Houselungo 23 January 22

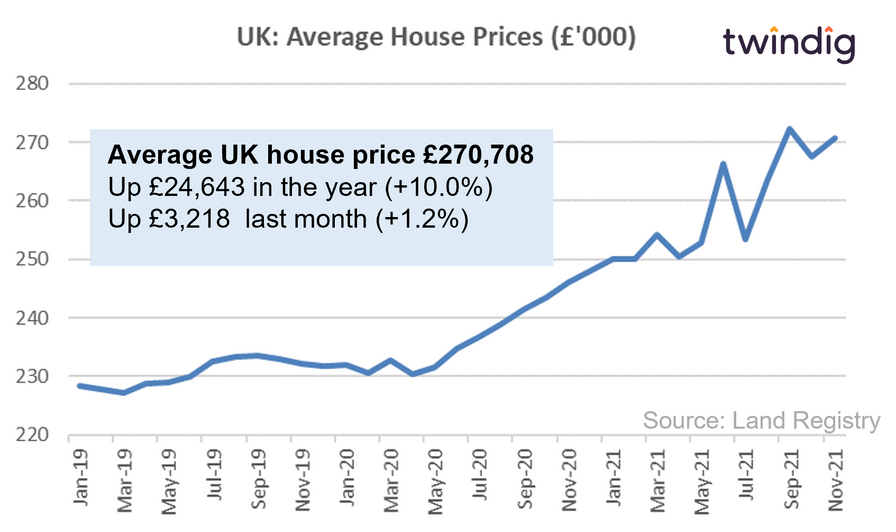

House prices up 10% (+£24,600)

The average house price in the UK is £270,708, average prices have increased by 10.0% or (£24,643) over the last year, and increased by 1.2% or (£3,218) last month. We note that these figures are provisional and subject to change, however, October is the first month following the end of the Stamp Duty holiday, and a month in which the UK housing market paused for breath.

UK average house prices have increased by 17.4% (£40,099) since the start of the COVID-19 pandemic.

House prices quickly recover from stamp duty holiday blues

UK house prices rose in all regions apart from London and Wales in November 2021, rising on average by £3,218 as the UK housing market got back into its stride following the end of the Stamp Duty Holiday.

It is comforting that house prices, in most areas, returned to growth so quickly after the benefits of the stamp duty holiday had been taken away. We already know that housing transactions have bounced back following a brief pause for breath and it seems that house prices are following suit.

We continue to believe that in the medium-term demand will outstrip underpinning house prices.

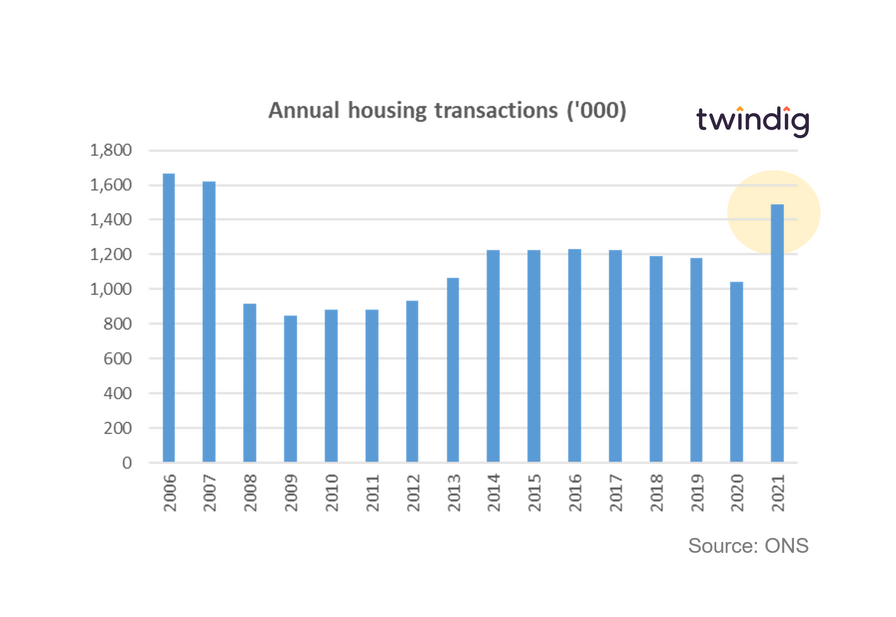

14 year high for housing transactions

HMRC released provisional housing transaction data for December 2021 this week

What they said

Seasonally adjusted housing transactions in December 2021 were 100,110

This was 7.6% higher than November 2021 and 20% lower than December 2020

Housing transactions during 2021 were at their highest level since 2007

Twindig take

2021 was a bumper year for housing transactions working from home and the race for space got people thing about moving the stamp duty holiday kicked people off their sofas and into action. At almost 1.5 million housing transactions, 2021 has seen the highest level of housing transactions since the heady days of 2007, before the Credit Crunch. The global COVID pandemic is certainly very different from the Global Financial Crisis and we would not expect housing transactions to fall off a cliff this year. Interestingly the 100,110 housing transactions in December is almost identical to the level of housing transactions before the pandemic broke. We hope this is a good omen for more normal times in the year ahead.

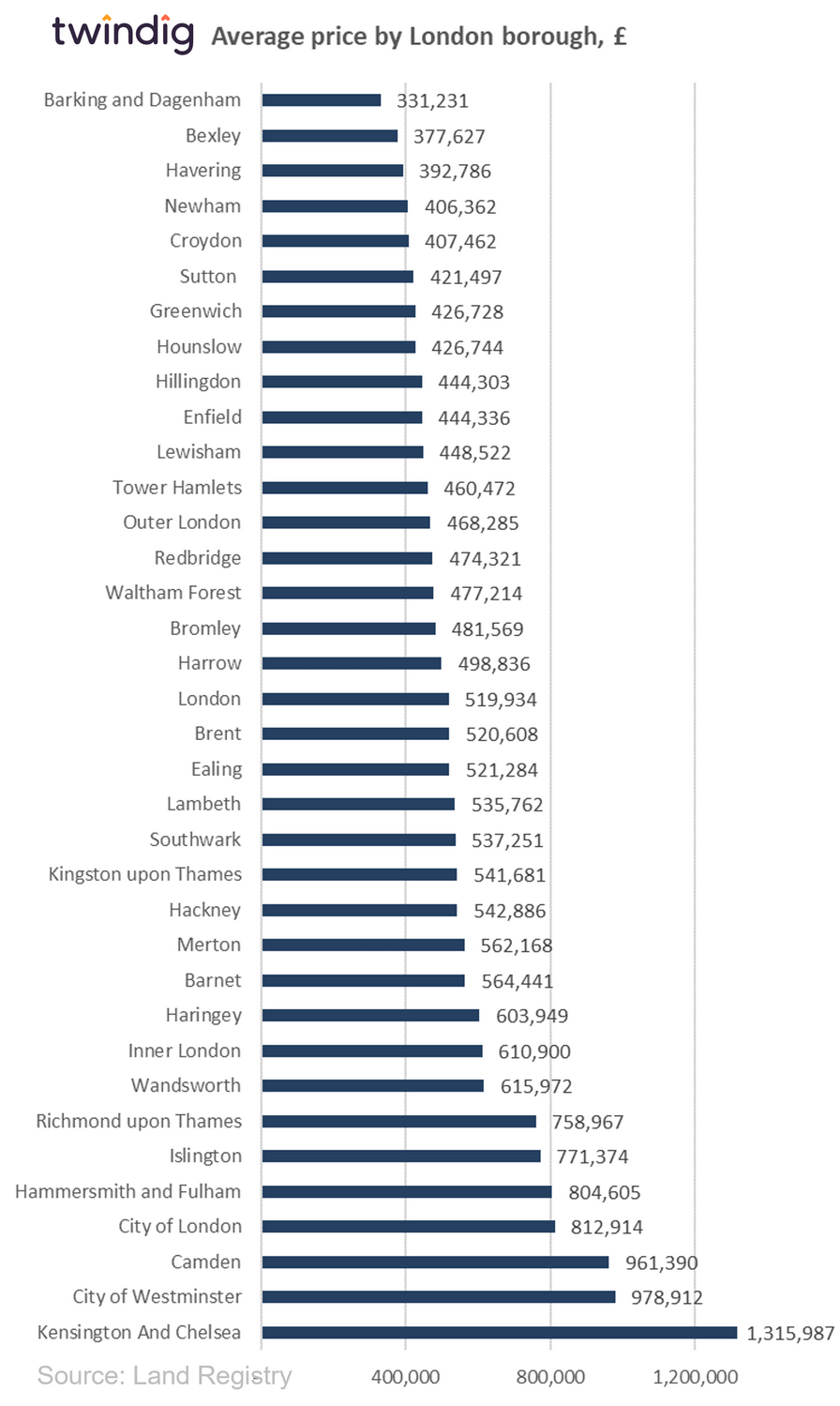

Are London house prices about to turn?

The latest data from the Land Registry shows that the average house price in London rose by 0.2% or £941 to £519,934 in November 2021. House prices fell in 19 of the 34 London boroughs during November.

The biggest rises were Camden up £86,359 (9.9%), Islington up £47,091 (6.5%) and Newham up £19,867 (5.1%).

The biggest London house price falls last month were to be found in Kensington & Chelsea down £104,112 (7.3%), the City of Westminster down £50,312 (4.9%) and the City of London down £43,579 (5.1%).

House Prices in London

The average house price in London is £519,934. This is 80% or £231,804 higher than the £288,130 average house price in England.

House prices in London have risen by 5.1% over the last twelve months compared to an average increase in house prices across England of 9.8%.

In absolute monetary terms, this translates to an average increase of £25,382 in London and £25,720 in England. House prices in England have therefore increased more in relative, but less in absolute terms than they have in London over the last 12 months.

To see the house prices and house price trends by London borough keep reading, you will find all that house price data in the body of this article.

London House Price Outlook

In the short term, following the outworking of the impacts of the stamp duty holiday, we expect house prices in London to increase. The Stamp Duty Holiday has led to an unusual amount of home buying and selling and the 'race for space' may have changed the broader patterns of housing demand, but we expect house prices in London to remain firm.

In the medium term as the pandemic, risks subside and the UK economy is re-opened we would expect to see a continued recovery in housing transaction volumes and positive momentum maintained for house prices.

Please note that lower than usual levels of housing transactions mean that house prices at the borough level will show higher levels of volatility than normal.

Awaiting the dawn

RICS UK Housing Market Survey

The Royal Institution of Chartered Surveyors published their latest UK Residential Market Survey this week

What they said

New buyer enquiries on the up

Shortage of homes for sale continues to underpin price growth

Sales expectations remain modestly positive for both the near term and year ahead

Twindig take

It is good news for the housing market that new buyer enquiries have increased for the fourth month in a row, especially as we had expected a longer and deeper lull following the end of the COVID induced Stamp Duty Holiday.

However, home buyer demand continues to outstrip the supply of homes for sale, and in December, a net balance of -14% reported a decline in new listings, the ninth 'negative' month in a row.

This continued demand and supply balance will, in our view, underpin house prices and rising prices may encourage more sellers onto the market during the traditional spring selling season.

Twindig Housing Market Index

In the week that confirmed 2021 had been a bumper year for UK housing transactions, which reached a 14 year high, the Twindig Housing Market Index fell by 1.4% to 90.8.

Rising inflation was on the minds of many housing market investors this week raising concerns about affordability in the housing market (the flipside to house price growth). Stringent, yet sensible affordability tests look at disposable income rather than headline salary statistics, and as day to day expenses take an ever bigger slice of the salary pie, there is less money available to secure and pay a mortgage. However, the concerns voiced by housing market investors are yet to be echoed by the homebuyers themselves and we remain confident on the outlook for the UK housing market.