Why we don't need Institutional landlords

John Lewis and Lloyds Bank (via Citra Living) have recently announced that they are planning to join the ranks of Grainger, Legal & General and M&G as professional landlords in the residential rental sector.

At a time when we are not building enough houses and house prices are rising, do we need such deep-pocketed corporations looking to get lots of feet on the housing ladder, whilst many aspiring homebuyers struggle to get just one foot onto the housing ladder?

Wouldn’t big corporations be better served to help others on to and up the housing ladder rather than taking the ladder away from them?

In a world where big companies and corporations are viewed with caution rather than trust, Twindig has a look into what might be driving these big corporations to buy up our homes.

The bottom line

In our view, housing is the most important long-term asset a person can own. It is one of the long-lasting assets we need every day. We need food, air and water, but they are here today and gone tomorrow.

Property was there yesterday, is here today and will be there tomorrow. There are no real substitutes – you cannot live in the cloud. Housing won’t, like an Ericsson or a Nokia phone, go out of fashion. Homes also outlive their owners, housing wealth can be passed on to future generations.

Because homes are so important, we believe in the social, economic and financial good of homeownership and we, therefore, question anything that works against or frustrates a person’s ability to own their own home. When a bank or pension provider wants to own your home rather than help you buy it, we have to question why. Even the trusted brand of John Lewis’s property aspirations look first to the benefit of its partners rather than its rental customers.

Are these big corporations not big enough already? Do they really need the renter’s help in making them bigger still? Could the rent that these aspiring homeowners will be paying these big corporations be better used in building up a deposit for their own home rather than helping big companies buy thousands of homes for the benefit of their shareholders?

The simple problem of Institutional PRS

A thought experiment – which is better?

Buying a home and paying into a pension or renting a home and paying into a pension?

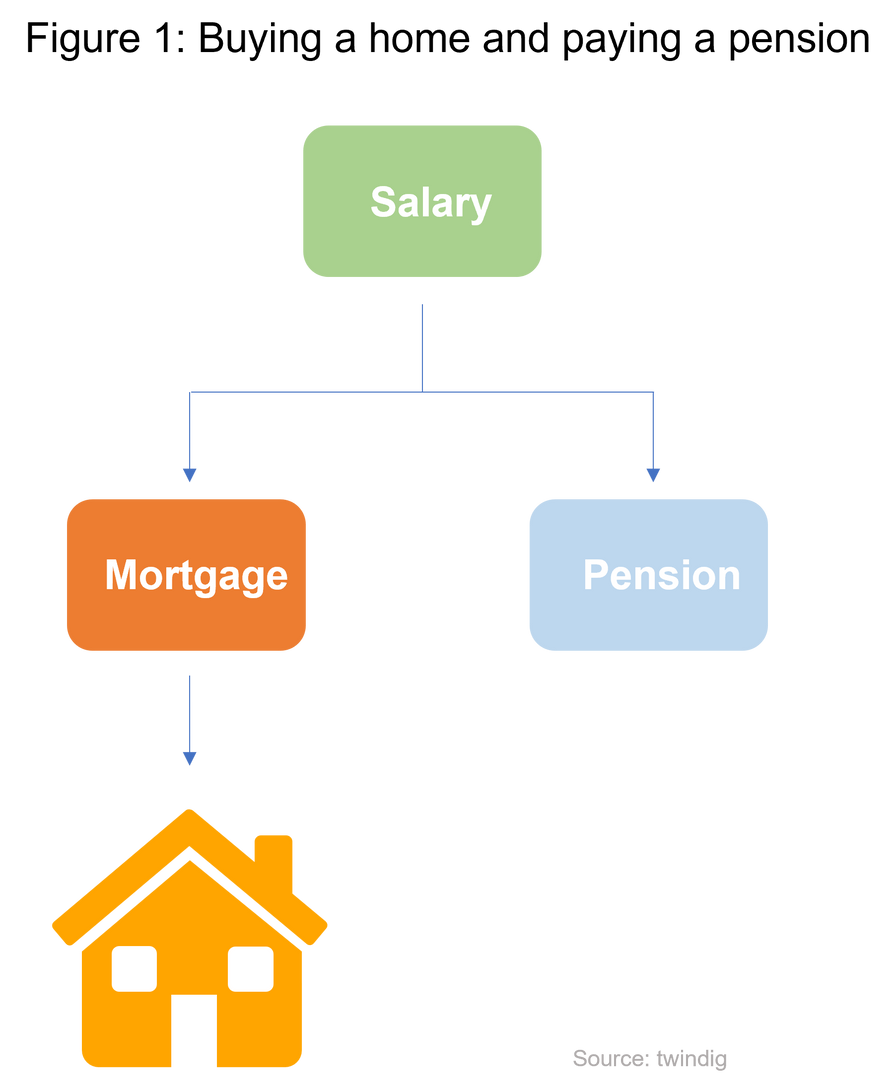

In Figure 1 we earn a salary and use some of it to pay a mortgage and some of it to pay into our pension.

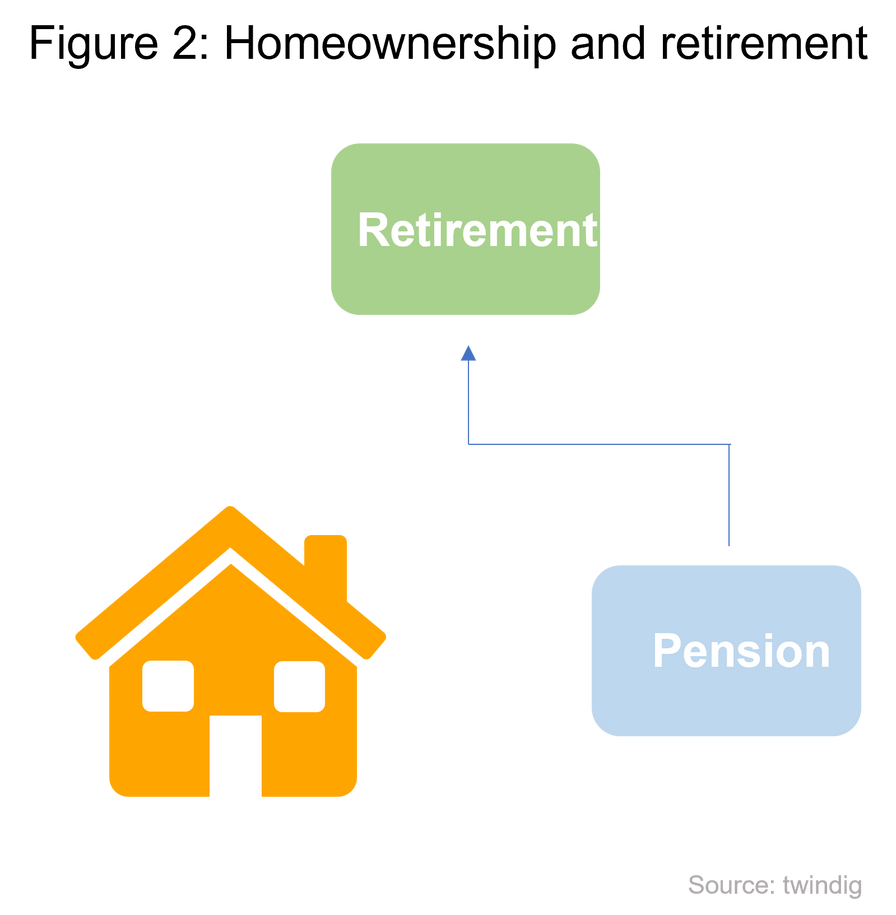

By the time we retire (Figure 2) we have paid off our mortgage, own our home so have no more to pay and we receive our pension.

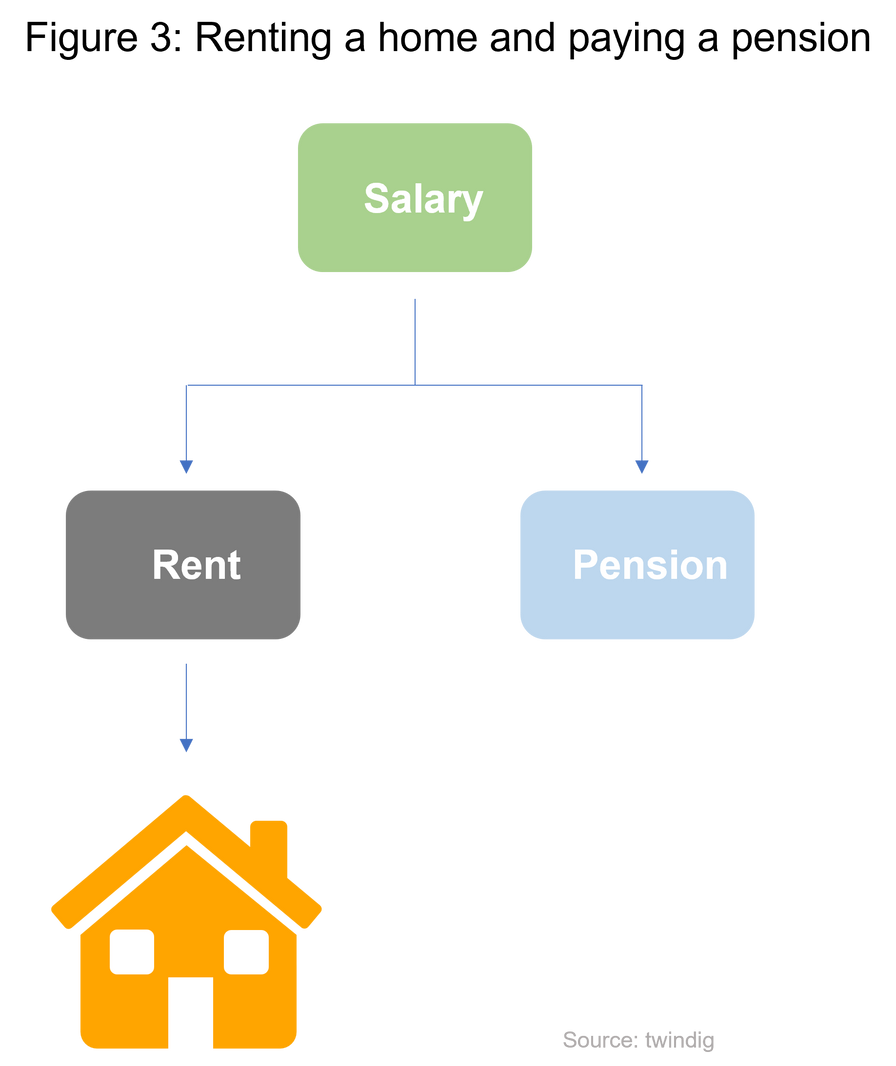

When it comes to renting and paying into a pension the picture looks similar to buying a home and paying into a pension

Initially, the cashflows of renting and paying into a pension are very similar to buying a home and paying into a mortgage. We might initially be better off we have not had to save for a big deposit or pay a lot of stamp duty and legal fees to purchase our home. However, things take a turn for the worse when the renter retires.

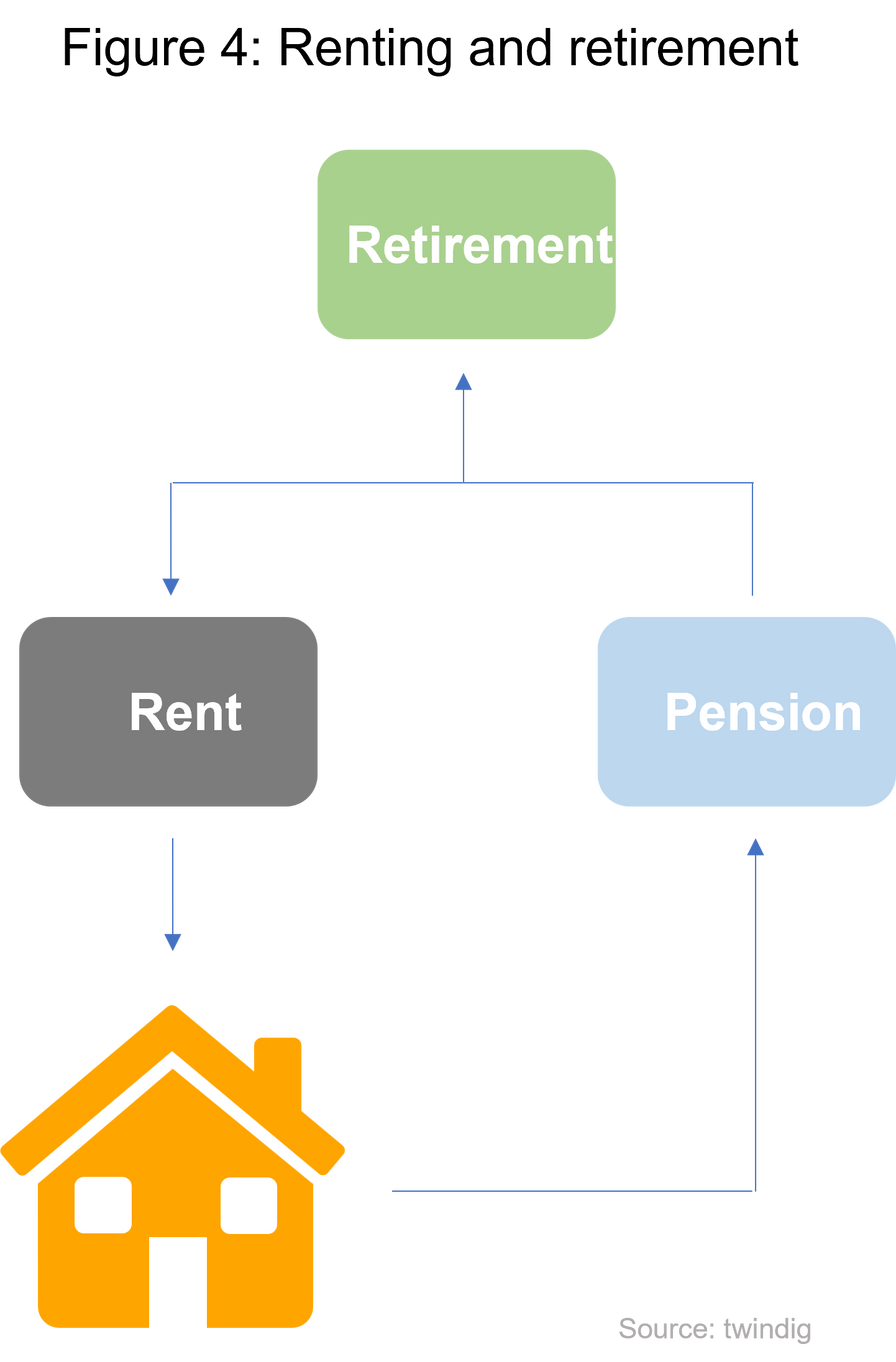

Unlike in Figure 2, where the mortgage is paid off, in Figure 4 some of our pension continues to be used to pay the rent and it is in Figure 4 that we see the social problem of Institutional landlords. Lloyds Bank, L&G and M&G could be both the renter’s pension provider and landlord, therefore they may be paying part of their pension back, in rent, to their pension provider.

The upshot is they will be financially worse off on a cashflow basis because they have less disposable income and they will also be worse off on a wealth basis, they do not own their home.

The money they would have used to buy their home has been paid to the already very large corporation and they may now need more financial support from the taxpayer. They have lost, the taxpayer has lost only the big corporation has won.

Why the interest in our homes?

Survey after survey reports that UK adults aspire to own their own homes, and the desire for homeownership is part of our national psyche, ingrained into our culture and integral to our newspaper’s column inches and our TV schedules.

The demand for homes will always be high

Housing is one of the few things we need every day of our lives. From the day we are born to the day when we die we need a roof over our heads. Housing is the ultimate high demand long term asset. It is in high demand, but short supply

The supply of homes is too low

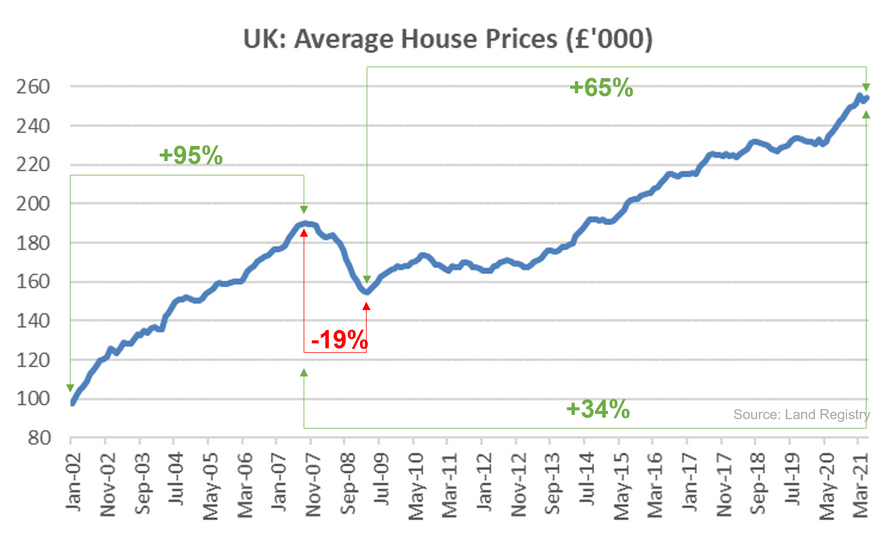

The UK has a structural undersupply of homes. In short, vested interests prevent us from building enough homes where homes are needed. As a result, outside of acts of God or a force majeure, it is difficult to make house prices go down. Even the impact of the global financial crisis on house prices was temporary and contrary to everyone’s expectations house prices have gone up, significantly, to new record levels during the global COVID-19 pandemic.

House growth is a good long-term bet

Due to the high levels of demand, everyone needs a home and the shortage of supply, we are not building enough homes, coupled with the escalating levels of intergenerational housing wealth transfer (Bank of Mum and Dad). The outlook for house prices is one of further house price growth.

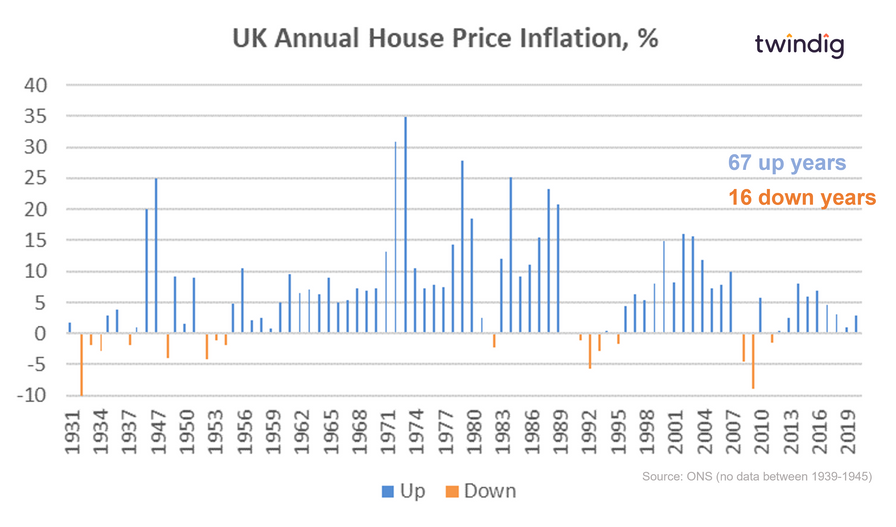

Housing has been a good long term bet for a long time. Data going back to 1930 shows there have only been 16 years where house prices have fallen compared to 67 where house prices have risen.

Working from home has changed how big corporations view homes

Big corporations such as L&G and M&G have until relatively recently focused their property investments in the commercial rather than residential sector. It is easier to buy (and manage) one large office block or one large shopping centre than to spend the same amount of money buy a very large portfolio of individual homes.

Turning to residential, ideally, these big corporations would buy a new build block or development, but when the market is strong developers and housebuilders would rather sell 100 homes to 100 different homebuyers than 100 homes to one large investor.

John Lewis has the upper hand here as it already owns the land it wishes to use for homes, the others need to find the land and partner with developers.

With interest rates so low and traditional commercial properties on the high street, urban centre or out of town shopping centre having an identity crisis, the big corporations have seen what UK adults always knew, residential property is a very good bet. We might not need shops, we might not need offices, but we will always need a place called home.

Who should be king of your castle?

It has been said that an English person’s home is their castle. The societal shifts emerging from the COVID -19 pandemic have led big corporations to see the crown jewels within the homes up, down and across our country, turning them into green-eyed monsters who want to own our homes.

We think it is time for these big corporations to get back to basics and remind themselves of their guiding principles:

Lloyd's strapline is ‘Wherever you want to get in life’

L&G’s strapline is ‘Making a difference through inclusive capitalism’

M&G’s strapline is ‘Helping people manage and grow their savings so they can live the life they want while making the world a little better along the way’

John Lewis John Spedan Lewis established the John Lewis Partnership to be a better way of doing business, driving positive change in society

We do not believe that Institutional ownership of residential property sits well with the guiding principles of the big corporations mentioned above.

We suggest that either their business or their straplines change:

‘Wherever you want to get in life’ – unless you want to own your home

‘Making a difference through inclusive capitalism’ – but excluding homeownership

‘Helping people manage and grow their savings so they can live the life they want while making the world a little better along the way’ – unless the life they want is to own their own home

‘To be a better way of doing business, driving positive change in society’ but not driving the positive societal change relating to homeownership.

Conclusion - there is a better way

There is a growing number of big corporations like Lloyds Bank, L&G and M&G who are looking to own the home you live in. They want to own homes because they know that homes are a very astute long term financial asset. They believe that they will make larger profits by owning more homes.

Every home these big corporations own will make it harder and more costly for aspiring homeowners looking for a foothold on the housing ladder and for homeowners to take their next step up the ladder. Each home these big corporations own reduces the number of homes available for individual households and families. Each home these big corporations owns makes it harder for UK households to own their own home and accumulate housing wealth.

Twindig believes in the good of homeownership and we suggest that it would be better for society if these big corporations helped families to get onto the housing ladder rather than take the ladder away from them altogether.

There is a better way. The big corporations could co-own homes with the families that wish to own their own homes. This is a win-win: allowing a family to participate in a housing market that was out of reach, and the corporation to increase not only its own exposure to the housing market but also that of the aspiring homebuyer. Both can benefit from the transaction. It does not have to be a winner takes all game.

Sharing the risks and rewards of homeownership could lead to big corporations entry into the housing market as being viewed as a help, not a hindrance and could lead to them surpassing their financial and social targeted returns.