Houselungo 14 November 21

A lungo length look at this week's housing market news

Cop 26 Cop Out

The latest RICS UK Housing Market Survey revealed that for most homeowners the cost of improving the energy efficiency of their homes, outweighs the financial benefits.

We are sure that homeowners do care about climate change, but perhaps the Government needs to provide the financial catalyst for change, we'd certainly prefer the carrot to the stick.

Aside from COP26 the temperature of the housing market appears to be on the rise again as buyers return, but sellers remain few and far between...

Last Time Buyers

We often hear about the plight of first-time buyers but the Daily Mail highlighted the plight of last time buyers this week suggesting that the value of retirement homes have not all shared the gains enjoyed by those homes in the wider housing market

The paper quotes Sebastian O’Kelly, founder of the campaign group Better Retirement Housing

‘Retirement housing has been a snake pit of rip-off practices and absolutely abysmal resale values. Buying a retirement flat can be the single worst residential property investment one can make in the UK’

We appreciate that the financial performance of an asset is important, but housing is first a source of shelter and second a store of wealth. It is also telling that typically those who complain about the value of retirement homes are those inheriting the home rather than those living in the property.

In our view, age and stage appropriate housing will be a growing area of importance, we are living longer, but unfortunately, as we live longer more of our lives are impacted by the issues of mobility and isolation. The current structure of retirement housing has pros and cons, and in this article, we ask if there is a better alternative than the current offerings?

Housebuilders Building Momentum

Several of the UK’s largest housebuilders published trading updates this week. They were all singing off the same hymn sheet and their singing was in fine voice.

The new-build housing market has remained robust so far in the second half of the year and the builders are now fully focused on 2022 rather than 2021 as their goals for 2021 have already been achieved.

The homebuilders have been helped by a shortage of stock in the second-hand market and the assistance of the Stamp Duty Holiday will not have done them any harm either.

The homebuilders are not immune to the well-publicised supply chain issues facing the wider economy, however, house price growth in the buoyant housing market has more than offset build cost pressures mounting in the supply chain.

Interestingly only one of the builders specifically mentioned the changes to Help to Buy earlier this year, which have reduced its scope, and their commentary was that the homebuilders have taken these changes in their stride. However, changes to the regime are one thing, the Help to Buy scheme is scheduled to come to a close in April 2023 and this will be impacting the homebuilders business plans today. Redrow commented that Help to Buy only accounted for 9% of reservations in the period.

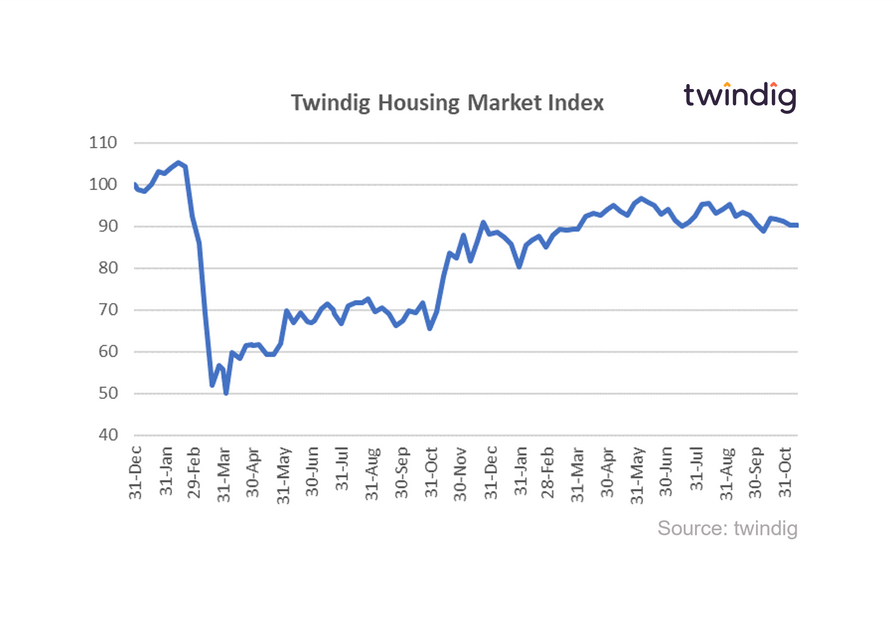

Twindig Housing Market Index

The Twindig Housing Market Index flatlined this week as COP26 struggled to keep 1.5 alive. Our housing market index nudged up ever so slightly by 0.2% to 90.4 this week as investors' eyes were more focused on Glasgow than the UK housing market.

Whilst we appreciate that the survival of our planet is more important than the shorter-term trends and signals in the housing market, the muted movement in the Twindig Housing Market Index covered what was a very strong week for UK housebuilders.

Barratt, Redrow, Taylor Wimpey and Vistry Group all issued trading updates this week and all reported that the housing market was in fine health and was expected to remain very healthy next year.

Strong, deep and wide forward orderbooks underpins the UK housebuilders confidence in the housing market. There is life after the stamp duty holiday and there is life after the reduction in scope of Help to Buy. Help to Buy was hardly mentioned by the housebuilders this week, this was a surprise to us given the rule changes in April and the fact that the scheme is scheduled to close in April 2023.