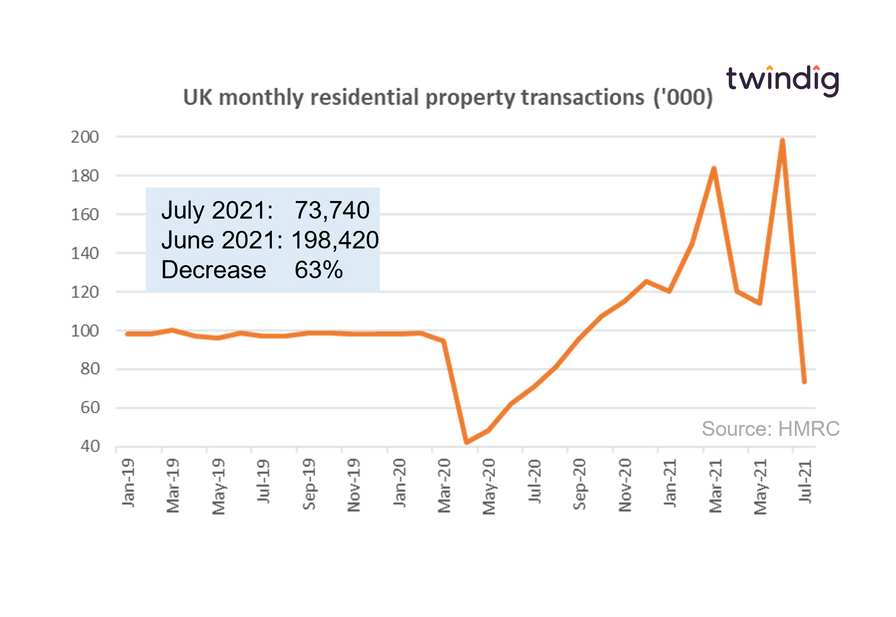

Housing transactions fall off a stamp duty cliff in July 2021

HMRC released provisional housing market transaction data for July 2021 this morning

What they said

Housing transactions in July 20201 were 73,740

A reduction of 63% since June 2021

Slightly ahead of July 2020's transactions volume of 70,790

Twindig take

Watch out for the cliff edge

In the first month following the reduction in the Stamp Duty Holiday benefit (the Stamp Duty Holiday threshold was reduced from £500,000 to £250,000 on 1 July 2021) UK housing transactions fell off a stamp duty cliff.

Housing transactions fell by 63% in July 2021 as we pass the first of two stamp duty holiday cliffs. This will lead to many asking if the housing market recovery was built on sand (or a lack of stamp duty) rather than a firmer foundation.

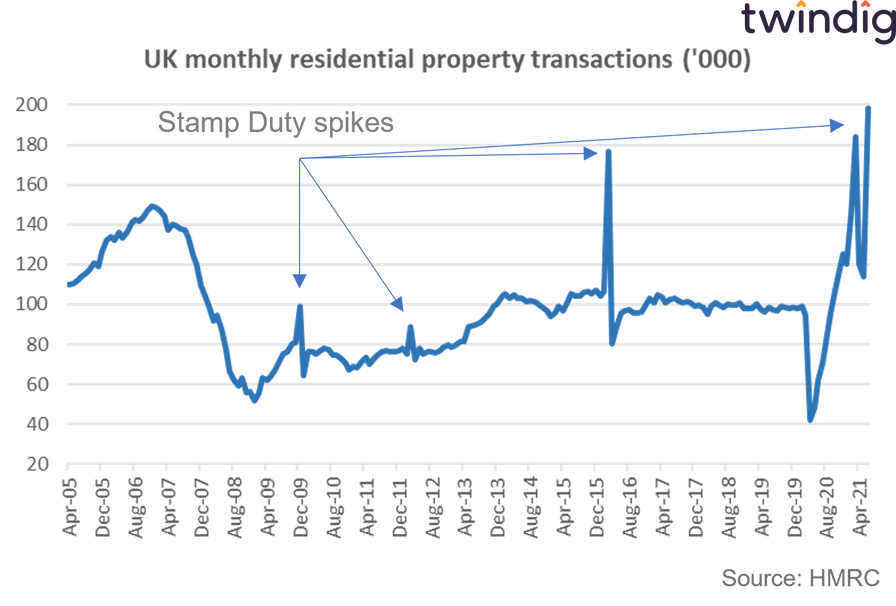

However, empirically housing transactions always fall after a significant change in stamp duty as many buyers have pulled forward their purchase decisions to take advantage of the stamp duty benefit whilst it lasts as illustrated below:

Stamp Duty Holiday down but not out

It is also worth remembering that many can still benefit from the Stamp Duty Holiday as the stamp duty threshold still remains at £250,000 (in line with average house prices) until 30 September, before returning to its pre-pandemic level of £125,000. This implies a stamp duty saving of £2,500 is up for grabs for house purchases completed before 30 September 2021

Luck favouring the rich?

Perhaps the July cliff edge points to those wealthier home buyers being fleet of foot, suggesting this has been a holiday for the cash-rich and those higher up the housing ladder rather than those aspiring to get a foot on the ladder.