Twindig Housing Market Index (HMI) - 9 July 22

In a week where few, if any, predicted the fall-out and decimation of the UK Government and the beginning of the end of Boris Johnson's reign as UK Prime Minister, the Twindig Housing Market Index was unchanged this week at 71.6. Time will tell if this was because residential investors had more than housing on their minds or if they were waiting for the political dust to settle before re-assessing the UK housing market. For what it's worth, our view is that this week was a good week for the UK housing market.

The Halifax house price index rose for the twelfth month in a row to another record high of £294,845, having increased by almost £50,000 since the start of the first COVID-19 lockdown, leading some to ask will UK house prices top £300,000 before the housing market turns?

Mortgage rates were also on the rise again during June, the average rate for a 2-year fixed-rate 75% LTV mortgage has doubled over the last year from 1.39% in June 2021 to 2.88% in June this year.

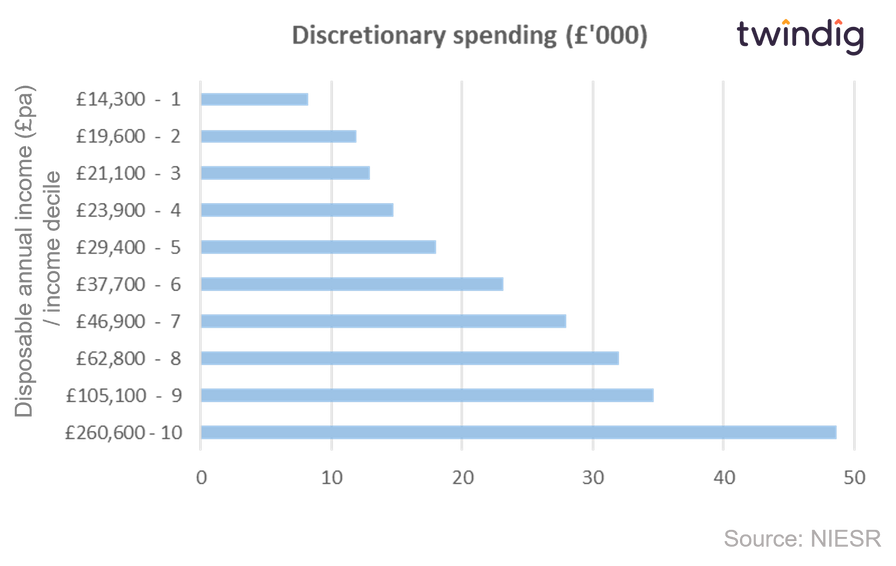

The cost of living crisis is still weighing on the minds of many residential investors, but our analysis of the NIESR report into household finances suggests to us that those households most likely to move have high levels of discretionary spending which could be pared back to facilitate a move and those in the higher household income tiers are still able to save a significant amount of their income each month.

Our take is therefore that for those in the higher household income brackets the cost of living crisis is yet to pass a real pain point. House prices may therefore be underpinned for some time to come. You can read our full report by clicking Read more below:

Despite the demand for homes exceeding supply, housebuilder Persimmon will be selling fewer homes this year than last. In the first half of 2021 it sold 7,406 homes, but in the six months to 30 June 2022 that number fell by 10% to 6,652 due to delays in the planning system and material and labour shortages. Lower volumes coupled with higher input prices will mean that Persimmon's overall profits will be lower this year. However, the Group reports that demand remains strong across the country and we suspect that if it were not for the planning delays Persimmon's profits, like house prices, would be rising rather than falling. Shareholders will also be comforted by the fact that Persimmon's capital return (dividend) programme remains unaffected by the changes to profits.

However, housebuilder Vistry Group's progress has not been held back by planning delays saw sales rates, sales and forward sales rise in the first half of 2022 which will lead to high than expected profit for the full year.