Houselungo 25 July 21

A lungo length look at this week's housing market news

Fixing the housing market ladder: Part 1 - Help more to buy

In our view, the UK housing ladder is broken at both ends. First-time buyers need a helping hand to step onto the housing ladder and older households need a hand to access the housing wealth they have accumulated. This article looks at how a bigger bolder version of help to buy could repair the broken lower rungs of the housing ladder.

Setting the scene: UK Housing market dynamics

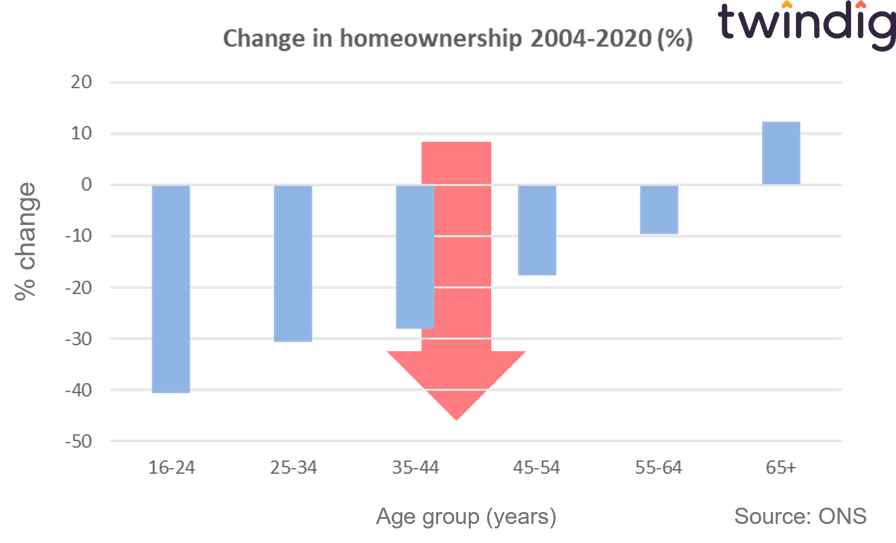

Homeownership is falling across all age groups, apart from those aged 65 and over

Meanwhile, the private rented sector continues to grow, with growth rates accelerating in the 35-64 years age groups

But is renting a lifestyle choice?

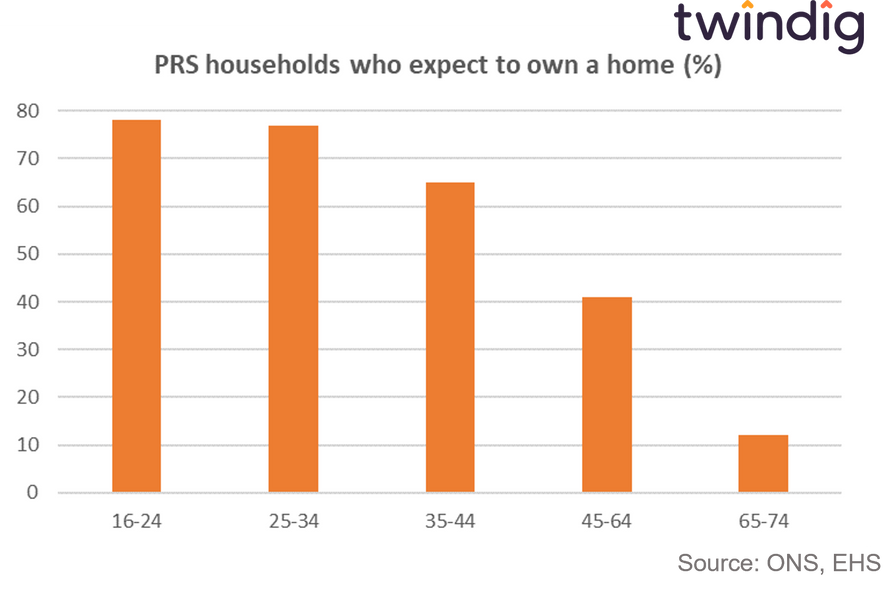

Some believe the changing tenure patterns reflect a lifestyle choice, where an increasing number of households choose the flexibility of renting over the rigidity of buying. We disagree, and so it seems, do the majority of those living in private rented accommodation.

Neither the Credit Crunch nor the COVID crisis has dented renters desire to buy a home. According to the latest English Housing Survey almost 80% of those aged 16-34 years old in the private rented sector expect to own their own home in the future. That equates to around 1,500,000 households.

The problem is a simple one: house prices have risen much faster than incomes, divorcing the two and we doubt that they will ever be successfully reconciled and reunited, however, all is not lost, we believe that thinking more boldly around Help to Buy could be the answer and help even more to buy.

Thinking of selling? You'll need a BASPI

With time scales for selling a home getting longer and longer, most sellers are looking for ways to speed up and de-stress the sales process. The BASPI helps with both.

The BASPI (Buying and Selling Property Information) has been produced by the 'Home Buying and Selling Group' a Government supported body that seeks ways to make the home buying and selling process easier. The BASPI collates all the upfront information you need to be able to sell your home, enabling you to get sale ready. THe BASPI is supported by the UK Conveyancing Association.

We are fans of the BASPI and have therefore digitised it to make it even easier to complete it and integrated it into twindig, you can even upload all the accompanying documents and we will pull them together into one 'BASPI Bundle' which can be easily (electronically) shared with the appropriate party (ie your conveyancer) at the appropriate time. To find out more and to get your 'free' BASPI click on the link below.

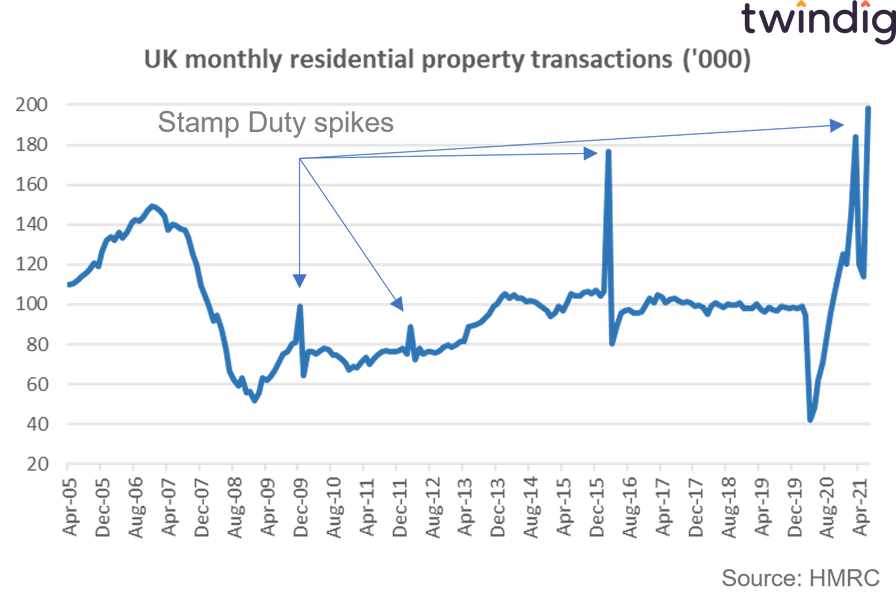

Record housing transactions in June

As the mercury rose across the UK this week, the HMRC reported the housing market was also heating up. Housing transactions hit a new high of 198,240 in June 2021 as thousands rushed to beat the 30 June Stamp Duty Holiday deadline.

The data from the HMRC is provisional, but is the highest monthly figure on record, beating all previous stamp duty holiday spikes as illustrated in the graph above. Transactions in June were 8% ahead of the March stamp duty stampede and were 74% up on May.

Zoomtown-on-sea anyone?

For many, the COVID pandemic has been an opportunity to take stock of life and to reassess what we are doing and why we are doing it.

Lockdown has challenged us to think about our homes: where we live, why we live there, and how we live. For those required or encouraged to work from home, lockdown has provided both challenges and opportunities, frustrations, and reliefs and for many a eureka moment. We can now live where we want to live rather than where we have to live. Some are giving in to the call of the sea, others to that of the rural idyll.

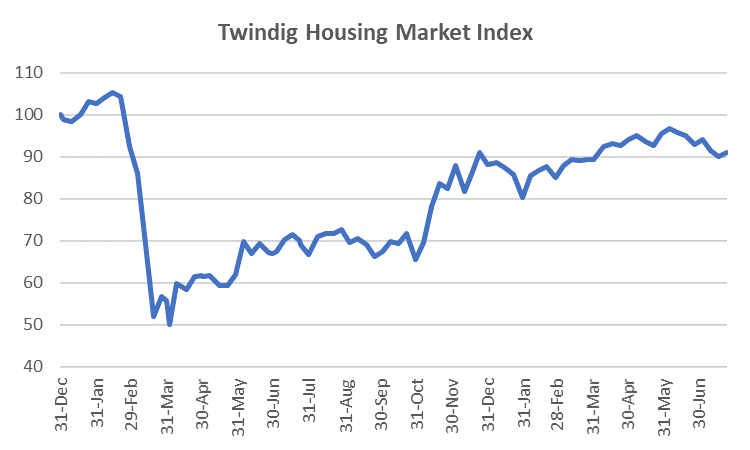

Twindig Housing Market Index

The Twindig Housing Market Index rose by 1.1% to 91.0 this week, as the HMRC reported that housing transactions reached record highs in June as homebuyers rushed to beat the 30 June 2021 Stamp Duty Holiday deadline.

But who are the stamp duty holiday winners?