Houselungo 10 April 22

House prices rise by £1m per minute

According to the Equity Release Council, the total value of UK housing rose by more than £1m every minute during 2021, increasing the value of housing equity across the UK to £5.2 trillion. Rising house prices have seen the average loan to value fall from 25.6% before the pandemic to 23.1% at the end of 2021. The housing market is a very equity rich market.

Equity release at record levels - but is it right for me?

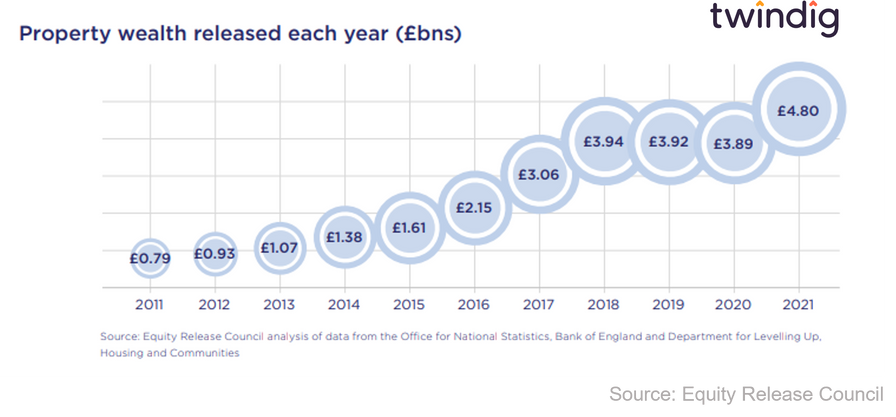

In 2021 homeowners released £4.8 billion of housing equity as house prices rose, which is £4bn or six times more than the £0.8bn released in 2011.

But this doesn't mean that equity release is the best thing since sliced bread, in our view.

The 25 most expensive Council Tax Bills

As the cost of living rises and new council tax bills are arriving in the post, Twindig has crunched the numbers on the most and least expensive council tax bills across the country. This is probably the only league table where Blaenau Gwent wished it wasn’t in the top spot, no doubt wishing it could change places with the City of Westminster. Are you paying over the odds?

Like all other taxes, most people do not enjoy paying Council Tax, we understand the need to fund local services but your Council Tax is based on the value of the home you live in rather than on your income or by the volume and value of services you consume.

And, when it comes to Council Tax all are not equal, depending on where you live you may live in a big house with a small Council Tax bill or a more modest house with a much bigger one as illustrated below.

The most expensive place to live in terms of Council Tax is Blaenau Gwent where a home in Band I has a Council Tax Bill of £4,897 per year (£408 per month) and the area with the lowest (Band A) Council Tax is the London Borough of Westminster with an annual Council Tax bill of £577 per year (just £48.10 per month).

Residents in Blaenau Gwent pay almost 10x as much Council Tax as those in the City of Westminster and yet the average house price in Blaenau Gwent is around £120,000, whereas the average house price in the City of Westminster is around £1,015,000 - almost 10x higher than those in Blaenau Gwent

The 25 most expensive Council Tax Bills

We show in the chart below the local authorities with the highest Council Tax bills for homes in the highest Council Tax bands.

The top three, all in Wales, are:

Blaenau Gwent with a Council Tax of £408 per month

Merthyr Tydfil with a Council Tax of £399 per month

Neath Port Talbot with a Council Tax of £391 per month

Interestingly, the area with the most expensive houses, London, does not appear in the top 25 most expensive Council Tax bills.

Halifax house prices hit 'another' new high

The Halifax released their house price index for March this week

What they said

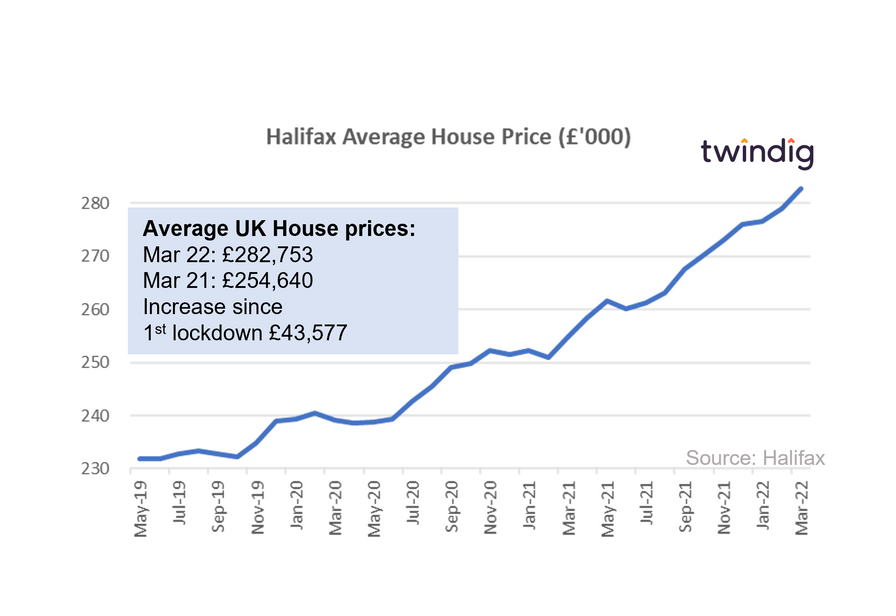

Average UK house price £282,753

House prices have risen by £43,577 since the first lockdown

Monthly house price increase of 1.4% the largest for six months

Twindig take

The Halifax house price index rose in March for the ninth month in a row, the 1.4% increase in March 2022 of £3,860, an amount significantly larger than the average full-time monthly wage, was the biggest increase since September.

The annual rate of house price inflation of 11.0% is a level of house price inflation we have not seen since mid-2007.

Despite the rising costs of living and increasing mortgage rates, house prices continue to be driven and underpinned by a shortage of homes for sale - the classic more buyers than sellers pushing up house prices.

The Halifax believes, as we do, that affordability concerns are starting to move up the housing ladder. Not only is it difficult for first-time buyers to take their first step onto the housing ladder, but it is increasingly difficult for those looking to trade up as the recent levels of house price inflation have increased the distance between the rungs on the housing ladder itself.

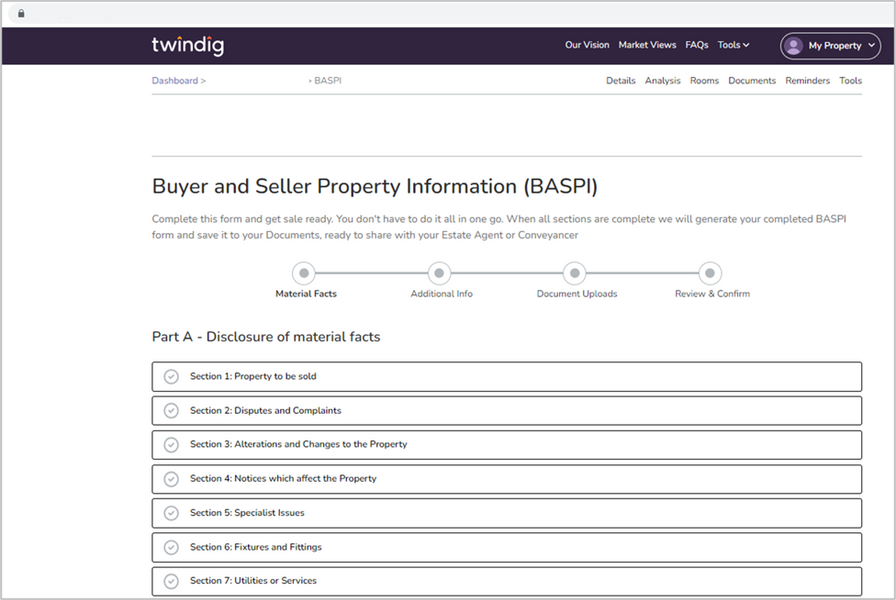

Thinking of selling, you'll need a BASPI

The Buying and Selling Property Information (BASPI) form has been designed to be a single source of truth for the upfront information required about a property when it is being sold.

The BASPI should be completed at the same time as the property is put on the market for sale.

By having all the information you need to buy and sell a home in one place at the time the property is first marketed for sale, the sale process should be less stressful, quicker to complete, and less likely to fail or fall through. The aim of the BASPI is to make the process of buying and selling your home less stressful.

What is a BASPI?

A BASPI is the Buying and Selling Property Information (BASPI) form. It has been designed by the Home Buying and Selling Group. It collates all the information you need to sell your home in one place.

The latest version of the BASPI was released in April 2022

Why do we need a BASPI?

Housing purchases and sales often fall through after an offer has been accepted due to a lack of information provided to the buyer from the seller. It often takes so long to collate all the information that the buyer is unable to complete the sale in a practical time frame and so the sale fails to complete. Every failed housing transaction usually means that a lot of time and money has been wasted, time and money that is very difficult to get back.

By having all the information you need to sell your home in one place when you put your home on the market for sale, the buying and selling process can be speeded up and completed more easily reducing some of the risks that the purchase and sale will fall through.

What is the Twindig BASPI?

Twindig has merely taken the Home Buying and Selling Group’s BASPI and digitised it to make it easy to complete.

Twindig also allows you to upload the supporting documents required by the BASPI. When a homeowner has completed their BASPI on Twindig we place the form itself and all the supporting documents in an easily shareable ‘BASPI bundle’.

The BASPI bundle allows you to share the complete BASPI and supporting documents with those who need to see it such as conveyancers, mortgage providers and the potential buyer of your home.

One in three housing transactions fall through why take that risk?

Twindig Housing Market Index

In the week that the Equity Release Council revealed that housing wealth in the UK increased by more than £1m per minute last year (surely lottery-style winnings but with better odds?), and the Halifax House Price Index reached 'another' high the Twindig Housing Market nudged down by the smallest of margins from 79.6 to 79.5.

It seems that the only way for the UK housing market at the moment is up. National estate agency chain Belvoir is certainly making hay whilst the sun shines delivering its 25th consecutive year of profit growth, very impressive when you think it has grown through the Global Financial Crisis, Brexit and the COVID pandemic.

The Halifax house price index this week followed on from Nationwide's the week before reporting that UK house prices are still rising and rising at quite a pace stock shortages continue to underpin prices and it seems that the race for space is a marathon, not a sprint. House prices, on average, are up £44,000 since the first lockdown and grew by 1.4% in March, their highest rate for six months.