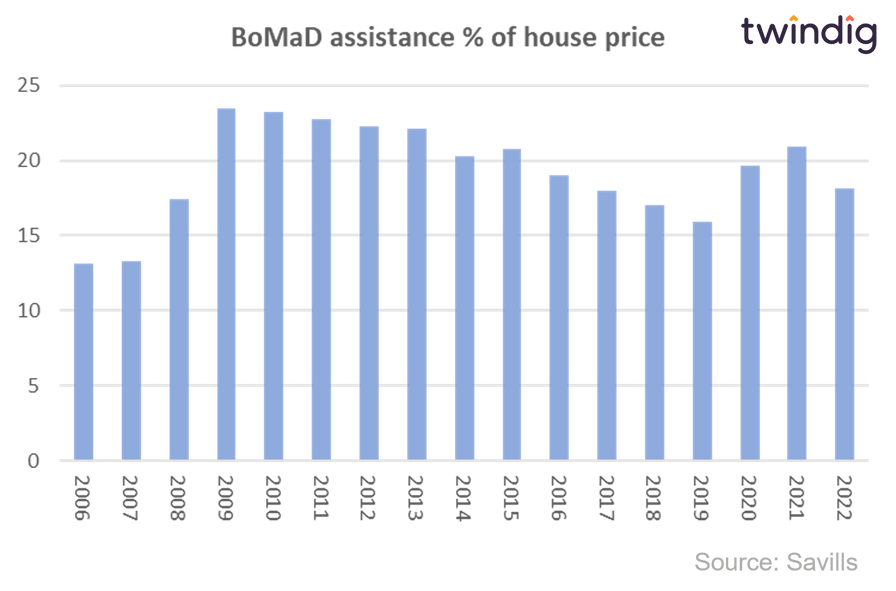

Bank of Mum and Dad and house prices

As already noted we believe that the Credit Crunch created an LTV gap for the Bank of Mum and Dad to fill, but that rising house prices during the COVID-19 pandemic have led to a Loan-to-Income Gap.

This financing or loan to income gap of £51,000 is very significant in a country where the median average full-time wage is around £32,000. This means that the loan-to-income gap is almost two years pre-tax earnings rising to 2 years 3 months if we consider take-home pay. These are figures known all to well for those without access to the Bank of Mum and Dad and it is easy to see why the UK Government is seeking to turn the UK into a high wage economy.

Should we level up or level down?

Whilst many are critical of help to buy for pumping money into an already heated housing market, those same critics are more than often silent on the inflationary impact of the contributions of the Bank of Mum and Dad. However, if one is inflationary then so is the other.

This leads us to the question should we, level down or level up?

Should we level down and take away the lending licence and close the doors of the Bank of Mum and Dad or should we level up and set up a bank of mum and dad for those without access to their own bank of Mum and Dad.

I am sure that supporters and detractors of both sides will voice their opinions with force and I am not suggesting that either approach is a perfect one, but what I am sure of is that if we do nothing then housing wealth inequality in this country will worsen and the gap between rich and poor will widen and the consequences of that are not good at all.