Houselungo 19 June 22

Rental reforms a rebalancing of power too far?

The Government has released details of its Rental Reform Bill as part of its 'Fairer Private Rented Sector White Paper. The Rental Reforms outlined certainly have teeth and Shelter's CEO Polly Neate commented that:

"The Renters Reform Bill is a game-changer for England's 11 million private renters."

The Government hopes that the fairer private rented sector white paper published this week will ensure millions of families benefit from living in decent, well-looked-after homes as part of the biggest shake-up of the private rented sector in 30 years.

The proposed rental reforms seek to rebalance the power balance between landlords and 4.4 million private rented tenants. It also seeks to provide new support for cost of living pressures with protections for the most vulnerable, and new measures to tackle arbitrary and unfair rent increases.

The rental reforms are part of the Government's wider reform agenda to improve lives and level up the country, delivering more housing and greater protections for tenants and homeowners.

Twindig take

The Rental Reform Bill is a highly ambitious plan to restructure and improve the private rented sector. Whilst the main theme appears to be a rebalancing of power away from landlords to tenants, essentially it enshrines the practices and policies followed by most good landlords and professional letting agencies. Not all landlords will agree with all of the proposals, but in our view, they work towards the greater good and should lead to a more transparent and better functioning Private Rental Sector.

Benefits to bricks

In our view, if carefully executed, the Benefits to Bricks initiative could lead to a watershed moment for all aspiring homeowners, and not just those currently living in social housing.

A safe and secure home is one of our biggest and most important needs. Homeownership takes away uncertainty, provides security and provides an opportunity for every household to accumulate wealth. The current model for buying homes is broken, in this article, we look at if 'benefits to bricks' might hold the keys to fixing our broken housing market.

Could Benefits to Bricks provide a savings vehicle fit for a deposit?

Speaking on Sky News on 9 June 2022 Michael Gove, the Secretary of State for Levelling Up, Housing and Communities said:

'We're looking specifically at a savings vehicle that people can use in order to save for that deposit.’

We believe that fractional ownership provides a perfect savings vehicle through which to save for a deposit.

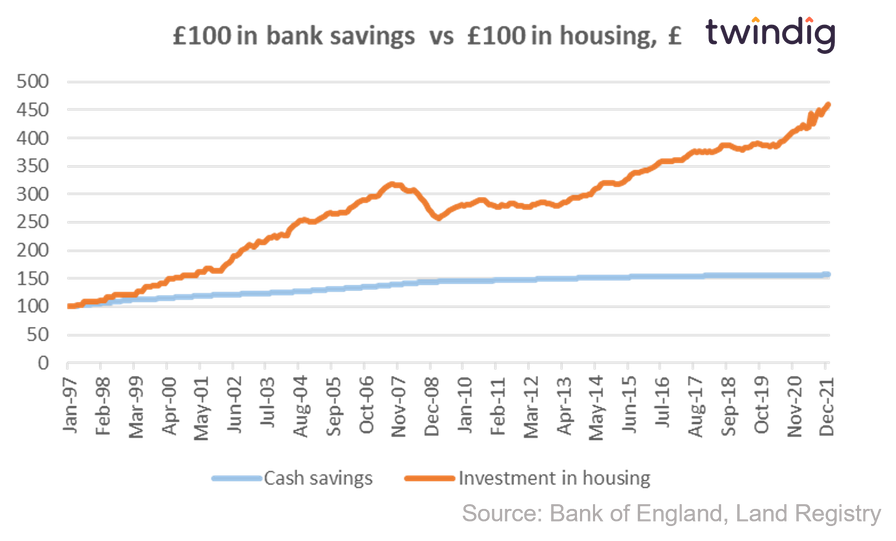

The main problem with saving for a deposit through a traditional bank account, savings account or cash ISA is that the interest accrued is not linked to house prices.

If we could establish that link, we could be on to a winning formula to help turn Generation Rent into Generation Buy

To illustrate the point: a typical mortgage has a term of 25 years, so £100 put into a savings account in January 1997 would today be worth £156, whereas £100 invested into the UK housing market in January 1997 would be worth £460 today – almost three times more.

Mortgage rates rise in May

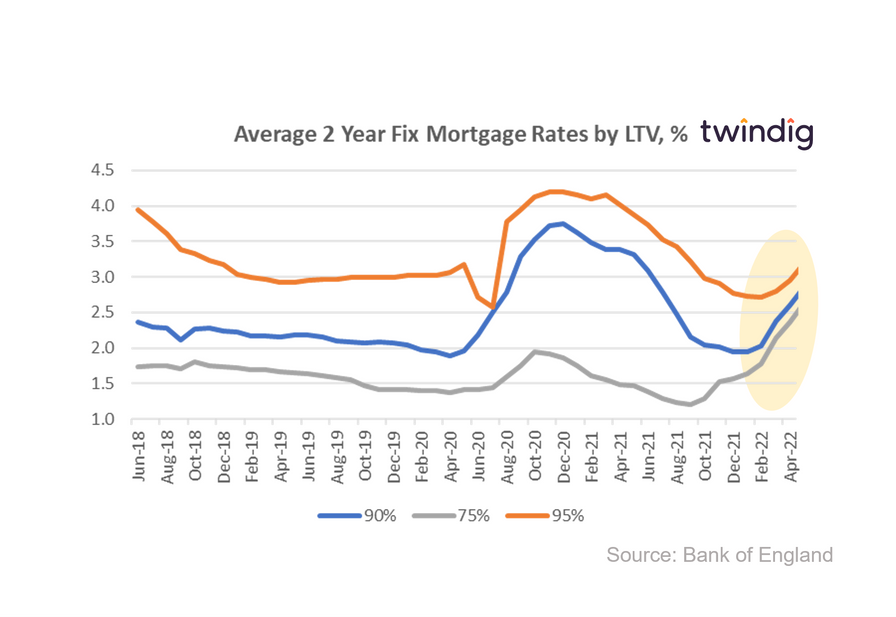

The Bank of England released average mortgage rates by Loan to Value (LTV) this week

What the Bank of England said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 2.63%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 2.86%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 3.19%

Twindig take

Mortgage rates continued to rise in May 2022. The average mortgage rate for a 2-year fixed-rate 75% LTV Mortgage increased by 11.4% in May to 2.63% and has increased by almost 80% since May 2021.

Interestingly although the average mortgage rates for 90% and 95% LTV 2-year fixed-rate mortgages increased by around 10% in May, both remain below the May 2021 levels.

Therefore although rates are rising it is still possible to secure a very attractive mortgage rate, but one might have to hurry...

Bank Rate rises in June

What the Bank of England said

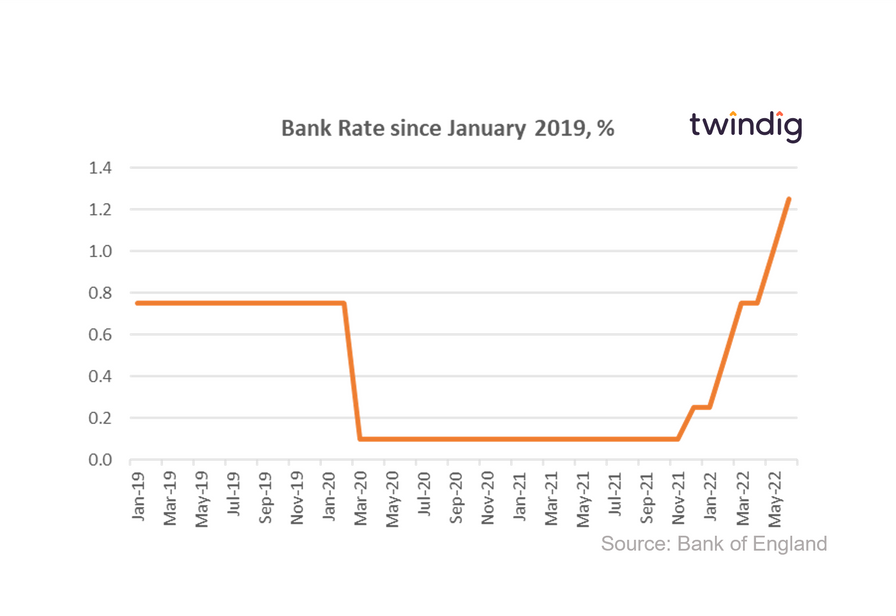

Bank Rate increased from 1.00% to 1.25%

The MPC voted by a majority of 6-3 for a 25 basis point increase

The MPC members in the minority voted for a 50 basis point increase

Twindig Take

The Bank of England's Monetary Policy Committee (MPC) sets monetary policy to meet the 2% inflation target, and in a way that helps to sustain growth and employment. It was no surprise therefore that with inflation running at 9% against a target of 2% The MPC voted to increase Bank Rate, the only uncertainty was by how much.

The MPC has a delicate balancing act when setting Bank Rate between controlling inflation and not adding further woes to the cost of living crisis.

The Bank of England expects that Consumer Price Index (CPI) inflation to be over 9% during the next few months and to rise to slightly above 11% in October.

How far will Bank Rate rise?

Bank Rate is now the highest it has been since January 2009 when it fell in response to the Global Financial Crisis and the latest evidence suggests it will rise by more than we previously thought.

Do interest rates drive the housing market?

Earlier this month I was interviewed by Iain McKenzie the CEO of the Guild of Property Professionals. We discussed the housing market and the interaction between interest rates and the housing market.

The link between Bank Rate (the main interest rate set by the Bank of England, which impacts all other UK interest rates) and the housing market is not as clear-cut as one may think.

We also discuss what our currently inflationary environment means for house prices, and

Is now a good or bad time to be buying and selling a home.

Twindig Housing Market Index

As the mercury rose this week, the Twindig Housing Market Index fell by 3.9% to 72.2, its lowest level since 13 November 2020. The rise in Bank Rate, and the heightened expectation of higher rates to come raised concerns about the future direction of the housing market, and led some to ask whether the house price party is over?

The housebuilders certainly don't think so. This week Bellway issued a trading update commenting that its sales reservations were up 5.9% on the same period last year and perhaps more importantly that its forward orderbook is up 27.3%. This means that despite rising mortgage rates and rising costs of living Bellway is selling more homes this year than it did last year.