Houselungo 10 July 22

House prices on firmer foundations than the Prime Minister

The Halifax released their House Price Index for June 2022 on Thursday

What the Halifax said

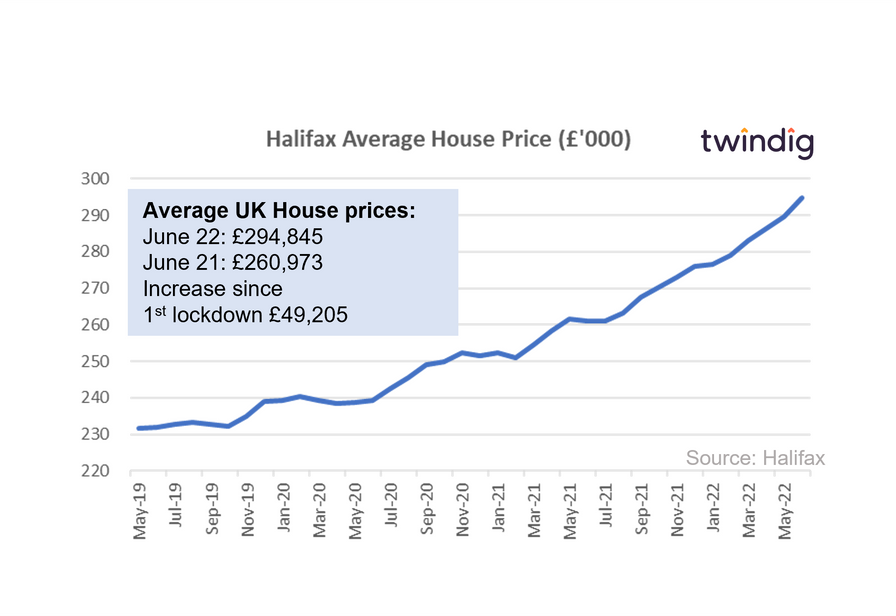

Average house price £294,845

House prices increased by 1.8% in June

Annual house price inflation 13.0%

Twindig take

No doubt Prime Minister Boris Johnson wishes his popularity in parliament was as resilient as house prices are in the face of economic headwinds and cost of living challenges. June 2022 marked the twelve consecutive rise in house prices, and at 13%, delivering the highest annual house price growth rate since late 2004. As house prices continue to defy expectations, we do not expect them to come crashing down in the short or medium-term, and it seems that the Prime Minister's luck ran out before house prices have started to run out of steam.

According to the Halifax, house prices have risen by £3,872 over the last year and by more than £5,000 in the last month.

The imbalance of demand for home purchases and the supply of homes for sale continues to underpin house prices and drive their growth.

Political upheaval and house prices

Following the rather dramatic events of the last few days and hours we thought it might be helpful to look at what political turmoil does for house prices, and what we find might surprise you…

House prices largely indifferent to political turmoil

In the recent past, we have had several major events to help us assess how house prices may react to the unusual political events of the last few days.

The Brexit Referendum,

The 2017 General Election,

The 2019 General Election, and

The COVID-19 Pandemic

If history repeats itself, the house price growth may plateau whilst a new Prime Minister is found and perhaps until we have had an election to confirm the incoming PM's mandate to lead and govern our country. Many will forecast house price falls, but we expect house prices to neither move significantly up nor down whilst the current political storm calms down and the dust settles.

What does the cost of living crisis mean for house prices?

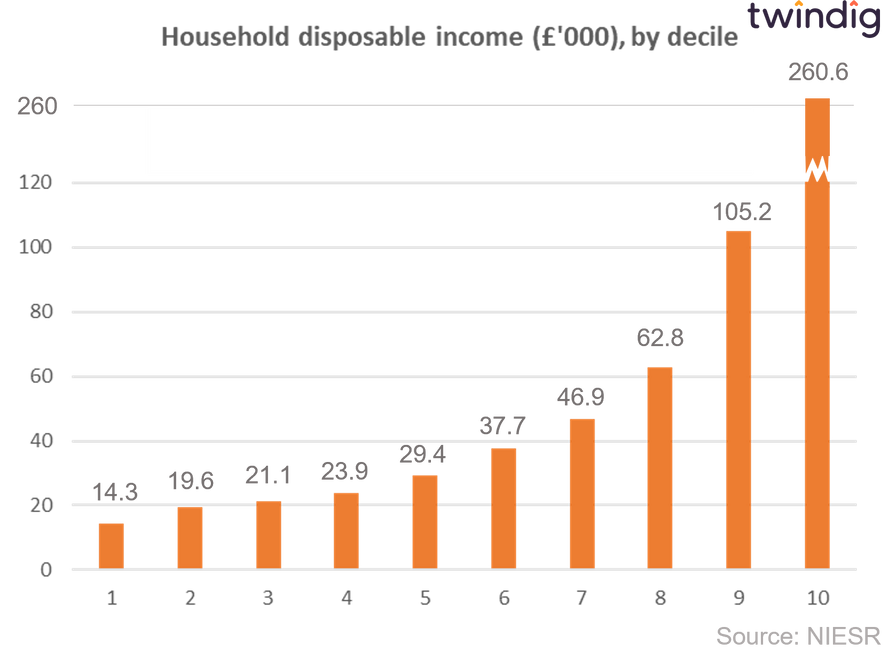

The National Institute of Economic and Social Research (NIESR) recently looked at the impact of the last budget and inflation on household finances, whilst they were not specifically looking at the implications for house prices, we believe that their analysis sheds some light on the strength of house prices at the current time.

What the NIESR found

The NIESR looked at spending patterns of households by income decile from those in the lowest 10% of income groups to those in the highest decile.

Those households in the lowest income decile had disposable income of £14,300 per year (£1,192 per month) whilst those in the households in the highest decile had disposable income of £260,600 per year (£21,717 per month).

Those households in the fifth decile had a disposable income of £29,400 per year (£2,450 per month).

What we we found fascinating was how much discretionary spending there is among households and perhaps this will provide the buffer between house prices and the cost of living crisis

Mortgage rates continue to rise in June

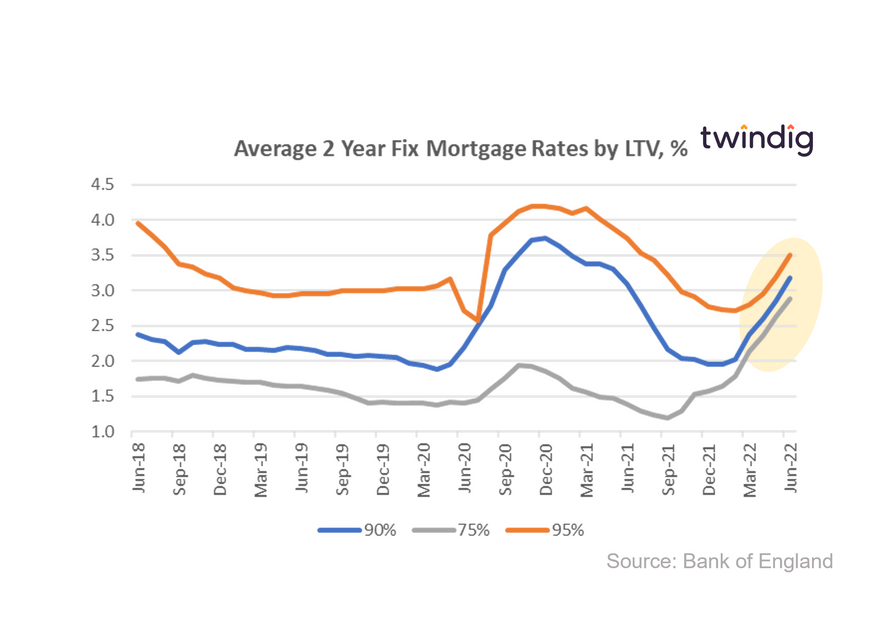

The Bank of England released average mortgage rates by Loan to Value (LTV) on Thursday

What the Bank of England said

Average mortgage rate for 75% LTV 2-year fixed rates mortgages 2.88%

Average mortgage rate for 90% LTV 2-year fixed rates mortgages 3.18%

Average mortgage rate for 95% LTV 2-year fixed rates mortgages 3.50%

Twindig take

As we have commented before with Bank Rate rising it is inevitable that mortgage rates will follow suit. The average mortgage rates for popular mortgage products rose by around 10% in June and mortgage rates are likely to continue rising during the rest of the year.

The average mortgage rate for a 2-year fixed-rate 75% LTV mortgage has more than doubled over the last year from 1.39% in June 2021 to 2.88% in June 2022. However, although the mortgage rates for higher LTV mortgage products are also rising, at the 95% LTV level they are lower than they were one year ago: 3.50% in June 2022, but 3.74% in June 2021.

Twindig Housing Market Index

In a week where few, if any, predicted the fall-out and decimation of the UK Government and the beginning of the end of Boris Johnson's reign as UK Prime Minister, the Twindig Housing Market Index was unchanged this week at 71.6. Time will tell if this was because residential investors had more than housing on their minds or if they were waiting for the political dust to settle before re-assessing the UK housing market. For what it's worth, our view is that this week was a good week for the UK housing market.

The Halifax house price index rose for the twelfth month in a row to another record high of £294,845, having increased by almost £50,000 since the start of the first COVID-19 lockdown, leading some to ask will UK house prices top £300,000 before the housing market turns?

Mortgage rates were also on the rise again during June, the average rate for a 2-year fixed-rate 75% LTV mortgage has doubled over the last year from 1.39% in June 2021 to 2.88% in June this year.