RICS survey COP26 cop out

The latest RICS UK Residential Market Survey published this week

What they said

Lack of stock remains an issue for the UK housing market

Sales soften, but buyer enquiries firming up

House prices continue to rise

COP26 yet to hit the housing market

Twindig take

The key challenge facing the UK housing market remains the lack of stock for sale, which is no doubt frustrating for buyers (and those who earn their crust from housing transactions) but good for homeowners who closely follow house prices, as the shortage of stock continues to uplift and underpin house prices.

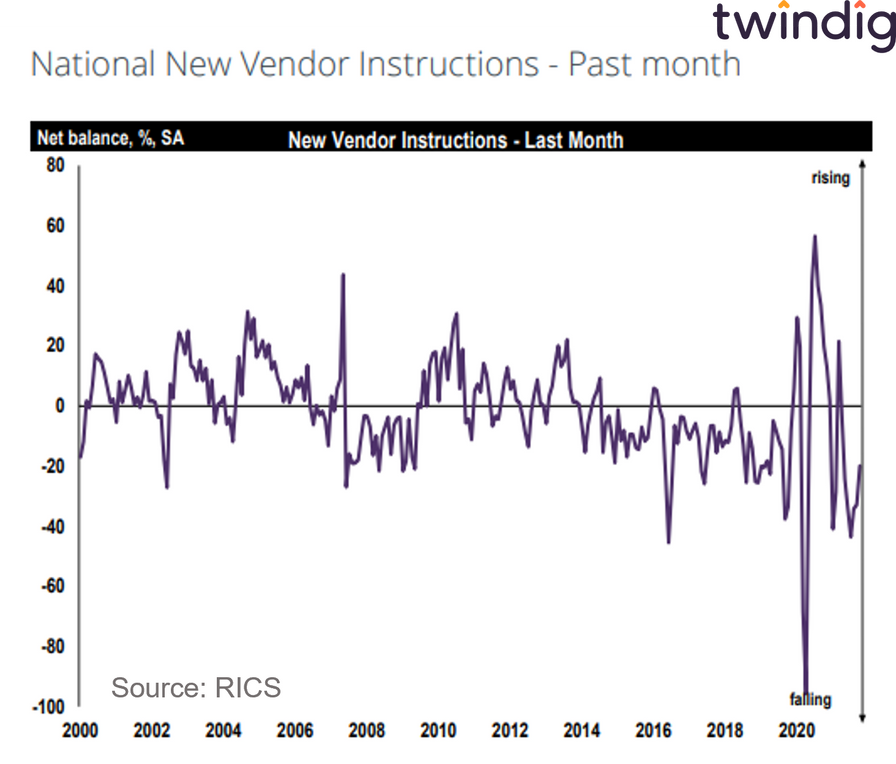

RICS data on new sales instructions has now been in negative territory for seven consecutive months

We had anticipated that sales would soften as the stamp duty holiday ended (this is what happened after every previous stamp duty holiday) and so this is not a surprise. However, we are positively encouraged by the fact that buyer enquiries have already started to rise. We had expected a lull in demand as many will have pulled forward their moving plans. The rising buyer demand points to a strong underlying and confident housing market, in our view.

COP26 cop out

Whilst COP26 has been dominating the media over the last fortnight, it has yet to have a meaningful impact on the UK housing market.

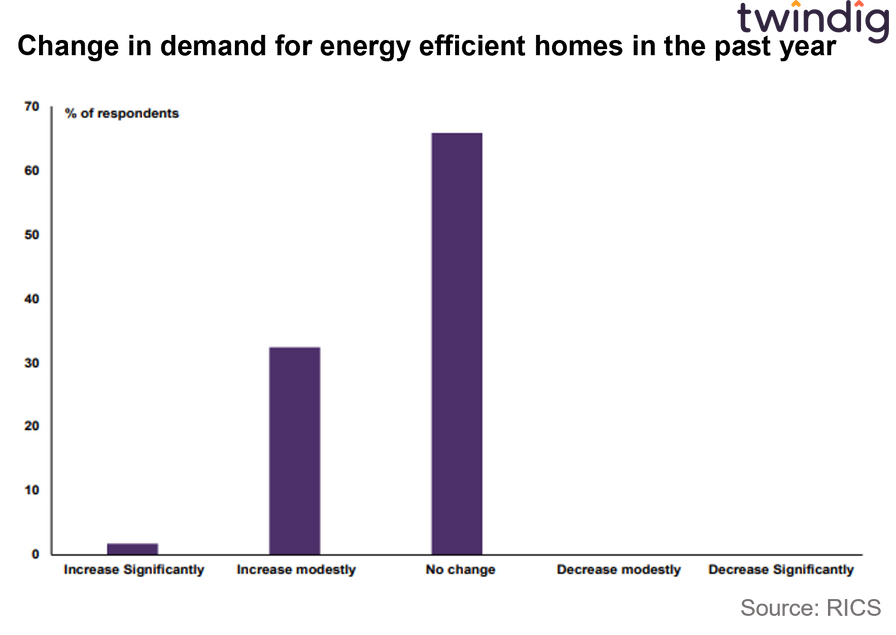

RICS latest survey reported that around two-thirds of those responding had not seen an increase in the demand for energy-efficient homes in the last year.

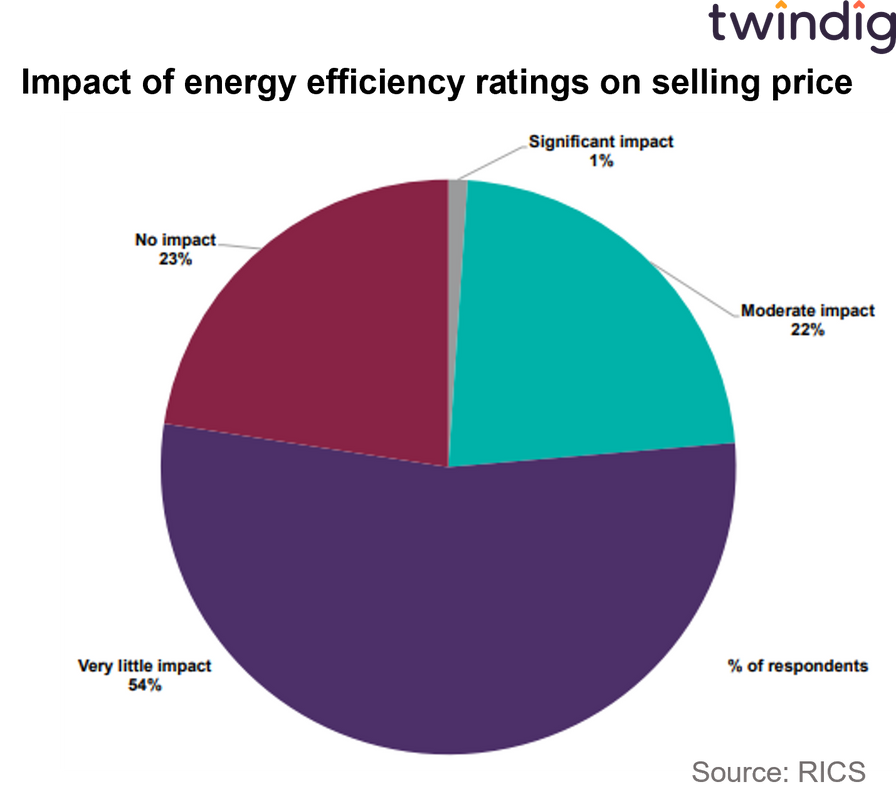

..And just over half thought that the energy efficiency of homes would have very little impact on house prices

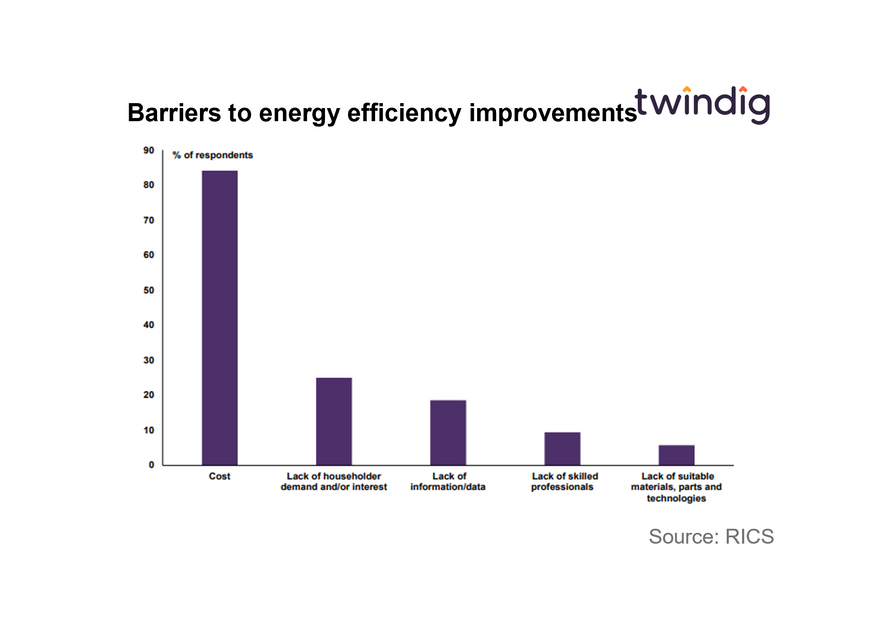

Not surprisingly the biggest barrier to making energy efficiency improvements to your homes is the cost of making the improvements at more than 80% of respondents, followed by a lack of interest and a lack of information and awareness about the changes that could be made. The costs of change are clearly an issue especially as research from Savills suggests that the costs of moving a home from EPC band D to EPC band B will take 36 years to be paid back by the energy savings gained. A period longer than most mortgages...