House prices seem on firmer foundations than the Prime Minister

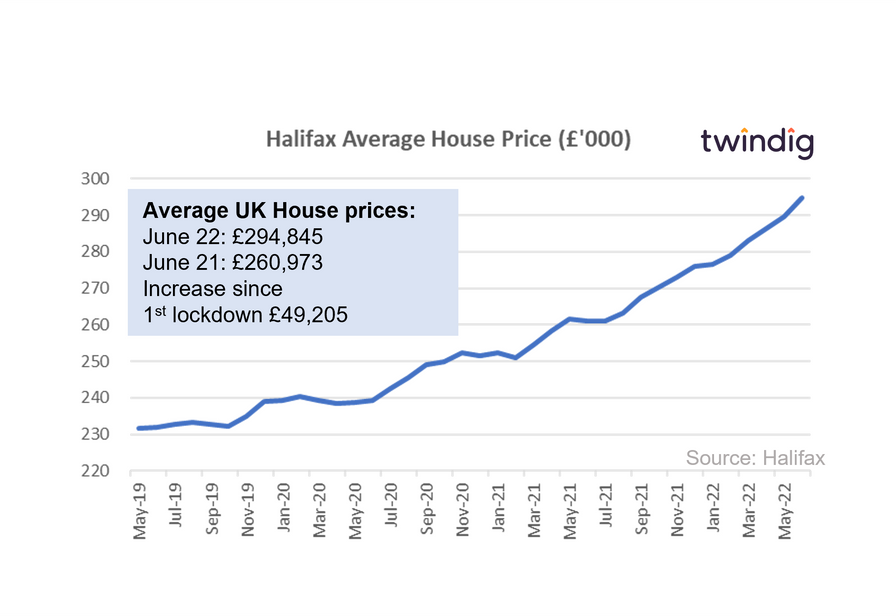

The Halifax released their House Price Index for June 2022 today

What the Halifax said

Average house price £294,845

House prices increased by 1.8% in June

Annual house price inflation 13.0%

Twindig take

No doubt Prime Minister Boris Johnson wishes his popularity in parliament was as resilient as house prices are in the face of economic headwinds and cost of living challenges. June 2022 marked the twelve consecutive rise in house prices, and at 13%, delivering the highest annual house price growth rate since late 2004. As house prices continue to defy expectations, we do not expect them to come crashing down in the short or medium-term, and we expect the Prime Minister's luck to run out before house prices run out of steam.

According to the Halifax, house prices have risen by £3,872 over the last year and by more than £5,000 in the last month.

The imbalance of demand for home purchases and the supply of homes for sale continues to underpin house prices and drive their growth.

As noted in our report yesterday What does the cost of living crisis mean for house prices? although the costs of living, and mortgage rates are rising, those buying homes are typically in the higher tiers of household income and are, or now, insulated from the cost of living increases through savings and high levels of discretionary spending which could be pared down.

This dynamic was highlighted again today by the Halifax who revealed that the average house price inflation for detached homes at 13.9% is almost twice the level it is for flats (7.6%). Those with more money are able to buy bigger homes and it seems the race for space is not over yet as working from home appears to have outlived lockdown.

The Halifax is mindful that house price-earnings ratios are at record levels and expects a slowing of house price growth in the future. The twindig view is slightly different, we expect discretionary spending to be cut back as the cost of living rises in order to fund house purchases and pay that bigger mortgage.

To see how interest rates may impact your mortgage payments you can use our mortgage calculator