Houselungo 29 August 21

A lungo length look at this week's housing market news

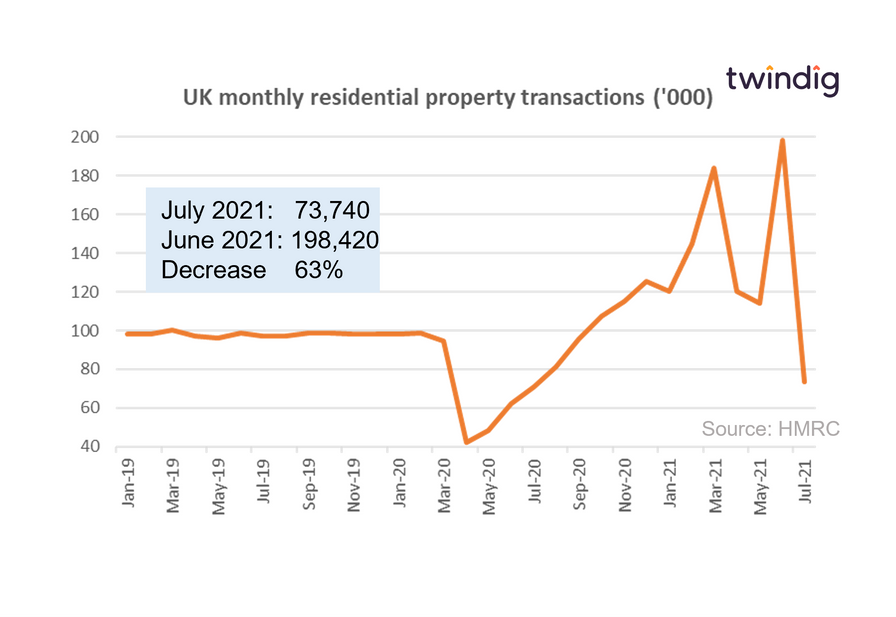

Housing transactions plummet in July

HMRC released provisional housing market transaction data for July 2021 this week

What they said

Housing transactions in July 20201 were 73,740

A reduction of 63% since June 2021

Slightly ahead of July 2020's transactions volume of 70,790

Housing transactions fall 63% in July 2021 as we pass the first of two stamp duty holiday cliffs. This will lead to many asking if the housing market recovery was built on sand (or a lack of stamp duty). However, empirically housing transactions always fall after a significant change in stamp duty as many buyers have pulled forward their purchase decisions to take advantage of the stamp duty benefit whilst it lasts. It is also worth remembering that many can still benefit from the Stamp Duty Holiday as the stamp duty threshold still remains at £250,000 (inline with average house prices) until 30 September. Perhaps the July cliff edge points to those wealthier home buyers being fleet of foot, suggesting this has been a holiday for the cash-rich and those higher up the housing ladder rather than those aspiring to get a foot on the ladder.

Is housing the key to unlocking the pension triple lock?

Traditionally those who are economically active today fund the cost of today’s state pensions. However, there is a problem brewing. The UK has an ageing population, therefore fewer workers are paying for a growing number of pensioners. Either taxes will have to rise, or pensions will have to fall. The triple lock suggests that taxes will rise, but does property hold the key to unlocking pensions without breaking the triple lock?

The ageing population

In 1950 10.8% of the UK population was aged 65 or more. By 2018 it had risen to 18% and is expected to reach 25% by 2050.

The £100bn pa pension bill

There are currently 12.4 million people claiming UK state pension at a cost of around £100bn each year. Under the triple lock, this will grow by at least £2.5bn pa.

What is the triple lock?

The triple lock relates to annual increases in the UK state pension. Currently, it increases each year in line with the highest of three metrics (hence it is called the triple lock):

- Consumer Price Index (CPI)

- Increases in average wages

- 2.5%

Which part of the triple lock is growing the fastest?

The latest provisional data from the ONS suggests that the highest of the triple lock metrics is wage growth, currently at 8.8%, which would, therefore, add £8.8bn to the cost of the state pension bill. An 8.8% pay rise is great if you are a pensioner, but not so great if you are a taxpayer footing the bill.

But, even without the triple lock the pension bill is growing...

Why we don't need Institutional landlords

John Lewis and Lloyds Bank (via Citra Living) have recently announced that they are planning to join the ranks of Grainger, Legal & General and M&G as professional landlords in the residential rental sector.

At a time when we are not building enough houses and house prices are rising, do we need such deep-pocketed corporations looking to get lots of feet on the housing ladder, whilst many aspiring homebuyers struggle to get just one foot onto the housing ladder?

Wouldn’t big corporations be better served to help others on to and up the housing ladder rather than taking the ladder away from them?

In a world where big companies and corporations are viewed with caution rather than trust, Twindig has a look into what might be driving these big corporations to buy up our homes.