Record high housing transactions in June 2021

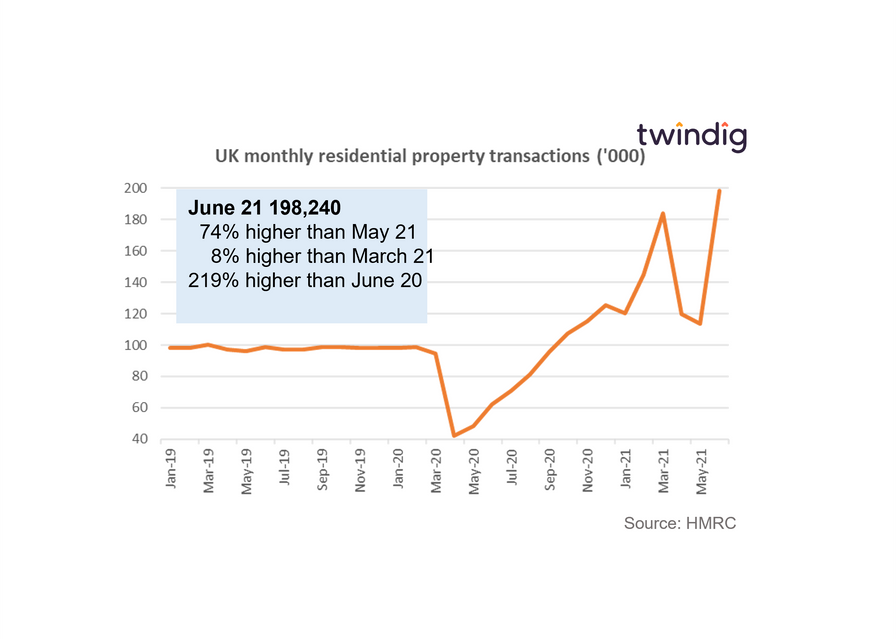

As the mercury rose across the UK this week, the HMRC reported the housing market was also heating up. Housing transactions hit a new high of 198,240 in June 2021 as thousands rushed to beat the 30 June Stamp Duty Holiday deadline.

Record high for housing buys

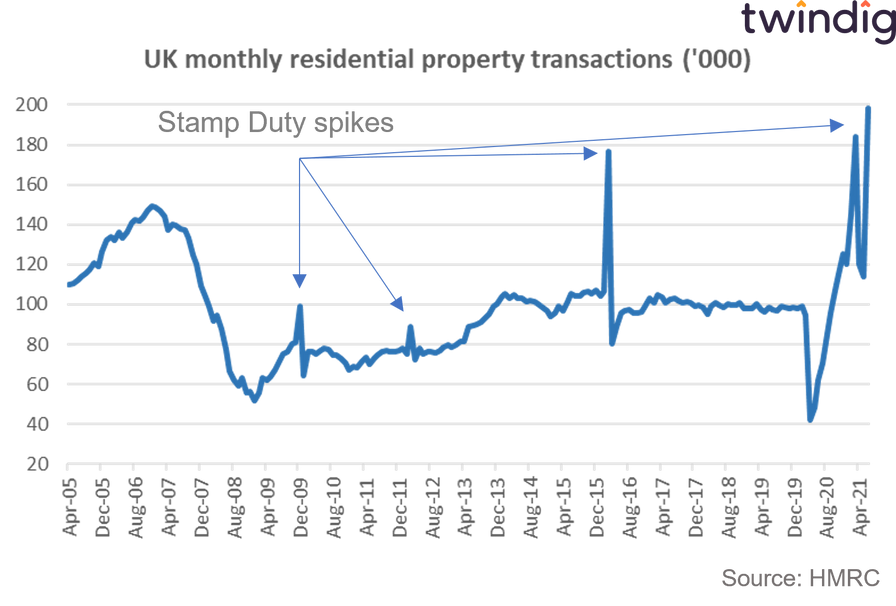

The data from the HMRC is provisional, but is the highest monthly figure on record, beating all previous stamp duty holiday spikes as illustrated below. Transactions in June were 8% ahead of the March stamp duty stampede and were 74% up on May.

As illustrated above stamp duty change deadlines often lead to a spike in housing transactions followed by a lull in activity as many transactions are pulled forward to take advantage of the tax breaks.

We have an unusual situation in 2021 where the stamp duty holiday deadline was originally 31 March 2021, which lead to a spike in March, but the holiday was extended to the end of June. We did not, therefore, see the usual transaction lull.

The June deadline is also complicated further in that it is not the final stamp duty holiday deadline, but a staging post. The maximum benefit of the stamp duty holiday until 30 June 2021 was for homes costing up to £500,000 and this now falls to a maximum purchase price of £250,000 until the 30 September 2021.

At present 30 September 2021 marks the full and final stamp duty holiday deadline. It has been extended in the past, but given the high levels of housing market activity and record levels of UK house prices we do not believe that the UK Government will look to extend the stamp duty holiday again.

Three spikes and you're out?

The $64,000 question is will it be a case of three spikes before we are out? As we can see the from the graph above we had a spike in March the original deadline, and a spike in June the first extended deadline, but will we have a spike in September the third and final deadline?

The Stamp Duty benefit has been reduced from homes costing up to £500,000 to homes costing £250,000. The £250,000 figure is more in-line with average house prices across the UK, which means there are lots of homebuyers who will still benefit from the stamp duty holiday. The maximum stamp duty saving has therefore fallen from £15,000 to £2,500 on a primary residence in England and Wales. You can see how much stamp duty you will have to pay by using our stamp duty calculator

We, therefore, expect to see another spike in transactions in September although given the reduction in the stamp duty holiday benefit we expect the spike to be lower than those seen earlier this year in March and June.

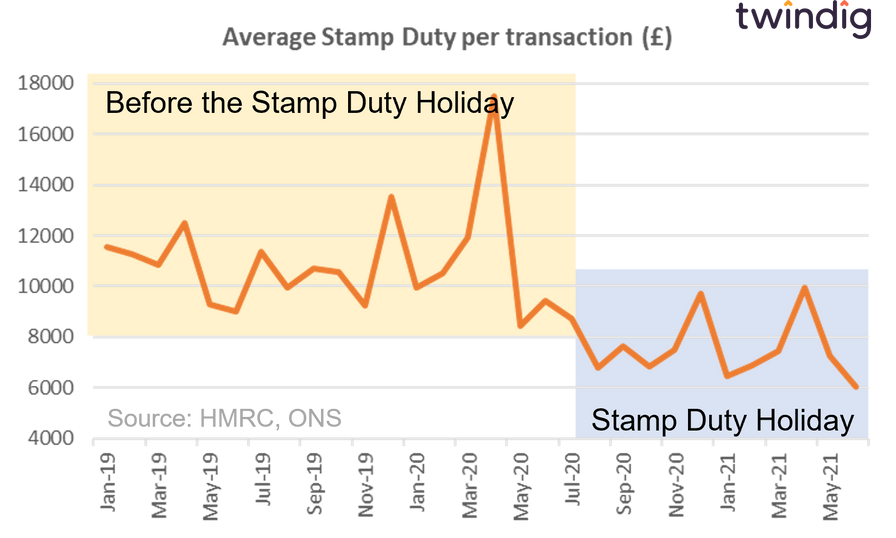

How have stamp duty payments changed during the stamp duty holiday?

Not surprisingly, they have reduced as illustrated in the chart below showing the average stamp duty paid on each housing transaction.

Did the stamp duty holiday work?

Yes if the aim was to increase housing transactions, but no if the answer was to save homebuyers money.

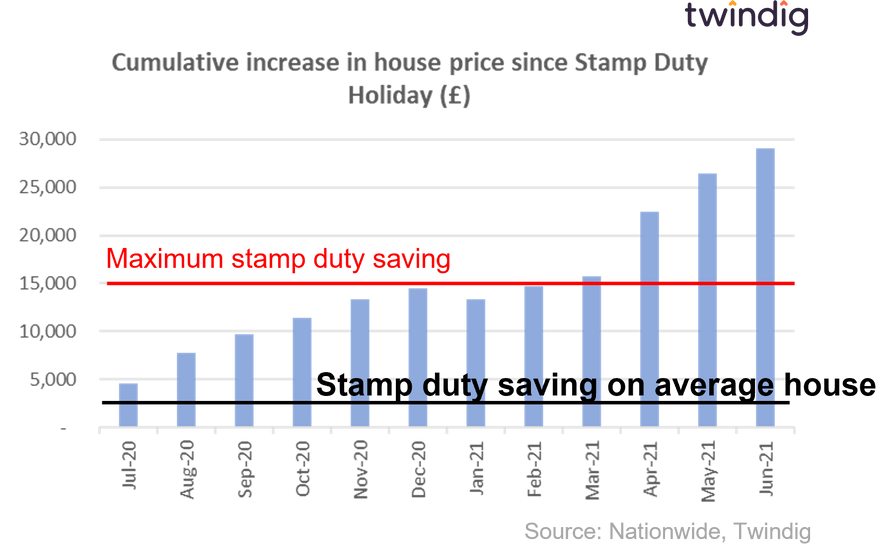

The chart below shows that for the averagely priced house, the homebuyer was worse off as soon as the stamp duty holiday started. The Nationwide House price index reports that house prices increased by an average of £4,500 in July 2020 against a potential stamp duty saving of £2,500.

Those buying homes costing £500,000 or more had more time to benefit before house price increases wiped out their stamp duty savings.