Houselungo 12 Feb 23

House prices stable

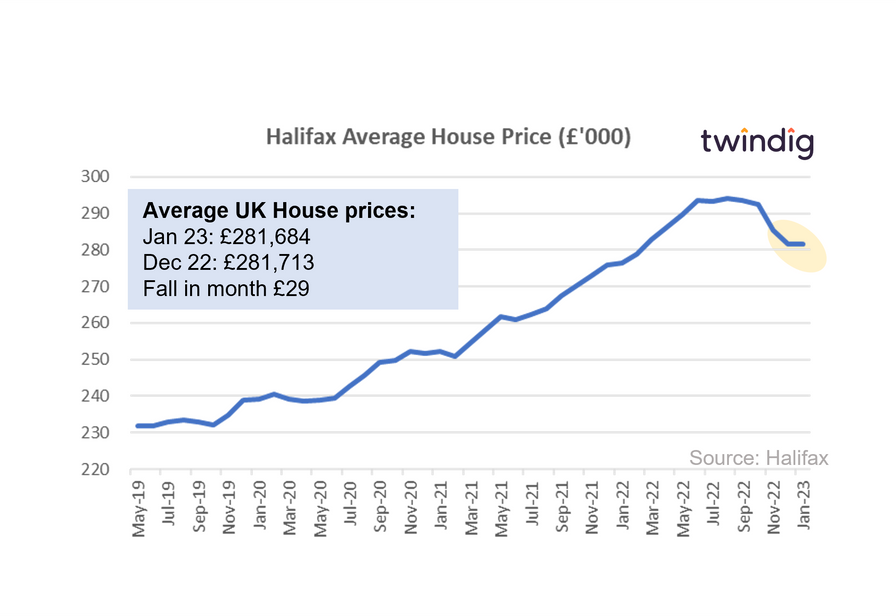

The Halifax published its House Price Index for January 2023 this week

What the Halifax said

Average house price £281,684

House prices stable in January down by just £29

Annual house price inflation 1.9%

Twindig Take

Whilst some seem to be taking delight in falling house prices and looking forward to a house price crash, the housing market is not following that particular script. According to the Halifax, house prices were stable in January 'falling' just £29 or 0.01% to £281,684.

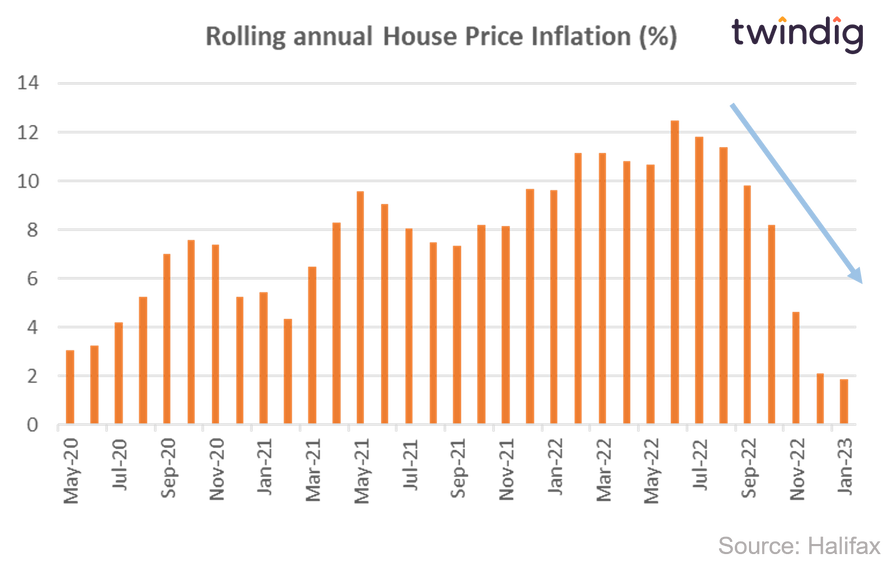

It is true that the rate of annual house price inflation has slowed as illustrated in the chart below, but talk of house price crashes appears somewhat premature, in our view.

The average UK house price is now 4.2% or £12,300 below its August 2022 peak, but still some £41,000 or 22% ahead of pre-COVID levels.

Whilst some seem to be taking delight in falling house prices and looking forward to a house price crash, the housing market is not following that particular script. According to the Halifax, house prices were stable in January 'falling' just £29 or 0.01% to £281,684.

It is true that the rate of annual house price inflation has slowed as illustrated in the chart below, but talk of house price crashes appears somewhat premature, in our view.

What the housebuilders said

This week three of the UK's biggest housebuilders (Barratt, Bellway and Redrow) reported financial results. All three were singing off the same hymn sheet: September to December was awful, but the new year has started with a spring in its step, it's still early days, but we might even see a Spring Selling Season this year....

What does what they said mean?

Our key conclusions are that the underlying housing market conditions are not as bad as some of the headline writers would have us believe.

The key moving parts are 'volume' and 'price'. Volume - how many homes are being sold. Price - the price of the homes being sold.

What is happening to volumes?

There are down, but not out. Yes, housebuilders are selling fewer homes, but it is not the end of the world and this year has started better than we thought

What is happening to house prices?

It seems that for housebuilders and the Halifax alike, house prices are stable. This is important, because housebuilders are price takers and if they are seeing stable prices it is not all doom and gloom for the market as a whole.

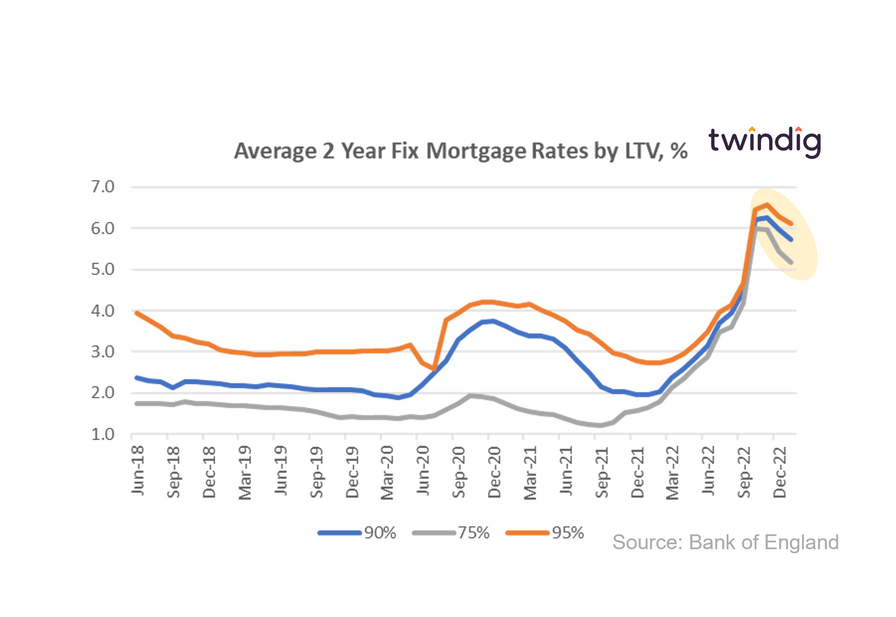

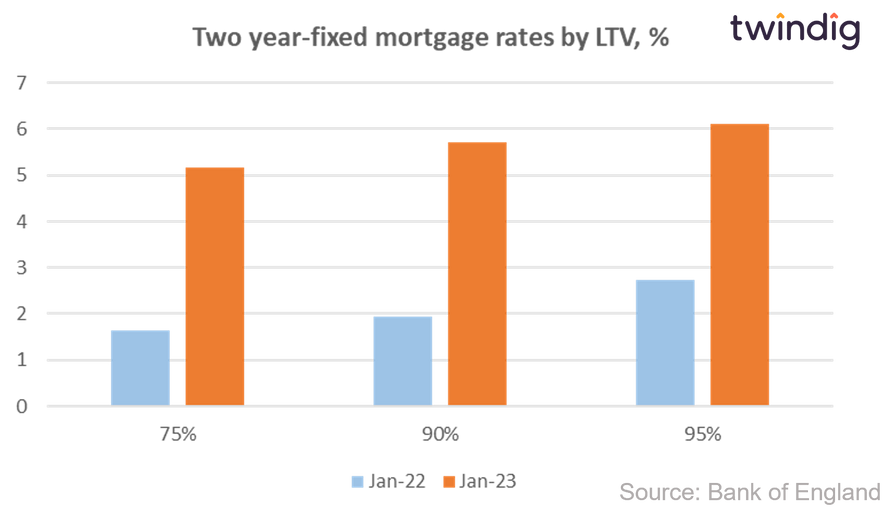

Mortgage rates falling

The Bank of England released average mortgage rates by Loan to Value (LTV) this week

What the Bank of England said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 5.17% (down 26bp)

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 5.72% (down 24bp)

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 6.11% (down 18bp)

Twindig take

Average mortgage rates for popular mortgage products fell in January 2023, the third fall in a row as stability continues to return to the financial markets.

This will be welcome news to those currently buying homes and those looking to re-mortgage in the near future.

However, mortgage rates are significantly higher than they were one year ago as illustrated in the chart below.

Housing market on mute

RICS released their January 2023 UK Residential Market Survey on Thursday

What RICS said

House prices continue to slip at a national level

Metrics on buyer enquiries, agreed sales and new instructions remain negative

Forward-looking indicators remain subdued

Twindig take

The January RICS UK Residential Survey makes for interesting reading and sheds some laser-focused light on the balance of housing supply and housing demand.

RICS report a housing market on mute with new buyer demand, new listings, sales and house prices all trending downwards, and that trend is likely to continue as the housing market adjusts to a higher mortgage rates environment.

At first glance this all sounds rather gloomy, but whilst fewer people seem to want to buy and sell, we believe that those that do want to buy and those that do want to sell will be able to find a home and agree on a fair price and should not be deterred by the madness of the crowds.

The balance for new buyer enquiries fell further from -40% to -47% in January, making January the ninth consecutive month of negative readings. Perhaps this should not be a surprise, if house prices are falling today, it might make sense to wait until tomorrow to buy. However, if the home you want and perhaps need to buy is on the market today, why risk losing out by waiting or tomorrow?

The housebuilder podcast

In this week's Property Market Insight podcast, Daniel Hamilton Charlton and Housing Hailey discuss house prices and housebuilders and the implications of what the housebuilders are saying on the wider UK housing market

Twindig Housing Market Index

In the week that the Halifax reported stable house prices, RICS that the UK housing market was on mute and mortgage rates fell, the Twindig Housing Market Index measuring investor confidence in the UK housing market nudged up by 0.2% to 77.3