Houselungo 30 January 22

https://www.twindig.com/market...

We need to talk about housing affordability

Data just released from Nationwide highlights the growing housing affordability crisis. Whilst for many rising house prices have been a silver lining in a dark and grey COVID cloud, for others it has only made a dark day darker.

Whilst we often view the UK as a nation of homeowners, we are rapidly becoming a nation of the haves and have nots when it comes to homeownership, and rising house prices exacerbate this thorny issue. As affordability gets ever more stretched the importance of securing a large deposit increases and this is often the final and biggest homeownership hurdle to clear.

Putting it bluntly the house price-earnings ratio (HPER)

The House Price Earnings Ratio is a blunt tool. It takes two figures: house prices and earnings (wages or salary) and divides one by the other. The result is how many salary years it would take to buy a home.

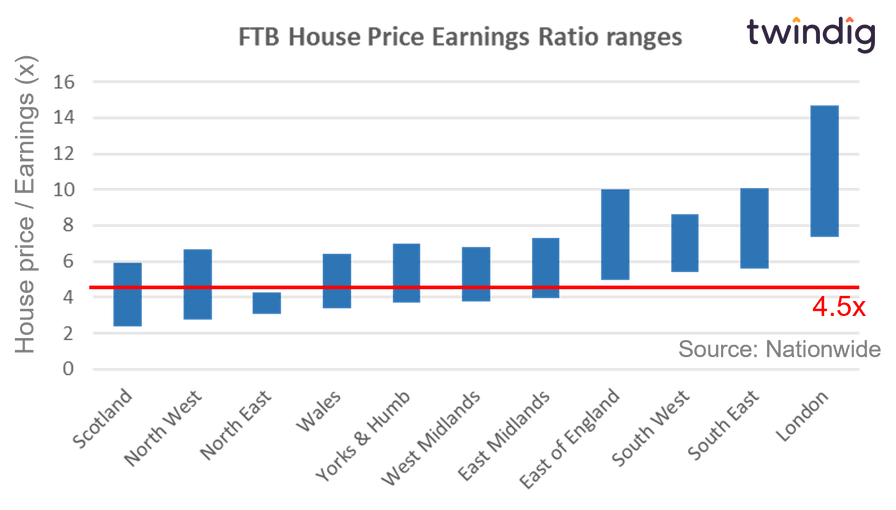

We show in the graph below data from Nationwide showing the range of House Price Earnings Ratio (HPER) by local authority in each region of the UK.

Scotland has the most affordable local authority East Ayrshire with an HPER of 2.4x and London the least affordable, Kensington and Chelsea at an eye-watering 14.7x.

HPER and Loan To Income

One of the key affordability metrics used by mortgage lenders is the ‘Loan to Income’ (LTI) ratio. This ratio is the size of the loan or mortgage divided by your income. It is therefore very similar to the HPER and this is important because no more than 15% of mortgages issued by lenders can be above an LTI of 4.5x. This becomes an issue where the average house price has a House Price Earnings Ratio above 4.5x. The LTI can be reduced by the size of a deposit.

To highlight the housing affordability problem we have added a line to the chart above to show where a 4.5x HPER falls across each region. Tellingly only housing in the North East falls below the all-important 4.5x line. House prices in the overwhelming majority of local authorities are above 4.5x HPER and in the south of the country, all house prices are above 4.5x HPER.

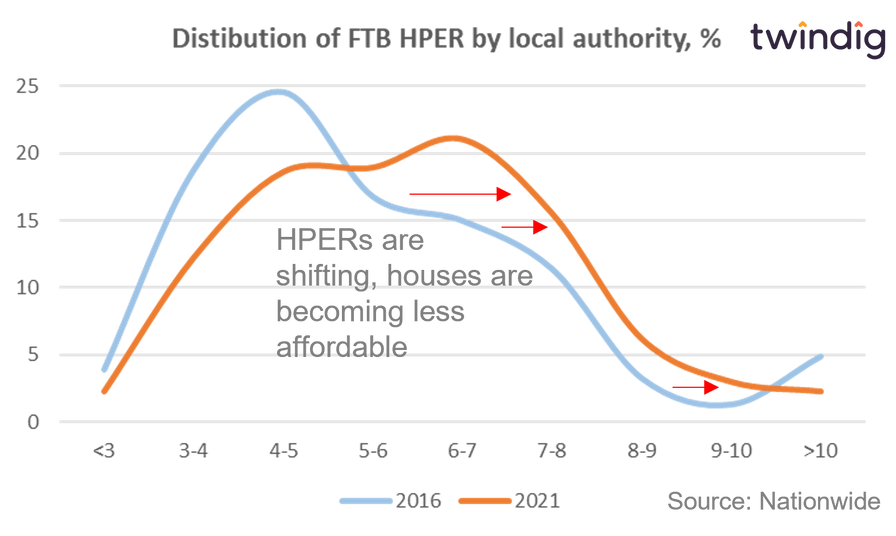

If we dig a little deeper, we can see that over time HPERs shave been shifting, house prices are rising faster than incomes as by the HPER curve shifting to the right in the graph below.

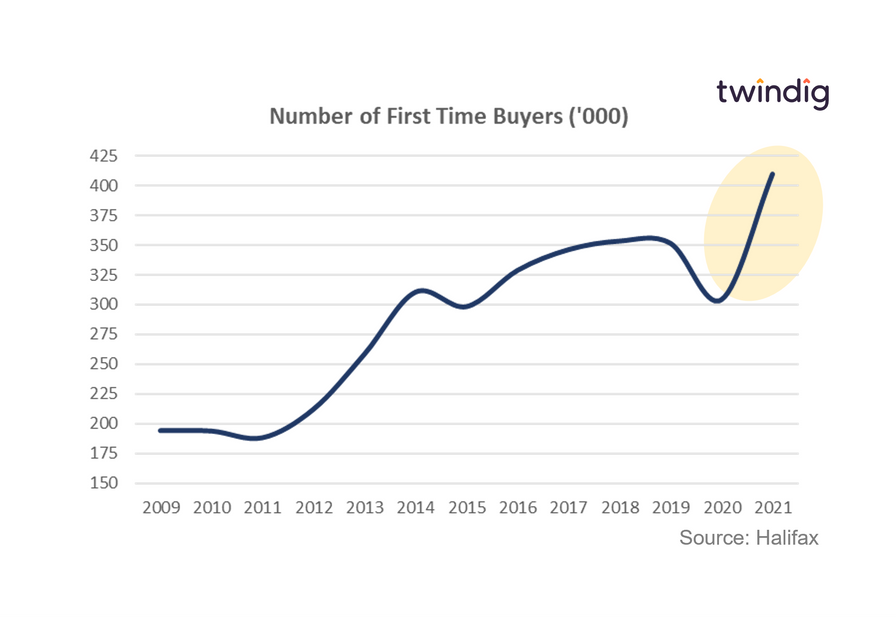

First Time Buyer High

The Halifax 2021 First Time Buyer review revealed that the number of First-Time Buyers shot up dramatically by 35% in 2021, which equates to 300 more first-time buyers per day than in 2020. This is all the more surprising given the surge in house prices in 2021 when house prices increased, on average, by more than £2,000 per month, much, much faster than the wages of the army of stretched first-time buyers. With the cost of living rising and mortgage rates likely to follow suit, it is difficult to see how the high level of first-time buyer activity will be maintained. However, with Help to Buy closing in 2023, 2022 could be a great year for those looking at new builds as developers won't want to be left with Help to Buy focused stock when the music stops in 2023.

With average first-time buyer deposits coming in at £53,935, we ask: Can first-time buyers keep buying?

Why first-time buyers reached new highs in 2021?

The strength of the first-time buyer housing market during the pandemic caught us off guard. However, uncertainty often brings opportunity, which was the case for first-time buyers. Lockdowns and Working From Home led to a race for space, and first-time buyers seized on the opportunity of those looking for a quick sale to escape to the country (or to buy a slightly bigger home).

Lockdown also led to a period of forced saving, as holidays, eating out and most other forms of entertainment were off-limits. During lockdown, the savings of aspiring first-time buyers received an unexpected boost, as did the saving pots of their parents. Combining their savings with the growing deposits in The Bank of Mum and Dad gave many aspiring first-time buyers the deposit boost they needed to get a foot on the housing ladder.

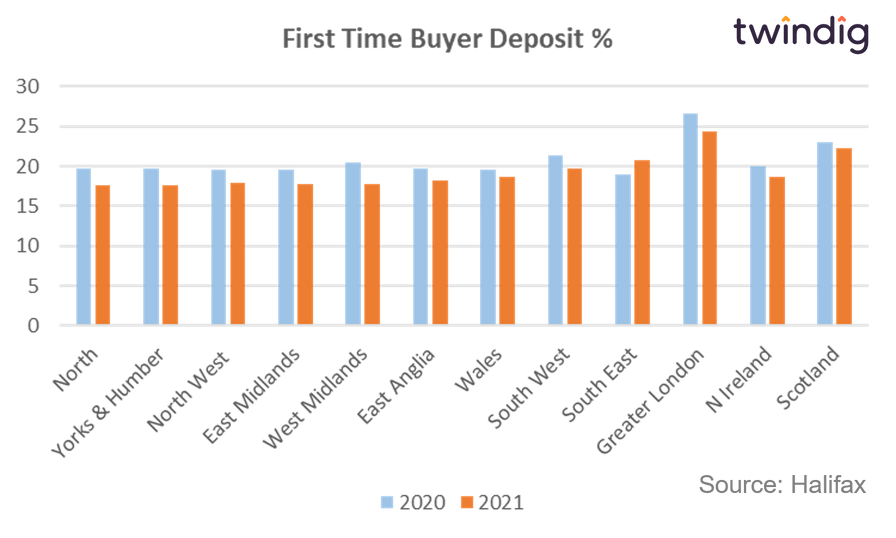

How much deposit does a first-time buyer need?

In theory, a first-time buyer needs a minimum deposit of 5% of the price of the home. Mortgage lenders are keen for first-time buyers to have some skin in the game. With a 5% deposit, a first-time buyer can then secure a home with a 95% loan to value (LTV) mortgage.

Unfortunately, the theory often differs from practice. The Halifax reported that in 2021 the average price of a house purchased by a First Time buyer was £264,140. Therefore a 5% deposit would equate to £13,200, however, the average deposit put down was £53,935, just over 20% or 4x more than a 5% deposit.

First House Prices now Rents

Aspiring first time buyers will find saving for a deposit even harder now as rents rise at record rates. In a further blow to those saving to get a foothold on the property ladder, Rightmove’s latest rental tracker revealed that average asking rents increased by 9.9%, their highest increase on record to £1,068 per calendar month outside of London. Reversing the trends witnessed as the pandemic took hold and making it harder for first-time buyers to save for a deposit.

Rents rising

Asking rents by almost 10% in 2021 outside of London, their highest increase on record.

Wales saw the biggest increase as average asking rents in s rose by 12.7% with Pontypool in Monmouthshire seeing the biggest increase, jumping 20% from £562 to £674 per calendar month.

Asking rents also bounced back in London, rising by 16.2% last year following a drop of 14% the year before. London rents are now just ahead of their pre-pandemic levels.

Why are rents now rising?

Demand factors are putting upward pressure on asking rents in our view. As the economy opens up and we make tentative steps to a more normal life renters are returning to urban centres, where we typically find most of the rental stock and this increase in demand is allowing landlords to raise prices.

We also believe that many tenants had to put off moving during the pandemic and we are seeing a period catch up in rental market activity as the normal moving patterns are being augmented by all of those who wanted to move in 2020 and 2021 but were unable to.

The rental market is therefore seeing the same demand and supply imbalances that plague the home buying and selling market.

Let’s be upfront about property information

Deciding where to live is one of the biggest decisions in life that we make and it can impact our health, our wealth and our wellbeing. It is therefore imperative that we can make informed decisions about where we live. Trading Standards are looking at ways of improving the provision of material upfront property information to enable households to make a good decision about where they live. It is our view that digital property logbooks have a very important role to play in the provision of material upfront property information. In this article, we look at what material upfront property information is and how digital property logbooks help get the right information to the right people at the right time.

What is Upfront Material Property Information?

The Consumer Protection from Unfair Trading Regulations 2008 defines Material Property Information as:

The information that the average consumer needs, according to the context, to take an informed transactional decision

In practice, this means providing the homebuyer, home seller, tenant or landlord with all the information they need at the right time to make an informed decision. For instance, if you spend half of the week working from home, then when buying a home the available broadband strength and speed would be material information required to help you make an informed decision.

The top 5 pieces of material upfront property information

In the most straightforward property sales, the top 5 pieces of material upfront information that should be given to consumers is very basic, as simple as it is important:

1. the asking price (or rent)

2. the specific location

3. the number and size of rooms

4. the tenure: whether the property is freehold or leasehold

5. EPC certificate

The big 10 bits of material upfront property information

After putting the top 5 pieces of information in place the big 10 that follow are also straightforward to collect:

Twindig Housing Market Index

The Twindig Housing Market recorded its biggest fall for a year this week as it dropped by 5.9% to 85.4 its lowest level since 27 February 2021. In the week where parties have repeatedly received a bad press, is the housing market party about to come to an abrupt end?

When lockdown eased, savings rates fell as holidays, going out and eating out were back on the agenda. First-time buyers had made hay whilst the sun shone, but now they and the Bank of Mum and Dad had less firepower to through at the housing market. Supply shortages are however underpinning house prices meaning that we have entered 2022 with housing affordability unusually stretched.

It seems that investors believe that all the low hanging fruit in the housing market has been picked and the helpful stamp duty holiday ladder has been taken away just at the point it is needed. Time will tell if homebuyers can stretch to reach the higher housing fruits or if the house price apples will have to fall in order to be bought.