50-year mortgages: do we need Generation Debt?

50-year mortgages: be careful what you wish for

The Government is looking for creative ways to turn Generation Rent into Generation Buy, but do we really want to create Generation Debt?

The Government has a problem. It wants to turn generation rent into generation buy, but the economy is working against them. House prices have risen by more than 25% since the start of the COVID-19 pandemic, much, much faster than wages. Costs of living are spiralling out of control, inflation is already at a 40-year high and expected to rise further and the Government wants us not to seek pay rises, but to seek pay restraint.

The numbers don’t add up, if house prices are rising faster than wages, and mortgages are based on wages then generation buy is shrinking not growing.

Whilst the majority of voters are homeowners, it seems that political parties of all colours are keen to guard against house prices falling on their watch. The latest idea from Government is to let homebuyers borrow for longer. Simply put, if you increase the number of mortgage repayments you can make, you can borrow more money and if you allow aspiring first-time buyers to borrow more money you can move more of them from generation rent to generation buy. Simples. Or is it?

If we end up paying our mortgages into our 80s aren't we just renting from banks rather than from landlords?

50-year mortgages: mortgage payments up and down

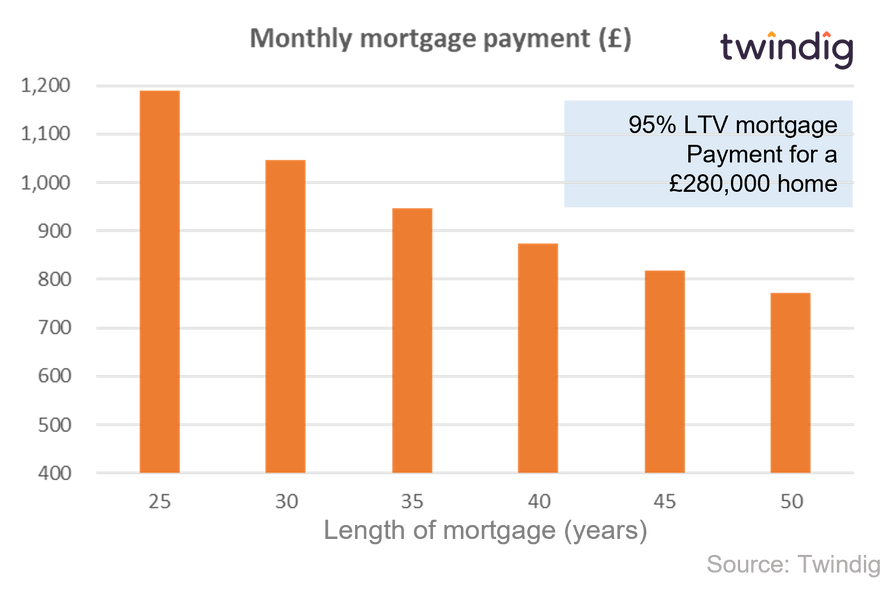

One of the advantages of paying back a mortgage over a longer term is that the monthly mortgage payments are lower, bringing a welcome boost to monthly cashflow. We how in the chart below how monthly mortgage payments fall as the term of the mortgage is increased (based on a 95% LTV mortgage for the averagely priced UK home (£280,000) with a mortgage rate of 2.5%).

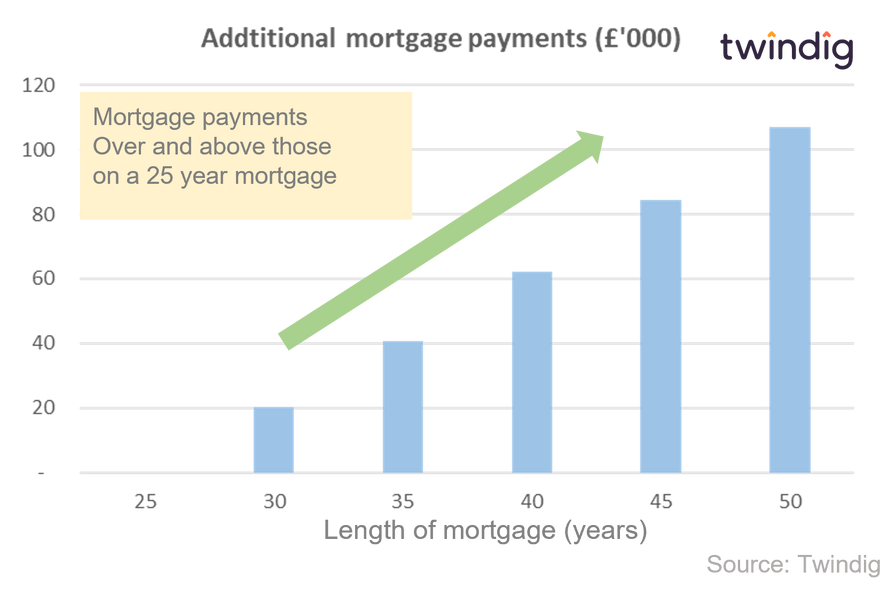

However, there is no such thing as a free lunch, the longer-term mortgage will cost you more in the longer run. As we illustrate below, every 5 years added to the mortgage term increases the total amount paid by more than £20,000 for the averagely priced UK home.

50-year mortgages: More upward pressure on house prices?

If we allow homebuyers to borrow more money, they probably will. If more money is put into the housing market then, all other things being equal, house prices will rise.

One could argue that this will lead to a situation where after a period of time first-time buyers remain unable to get onto the housing market with a 50-year mortgage, so we need to increase that 50 years to 55 or 60 years.

The challenge is where do we draw the line? It used to be 25 years, the logic being you will have a mortgage-free retirement, but now we can happily retire with our mortgages, have debt in our dotage and pass on housing debt rather than housing wealth.

Is this really the road we want to travel on?

50-year mortgages: What no retirement?

When push comes to shove we all prefer jam today rather than jam tomorrow, and whilst deferred gratification has benefits, it never looks as enticing as instant gratification. If signing up for a 50-year mortgage is the only way to get a foot on the housing ladder, many will boldly take that giant leap, but we must be careful what we wish for.

According to the Halifax, the average age of a first-time buyer in the UK in 2021 was 32. Currently, the state pension age is 66, but the 32-year-old taking out a 50-year mortgage will be paying their mortgage until they are 82, some 16 years into their retirement, and one year higher than the average life expectancy....

Whilst 50-year mortgages may help you get on the housing ladder they may also saddle you with debt for the rest of your life. The logic behind the 25-year mortgage was that the homebuyer would be mortgage-free in retirement. As mortgages become longer this will either not be the case and/or the length of retirement may actually shrink as we work for longe periods to clear our debts.

50-year mortgages: just kicking the can down the road

In our view, lengthening the mortgage term is just a partial, short-term solution that will lead to a never-ending cycle of longer and longer mortgages that will ultimately add to the problem they are trying to solve. At the end of the day whilst it levels some part of the housing playing field it doesn't solve the issue of deposits and incomes. You do not solve the issues of deposits and income inequality by tweaking how long you can be beholden to a mortgage lender for.

It is also not just a case of kicking the can down the road, but increasingly it will be the case of kicking the can to the next generation as households pass on housing debt as well as housing wealth. This does not seem like progress to us.

50-year mortgages: are longer mortgages creative?

Prime Minister Boris Johnson has said he wants to “find all sorts of creative ways to help people into ownership” Is lengthening the term that creative?

Housing’s primary role is that of shelter and security of shelter, along with food and clothing is one of our most basic and most important needs.

Increasingly housing’s secondary role is as a store of wealth, an asset that can be called upon to help finance retirement or to assist other family members. The problem with housing as a store of wealth is that it is increasingly difficult to get a foot on the housing ladder to be in a position to build housing wealth and, in our view, 50-year mortgages are not the silver bullet the housing market is looking for.

Housing wealth, a question of distribution not time

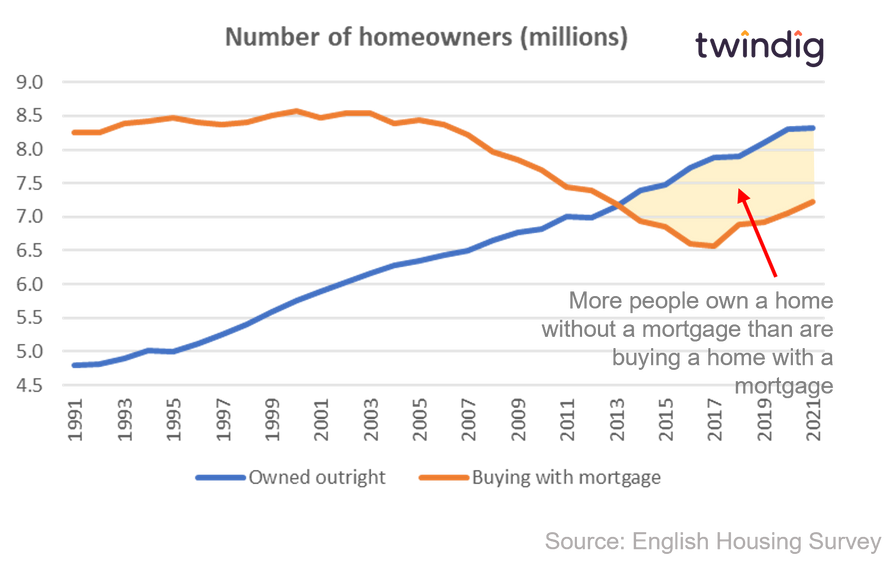

Data from the English Housing Survey reveals that there are 24 million homes in England, of which 15.5 million (65%) are owned by homeowners and of these more than half (54%) are owned without a mortgage.

Across the UK the housing loan to value ratio is just 21%, and almost 80% of the UK’s housing market is owned outright.

The gap between the 'haves' and the 'have nots' is startling, and unfortunately for the have nots, growing at quite a pace.

Is fractional ownership the solution?

We believe that a creative way to help turn generation rent into generation buy is through fractional ownership, where those with wealth to spare help those without enough to buy their home. This would allow much greater participation in the UK housing market and help to turn the rising tide of housing wealth inequality.

Rather than pitting the haves against the have nots or seeing the barriers to homeownership raised ever higher, why not work together and let one person's ownership of property facilitate another's?