Benefits to bricks: Watershed or Whitewash?

In our view, if carefully executed, the Benefits to Bricks initiative could lead to a watershed moment for all aspiring homeowners, and not just those currently living in social housing.

A safe and secure home is one of our biggest and most important needs. Homeownership takes away uncertainty, provides security and provides an opportunity for every household to accumulate wealth. The current model for buying homes is broken, in this article, we look at if 'benefits to bricks' might hold the keys to fixing our broken housing market

Benefits to landlords

The UK Government currently pays £30bn each year (£577 million per week) on housing benefits and this is expected to rise to £50bn (almost £1,000 million per week) by 2050 and much of this £577 million per week is paid to private landlords.

Prime Minister Boris Johnson believes that the £30bn the government spends each year on housing benefits would be better spent on helping people become homeowners, and we agree.

Barriers to bricks

The challenge is that many aspiring homeowners are unable to secure a mortgage even though they can afford to pay rent each month. The UK Government believes that over 50% of today’s renters could afford the monthly cost of a mortgage but various constraints mean only 6% could immediately access a typical first-time buyer mortgage.

The two key constraints to mortgage lending are:

Loan to value (LTV) ratios: the size of the loan compared to the price of the home, and

Loan to Income (LTI) ratios: how big the loan can be when compared to your income

Loan to value ratios for first-time buyers are typically capped at 95%, which means they require a 5% deposit, if the home costs £250,000, they will need a deposit of at least £12,500

Loan to Income ratios are currently influenced by the Bank of England which says that no more than 15% of mortgages sold in any 12 months can have an LTI ratio of more than 4.5x.

The average full-time wage in the UK is around £35,000, suggesting a mortgage capacity of £157,500, more than £100,000 less than the price of the average home in the UK. The gap between the mortgage and the price o the home will need to be filled by the deposit.

In our view, the deposit gap is the biggest barrier to homeownership in the UK

Benefits to bricks – filling the deposit gap

Can benefits to bricks fill the deposit gap? Yes, but we need to change the way we buy homes. Whilst the Government is concerned that much of the £577 million a week housing benefit is paid to private landlords, we are pretty sure that they wouldn’t want it lining the pockets of big international banks either as mortgage payments.

We believe a better way is through fractional ownership. Fractional ownership allows you to buy as you can afford it without the need to take on debt, a form of Buy As You Can (BAYC).

If a social housing tenant could allocate their rent to directly buying fractions of the home they were living in they could buy it without the pressure and risks of taking on a mortgage. This would allow them to build up their housing wealth as they could afford to. The housing association would not have a sudden loss of assets and would have more time to plan how to replace the home that was being sold.

Benefits to Bricks: A savings vehicle fit for a deposit

Speaking on Sky News on 9 June 2022 Michael Gove, the Secretary of State for Levelling Up, Housing and Communities said:

'We're looking specifically at a savings vehicle that people can use in order to save for that deposit.’

We believe that fractional ownership provides a perfect savings vehicle through which to save for a deposit.

The main problem with saving for a deposit through a traditional bank account, savings account or cash ISA is that the interest accrued is not linked to house prices.

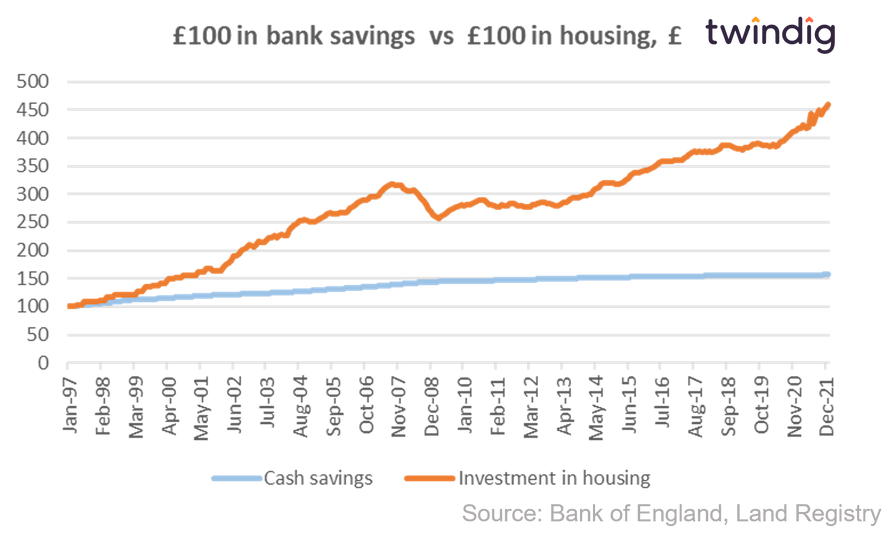

To illustrate the point: a typical mortgage has a term of 25 years, so £100 put into a savings account in January 1997 would today be worth £156, whereas £100 invested into the UK housing market in January 1997 would be worth £460 today – almost three times more.

No wonder those trying to save for a deposit feel doomed like Sisyphus trying to complete a never-ending impossible task.

However, rather than making saving for a deposit like pushing a large stone up a hill, we can level the playing field, fractional ownership allows you to buy as you go, more akin to pushing the stone along a perfectly flat surface as your savings move in line with the asset you are trying to buy.

Savings for bricks – why stop at benefits?

We believe that a savings vehicle fit for a deposit should be open to all aspiring homeowners, not just those currently in social or affordable housing.

The private rented sector in England currently comprises around 4.5 million households many of whom would love to own their own home. Surveys consistently report that more than 80% of those currently renting would like to own their own home.

Similarly, those looking to move up the housing ladder due to changing family circumstances may also wish for a savings vehicle linked to the housing market to enable them to better provide for their families.

Benefits to Bricks: Is Right to Buy Insane?

On 9 June 2022, Michael Gove told Sky News that ‘It is absolutely vital that we reverse the decline there has been in homeownership that we gave seen over recent years.

Right to Buy has been in operation since 1980, thus if one believes that: ‘Insanity is repeating the same mistakes and expecting different results’, a reheating of Right to Buy might not reverse the decline in homeownership. That is why we believe the Government should try a new approach.

Benefits of fractional ownership (of bricks)

We believe that fractional ownership is a new path to homeownership that avoids the potholes and undesirable side effects we have seen with some other housing policies of the past.

Fractional ownership is open to all, not just those lucky enough to have a high wage, a high level of savings, or parents and families with a high level of wealth.

Fractional ownership has 'levelling up' at its core and social good as its heartbeat.

You can read more about the case for fractional homeownership here