Is housing the key to unlocking the pension triple lock?

Traditionally those who are economically active today fund the cost of today’s state pensions. However, there is a problem brewing. The UK has an ageing population, therefore fewer workers are paying for a growing number of pensioners. Either taxes will have to rise, or pensions will have to fall. The triple lock suggests that taxes will rise, but does property hold the key to unlocking pensions without breaking the triple lock?

The ageing population

In 1950 10.8% of the UK population was aged 65 or more. By 2018 it had risen to 18% and is expected to reach 25% by 2050.

The £100bn pa pension bill

There are currently 12.4 million people claiming UK state pension at a cost of around £100bn each year. Under the triple lock, this will grow by at least £2.5bn pa.

What is the triple lock?

The triple lock relates to annual increases in the UK state pension. Currently, it increases each year in line with the highest of three metrics (hence it is called the triple lock):

- Consumer Price Index (CPI)

- Increases in average wages

- 2.5%

Which part of the triple lock is growing the fastest?

The latest provisional data from the ONS suggests that the highest of the triple lock metrics is wage growth, currently at 8.8%, which would, therefore, add £8.8bn to the cost of the state pension bill. An 8.8% pay rise is great if you are a pensioner, but not so great if you are a taxpayer footing the bill.

Even without the triple lock, the pension bill is growing

The cost of the UK state pension is expected to rise each year as more and more people qualify for a state pension. We estimate that before increases to the level of state pension, the state pension bill will increase by at least £725m per year for the next three years and then by more than £1,000m until 2028 before increasing to more than £2,000m a year from 2029 as our population ages.

The cost of the triple lock, at least £2,500m each year will be on top of the figures described above.

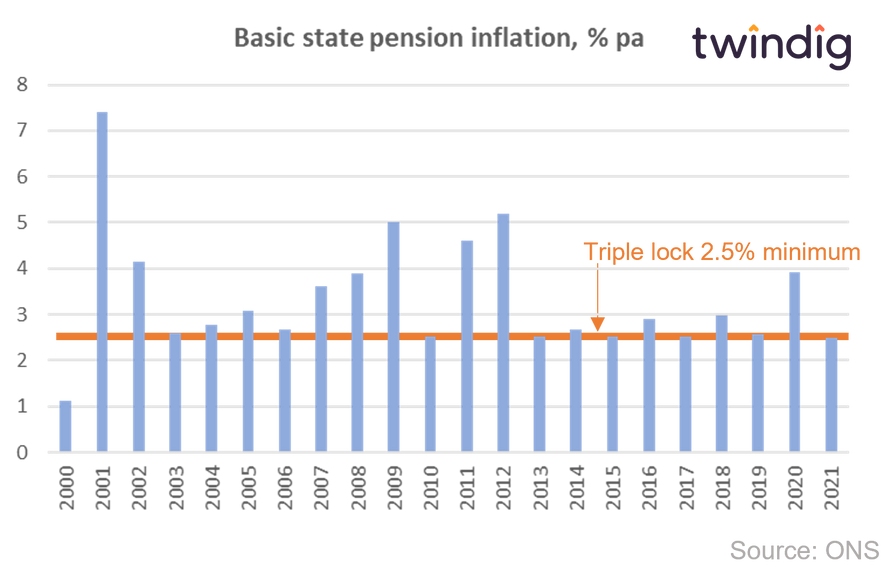

How quickly have pensions grown?

If we look at the basic weekly UK state pension since the turn of the century the average annual inflation is 3.5% pa. Over the last 20 years therefore the UK state pension has increased by more than the lower limit established by the triple lock.

Can property solve the pension problem?

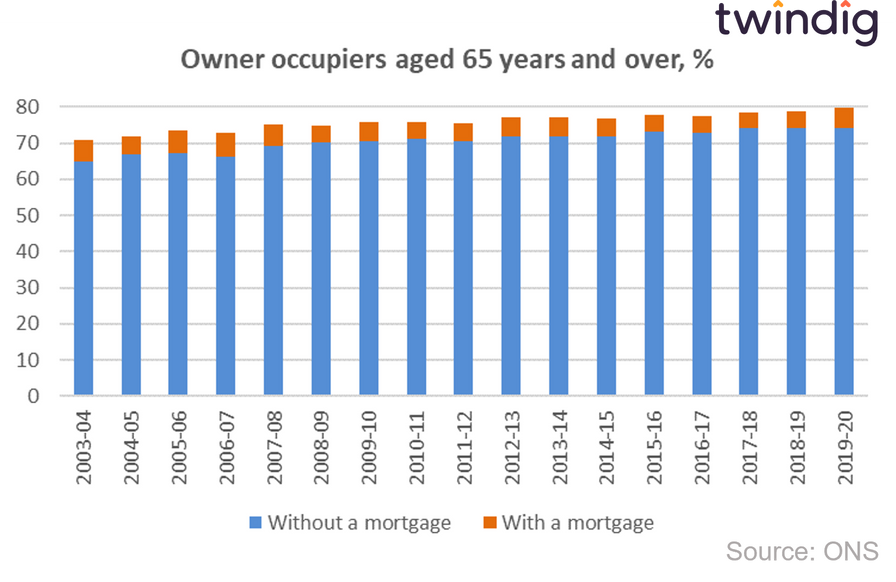

Across the country, 78% of households headed by someone aged 65 or higher are owned, and only 6% of those still have a mortgage.

Across the country, 64% of households who own their home outright (with no mortgage), are headed by a person aged 65 or more.

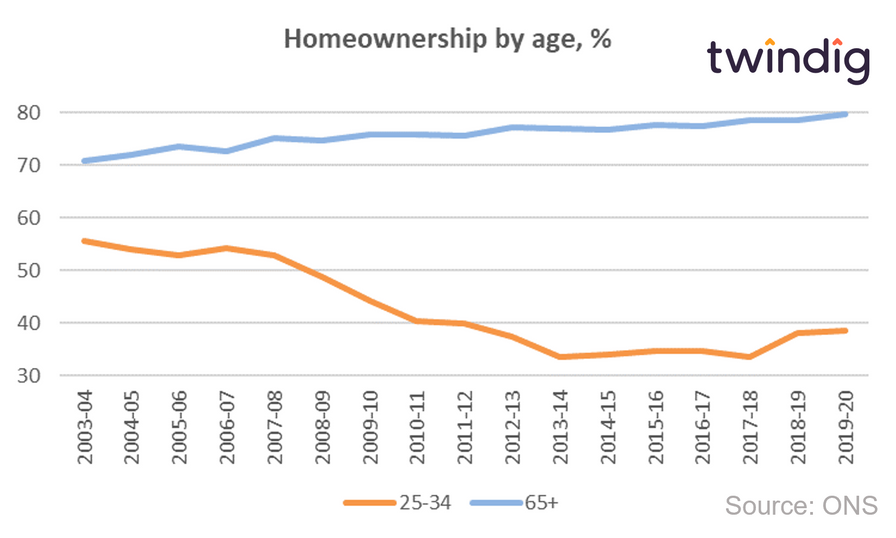

Homeownership is increasingly becoming an age-related issue

The ONS estimate that the number of households headed by someone aged 65 or more is projected to increase by 54% by 2041, which will bring the total number of households headed by someone aged 65 or more to almost 10 million, whereas the number of households headed by someone under 65 is projected to grow by just 3%

However, homeownership is already an age-related issue as the graph below illustrates, homeownership rates are declining for the traditional 'first-time buyer', whilst homeownership rats continue to increase for the older generation.

Homes are our biggest assets

Homes are the biggest assets for the majority of households. However, they cannot currently use them as part of their pension planning.

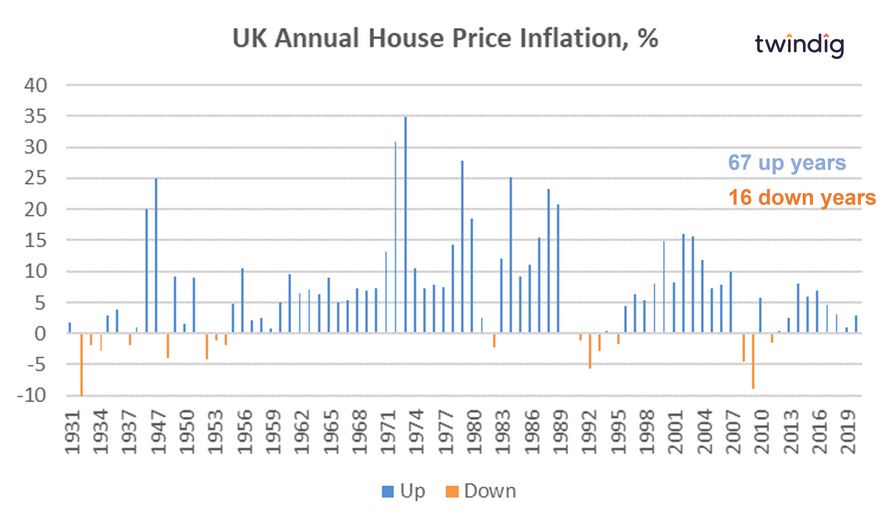

Residential property performs well as a financial asset

Since 1930, on average, UK house price inflation has been 7% pa, few other asset classes, if any, can match this level of performance, in our view.

Older households have huge amounts of equity tied up in their homes, whilst younger households struggle to get a foothold on the housing ladder.

Why are properties locked out of pensions?

If residential properties were able to become a pensionable asset class, we believe they could be the key to solving the UK’s current pension dilemma. Allowing property in pensions would provide an orderly intergenerational transfer of housing wealth and help older households fund a more comfortable retirement, whilst not letting pensions break the public finances. Property, in our view, is the key to unpicking the triple lock without breaking the pensions they protect.