Twindig Housing Market Index (HMI) - 18 June 22

As the mercury rose this week, the Twindig Housing Market Index fell by 3.9% to 72.2, its lowest level since 13 November 2020. The rise in Bank Rate, and the heightened expectation of higher rates to come raised concerns about the future direction of the housing market, and led some to ask whether the house price party is over?

The housebuilders certainly don't think so. This week Bellway issued a trading update commenting that its sales reservations were up 5.9% on the same period last year and perhaps more importantly that its forward orderbook is up 27.3%. This means that despite rising mortgage rates and rising costs of living Bellway is selling more homes this year than it did last year.

Housebuilder Crest Nicholson was similarly, if not more, upbeat when announcing its half-year sales volumes (the number of homes sold) was up 7.8% and it increased its profitt expectations for the full year by 5-10%

Neither Bellway nor Crest Nicholson sound like housebuilders who are starting to see a slowdown in housing market activity. We were also pleasantly surprised that the growth in order books was not due to a final sprint from homebuyers looking to use Help-to-Buy before the scheme closes

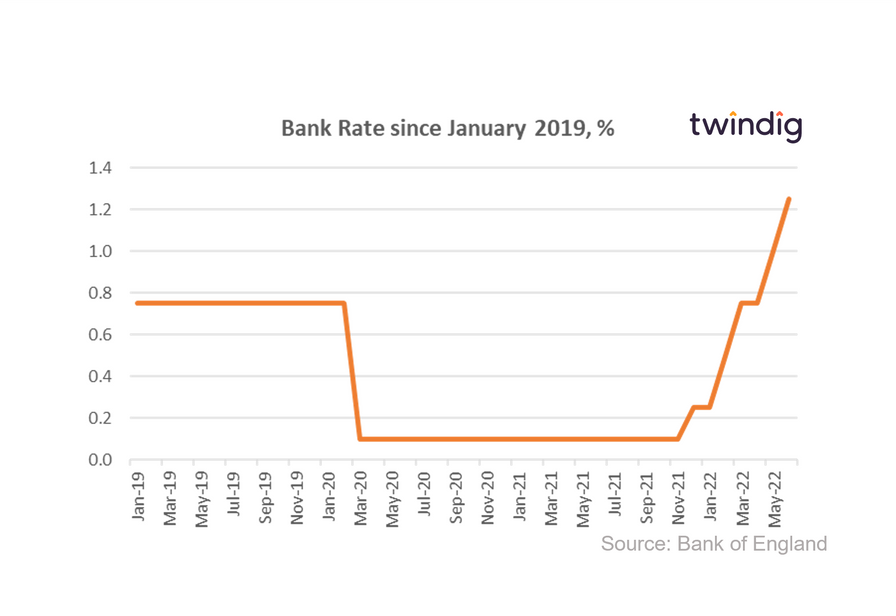

However, residential investors took fright, not perhaps at the Bank of England's decision to increase Bank Rate to 1.25% this week, its highest level since January 2009, but that it suggested that Bank Rate might rise by more than it had previously anticipated. The Bank of England commented that the market-implied path for Bank Rate had risen materially since the MPC’s previous meeting, reaching around 2.9% by end-2022 and peaking at 3.3% in 2023. Rising Bank Rate is very likely to lead to rising mortgage rates and following a period of sustained house price inflation residential investors do not appears as confident as the housebuilders that the party isn't yet over.