Houselungo 17 July 22

50-year mortgages do we really want Generation Debt?

The Government is looking for creative ways to turn Generation Rent into Generation Buy, but do we really want to create Generation Debt?

The Government has a problem. It wants to turn generation rent into generation buy, but the economy is working against them. House prices have risen by more than 25% since the start of the COVID-19 pandemic, much, much faster than wages. Costs of living are spiralling out of control, inflation is already at a 40-year high and expected to rise further and the Government wants us not to seek pay rises, but to seek pay restraint.

The numbers don’t add up, if house prices are rising faster than wages, and mortgages are based on wages then generation buy is shrinking not growing.

Whilst the majority of voters are homeowners, it seems that political parties of all colours are keen to guard against house prices falling on their watch. The latest idea from Government is to let homebuyers borrow for longer. Simply put, if you increase the number of mortgage repayments you can make, you can borrow more money and if you allow aspiring first-time buyers to borrow more money you can move more of them from generation rent to generation buy. Simples. Or is it?

If we end up paying our mortgages into our 80s aren't we just renting from banks rather than from landlords?

What is a twindig and how can it help me?

I was recently interviewed by the Guild of Property Professionals CEO Iain McKenzie and Holly Hibbett about what can a twindig do for you?

You can read about the podcast or put your feet up and listen to the podcast by clicking the link below

Will falling homebuyer demand mean falling house prices?

RICS released their latest UK Residential Market Survey on Thursday this week

What RICS said

New buyer enquiries indicator moves further into negative territory

Sales soften slightly, whilst new instructions remain flat

House prices continue to rise, but growth slowing

Twindig Take

RICS noted last month that new buyer enquiries had started to soften and softened further in June. The questions on everybody's lips are therefore:

Is this the first sign that the cost of living crisis is starting to be felt by homebuyers?

Will falling homebuyer demand lead to falling house prices?

Falling homebuyer demand

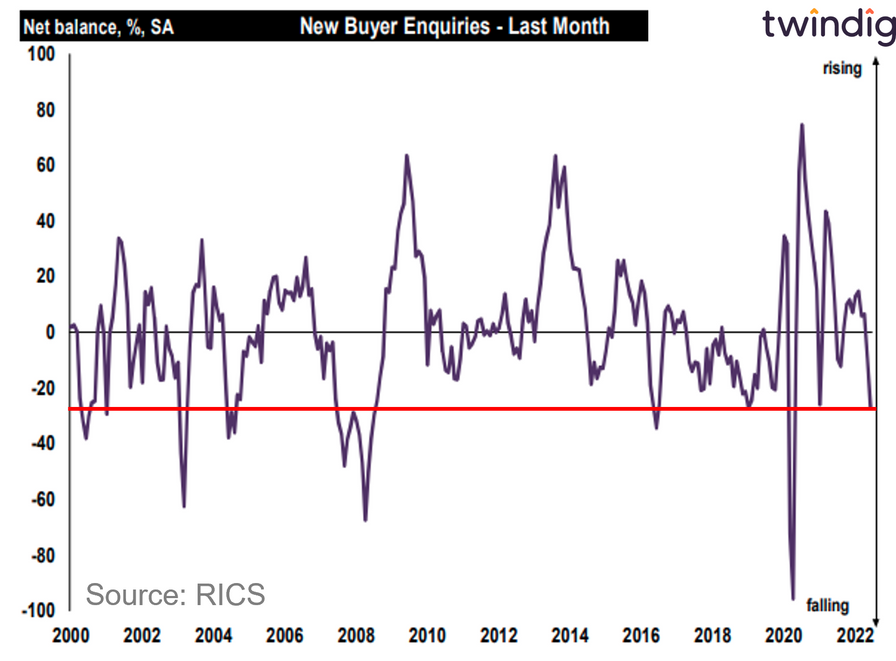

We show the historical context of the fall in new buyer enquiries in the graph below, the red line indicates the current level not seen since the start of the pandemic, a certain Brexit Referendum and a common or garden Global Financial Crisis (GFC). Aside from the GFC we note that such dips in buyer enquiry levels have so far been short-lived and we will watch how this metric evolves in the coming months with interest.

Is credit about to be crunched?

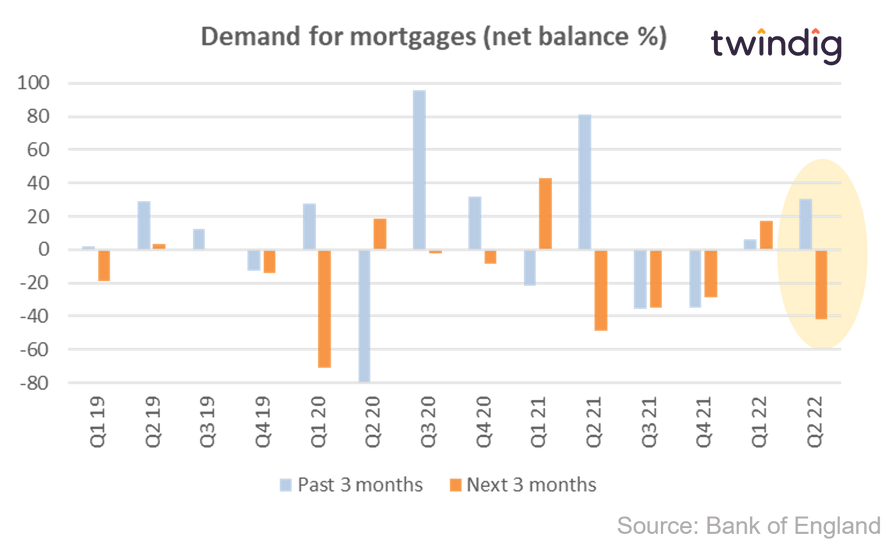

The Bank of England published its Q2 2022 Credit Conditions Survey on Thursday

What they said

Mortgage supply expected to decrease in the coming quarter

Demand for mortgages expected to decrease in the next three months

Mortgage rates are expected to rise during the next quarter

Twindig take

The bullet points in the Bank of England's Q2 22 Credit Conditions survey certainly pack a punch. Rising mortgage rates, fewer mortgages and lower demand for those mortgages. The Credit Conditions Survey came hot on the heels of the RICS June UK Residential Housing Market Survey, which also reported waning demand from homebuyers.

The evidence appears to be mounting that the housing market is on the turn. Are we heading towards a stormy summer and awkward autumn for the UK housing market? We don't think so, credit is not about to get crunched and demand is not on its deathbed, we might be in for a quieter summer, but we expect normal service to resume once we are all back for school in September.

Twindig Housing Market Index

In the week that saw mortgage supply shrink and home buyer demand wane, the Twindig Housing Market Index nudged up, very slightly, by 0.3% moving from 71.6 to 71.8. Much like the Conservative Party leadership contest, the jury is still out as to the future direction of travel for the housing market.

When reading this week's reports of falling mortgage supply and home buyer demand, residential investors were not overly concerned. They point out that both falls come against a backdrop of unusually high levels of activity in the UK housing market as the working-from-home race-for-space met coincided with the stamp duty holiday. The housing market may have past the peak of its heatwave, but it is still summer in the housing market, and its temperature is agreeable, with less chance of getting burnt.