Is credit getting crunched?

The Bank of England published its Q2 2022 Credit Conditions Survey on Thursday

What they said

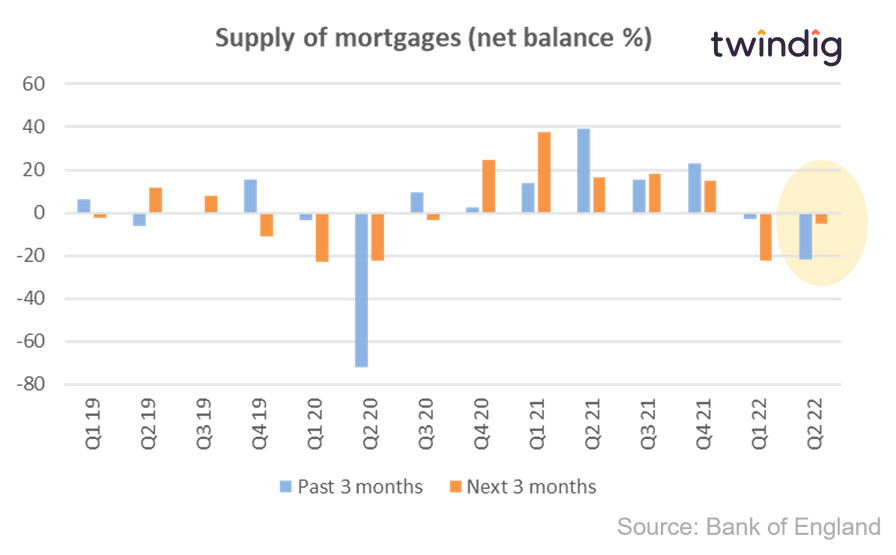

Mortgage supply expected to decrease in the coming quarter

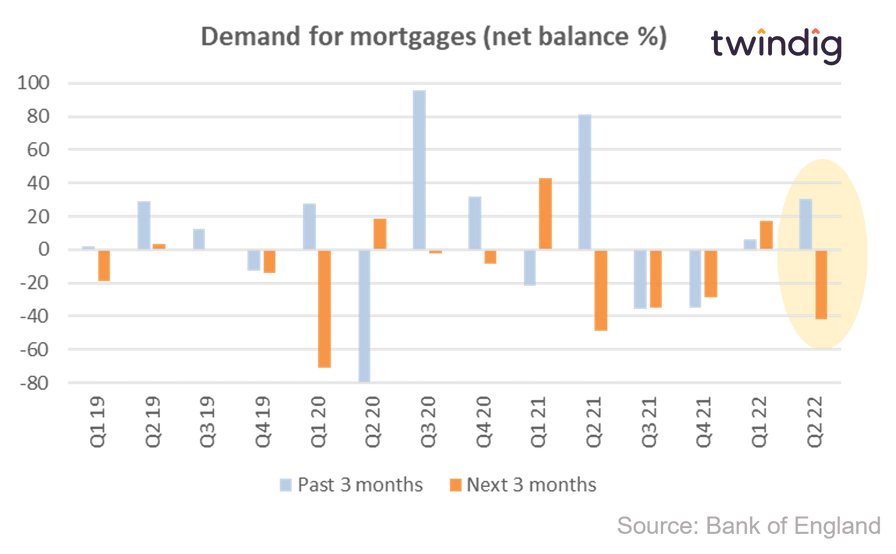

Demand for mortgages expected to decrease in the next three months

Mortgage rates are expected to rise during the next quarter

Twindig take

The bullet points in the Bank of England's Q2 22 Credit Conditions survey certainly pack a punch. Rising mortgage rates, fewer mortgages and lower demand for those mortgages. The Credit Conditions Survey came hot on the heels of the RICS June UK Residential Housing Market Survey, which also reported waning demand from homebuyers.

The evidence appears to be mounting that the housing market is on the turn. Are we heading towards a stormy summer and awkward autumn for the UK housing market? We don't think so, credit is not about to get crunched and demand is not on its deathbed, we might be in for a quieter summer, but we expect normal service to resume once we are all back for school in September.

Dwindling mortgage supply

Mortgage supply is expected to reduce in the coming quarter, but by less than it did in the previous quarter. In the graph below the orange bars are what is expected in the next three months and the blue bars are what actually happened in the previous three months. The good news is that the rate of decline in mortgages is slowing, suggesting that banks are seeing a few rain clouds on the horizon rather than significant storm clouds.

Mortgage Demand going south for Summer

Mortgage demand is expected to fall in the coming quarter, but as the chart shows it has been expected to fall for 'four' of the last 'five' quarters and has so far only fallen twice. Not surprisingly demand fell as the stamp duty holiday came to an end as any had raced to complete transactions and/or brought their house purchase decisions forward.

Interestingly as the cost of living, and mortgage rates, started to rise in Q1 and Q2 of this year so did mortgage demand, which adds weight to our view that those in a position to buy are in rude financial health with savings bolstered by lockdowns and high levels of discretionary spending which can be re-allocated to housing.

RICS also pointed out in their latest survey that buyer demand was waning, however, this is against a backdrop where demand for home purchases still outweighs the number of homes offered on the market for sale.

We must also bear in mind that 2022 is the first time since 2019 that many have been able to plan for and take a summer holiday and so homebuying may for a short while take a back seat whilst we all get reacquainted with our buckets and spades.

Financial Policy Committee (FPC) Report July 2022

The Bank of England's Financial Policy Committee identifies, monitors and takes action to remove or reduce risks in the financial system. In it's latest report, published this month, the FPC commented that the major UK banks have considerable capacity to support lending to households and businesses even with the deterioration in the economic outlook. Although downside risks will present headwinds, the FPC judges that UK banks have capacity to weather the impact of severe economic outcomes.

The FPC also reported that aggregate household debt relative to income has remained broadly flat in recent quarters, and there is little evidence of a deterioration in lending standards. However, the rise in living costs and interest rates will put increased pressure on UK household finances in coming months.

Looking ahead the FPC believes that banks are adjusting to the changes in the economic environment by adjusting mortgage affordability tests to account for recent and expected increases in inflation and interest rates. And in the consumer credit market, intelligence suggests that given the considerable uncertainty in the economic outlook, banks are looking to target new lending towards borrowers with higher credit scores.