The 25 most expensive Council Tax Bills

Like all other taxes, most people do not enjoy paying Council Tax, we understand the need to fund local services but your Council Tax is based on the value of the home you live in rather than on your income or by the volume and value of services you consume.

And, when it comes to Council Tax all are not equal, depending on where you live you may live in a big house with a small Council Tax bill or a more modest house with a much bigger one as illustrated below.

The most expensive place to live in terms of Council Tax is Blaenau Gwent where a home in Band I has a Council Tax Bill of £4,897 per year (£408 per month) and the area with the lowest (Band A) Council Tax is the London Borough of Westminster with an annual Council Tax bill of £577 per year (just £48.10 per month).

Residents in Blaenau Gwent pay almost 10x as much Council Tax as those in the City of Westminster and yet the average house price in Blaenau Gwent is around £120,000, whereas the average house price in the City of Westminster is around £1,015,000 - almost 10x higher than those in Blaenau Gwent

The 25 most expensive Council Tax Bills

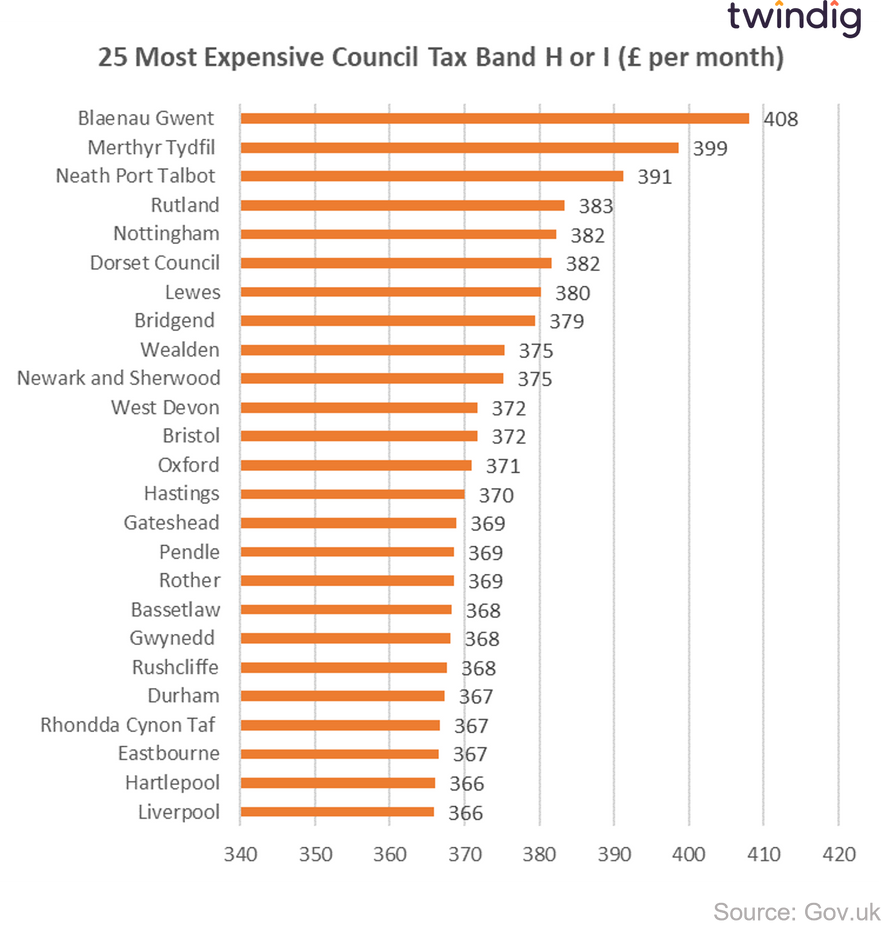

We show in the chart below the local authorities with the highest Council Tax bills for homes in the highest Council Tax bands.

The top three, all in Wales, are:

Blaenau Gwent with a Council Tax of £408 per month

Merthyr Tydfil with a Council Tax of £399 per month

Neath Port Talbot with a Council Tax of £391 per month

Interestingly, the area with the most expensive houses, London, does not appear in the top 25 most expensive Council Tax bills.

The 25 cheapest Council Tax Bills

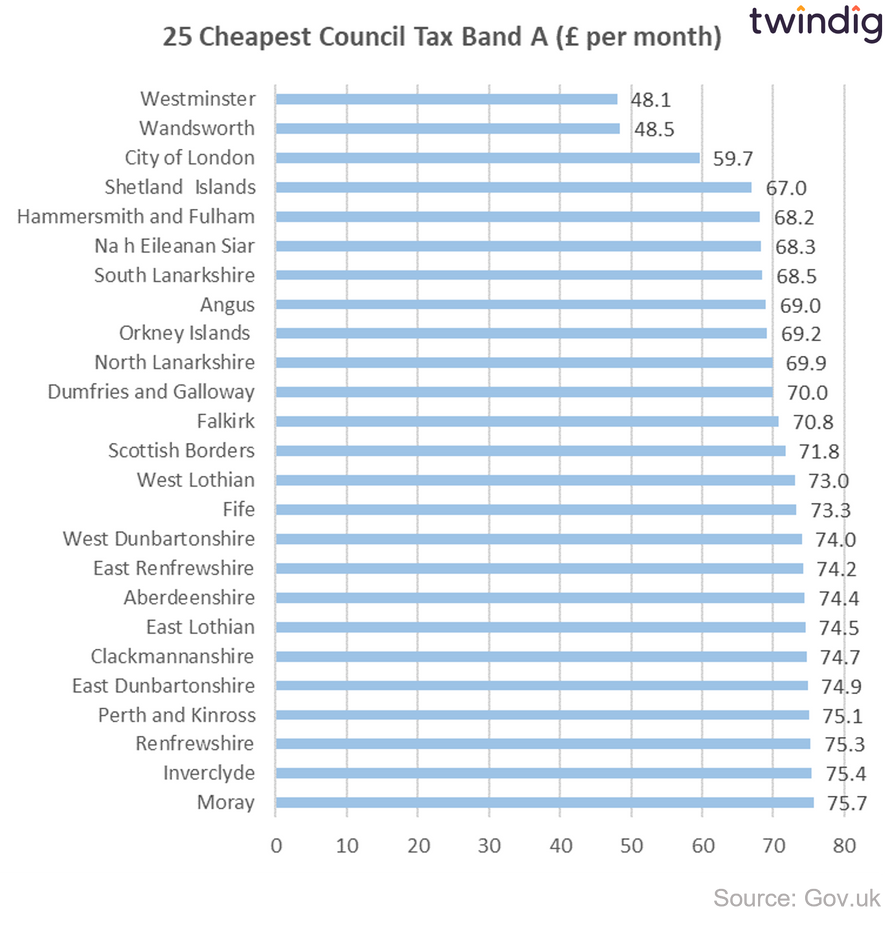

If we turn our attention to the other end of the spectrum a very different picture emerges. London fills the podium for the cheapest Council Tax bills across our country, despite having the highest house prices.

The cheapest place to live from a Council Tax perspective is the London borough of Westminster where a home in Band A will pay Council Tax of just £48.10 per month

In a very close second place is the London borough of Wandsworth with a Band A monthly Council Tax bill just 40p a month higher at £48.50 per month.

In third place is the City of London itself, home to some of the largest financial institutions in the world. The Council Tax for a Band A home in the City of London works out at £59.70 per month, less Council Tax than you would pay for a Band A home on the Shetland Islands

We show the 25 lowest Council Tax bills by local authority in the chart below.

Which council tax band is my home in?

In England and Scotland, homes are allocated into one of eight Council Tax bands (Bands A to H). Band A has the lowest council tax in a particular local authority and Band H the highest.

In Wales, the Council Tax is organised across nine bands (Bands A to I). Band A has the lowest council tax in a particular local authority and Band I the highest.

You can easily find out your council tax band and annual Council Tax bill by finding your home on twindig.com Your properties profile on twindig also contains details about house prices where you live and a valuation for your home.

Have the Cost of Living increases increased Council Tax?

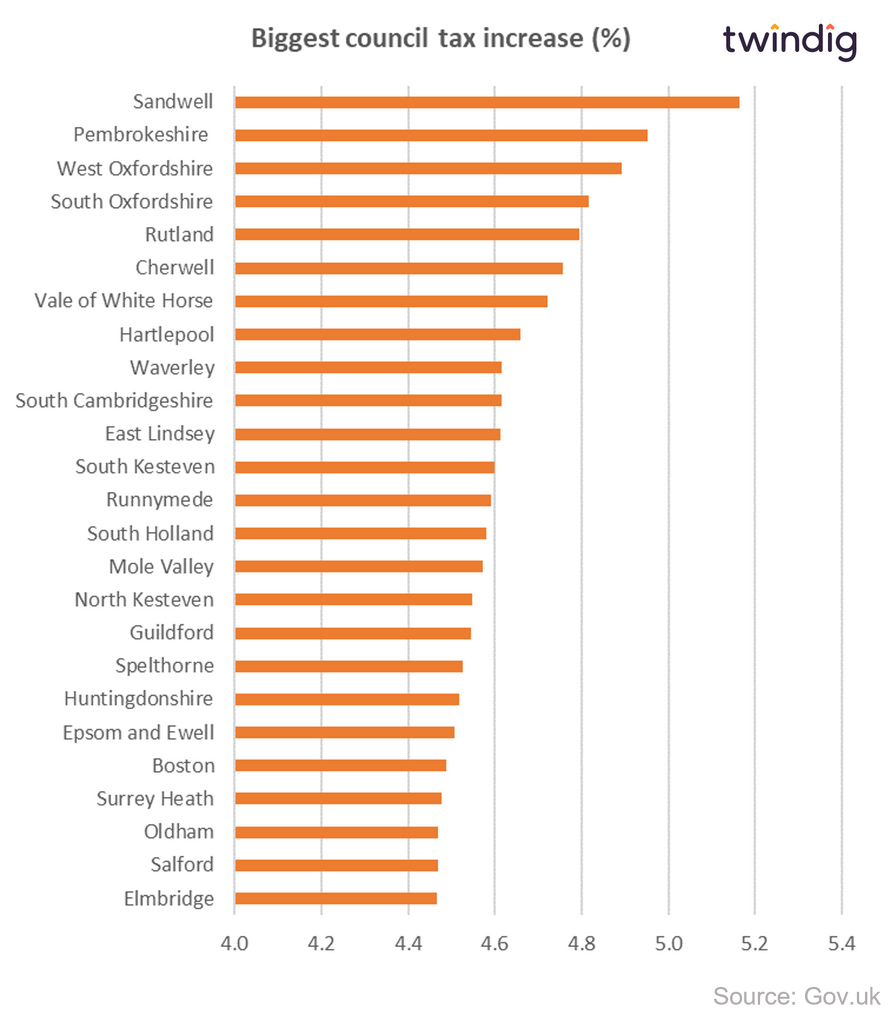

Council Tax bills increased in every local authority across the country in 2022. The smallest increase in percentage terms was in Bridgend where Council Tax bills increased by 0.7% and the biggest percentage increase was in Sandwell where Council Tax bills increased by 5.2%

Following on from Sandwell, the next biggest percentage increase in Council Tax bills in 2022 was in Pembrokeshire up 4.92% and in third place was West Oxfordshire which saw Council Tax bills increase by 4.89% this year.

We show in the chart below the 25 local authorities which saw the biggest percentage increases in Council Tax bills this year.

Biggest absolute increases in Council Tax Bills

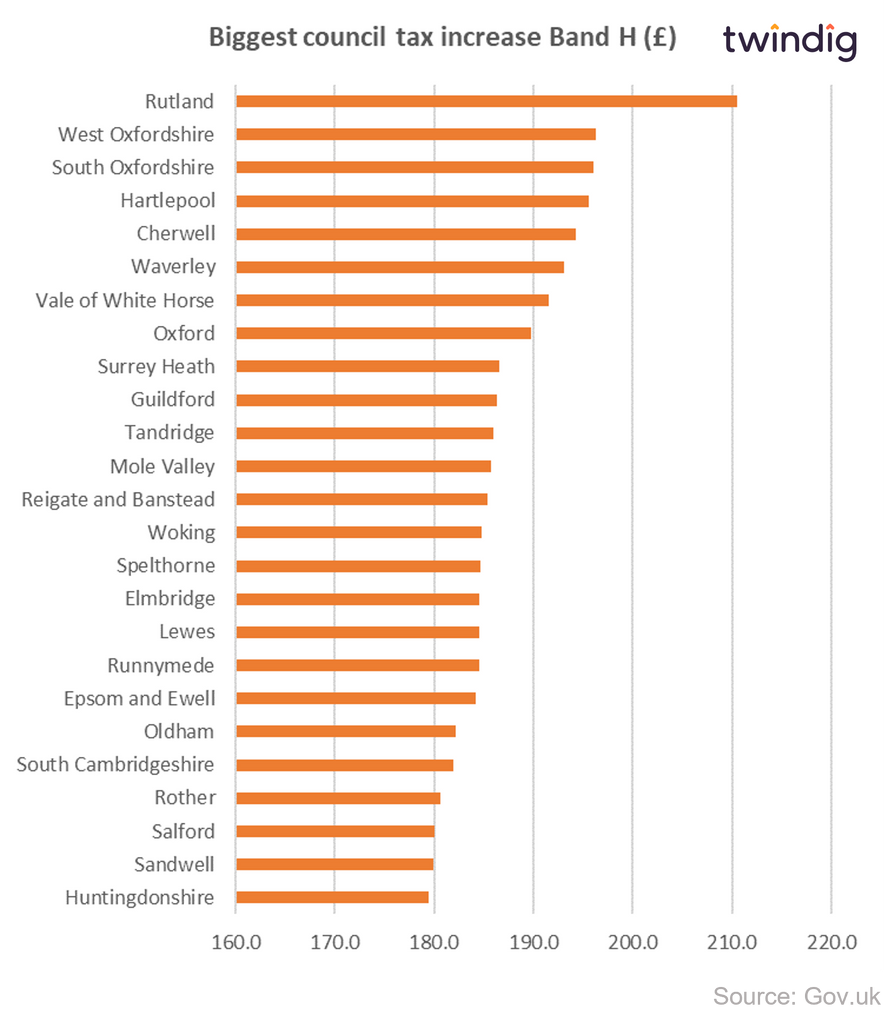

Turning to hard cash, the biggest Council Tax increases this year are found in Rutland where Band H properties have seen their Council Tax bills increase by £210 this year. Rutland is followed by West Oxfordshire and South Oxfordshire where both have increased their Band H Council Tax bills by £196.

We show the full 25 biggest Council Tax increases in the chart below

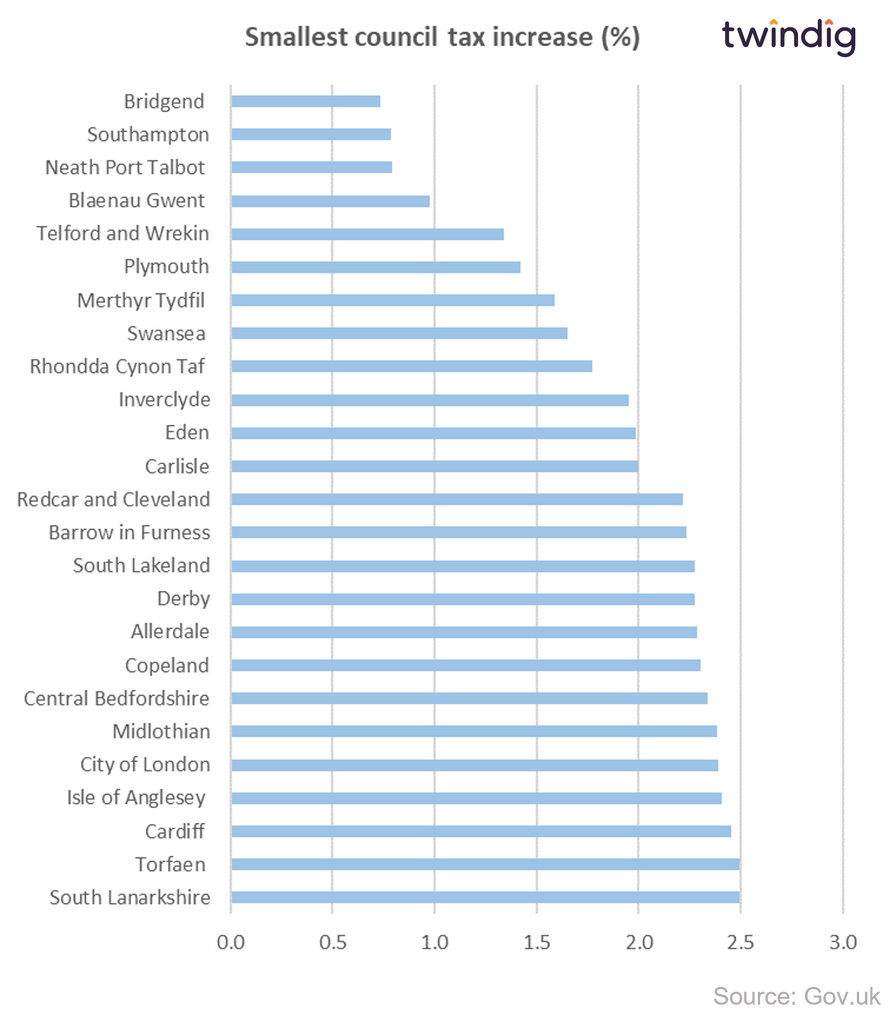

Smallest percentage increases in Council Tax

Perhaps because Wales already dominates the most expensive Council Tax league table it also dominates the league table for the smallest percentage increase in Council Tax this year taking up six of the top ten places.

The smallest percentage increase in Council Tax this year is in Bridgend up just 0.73%

Bridgend us closely followed by Southampton up 0.78% and Neath Port Talbot is in third place up 0.79%

We show the 25 local authorities with the smallest percentage increase in Council Tax in the chart below

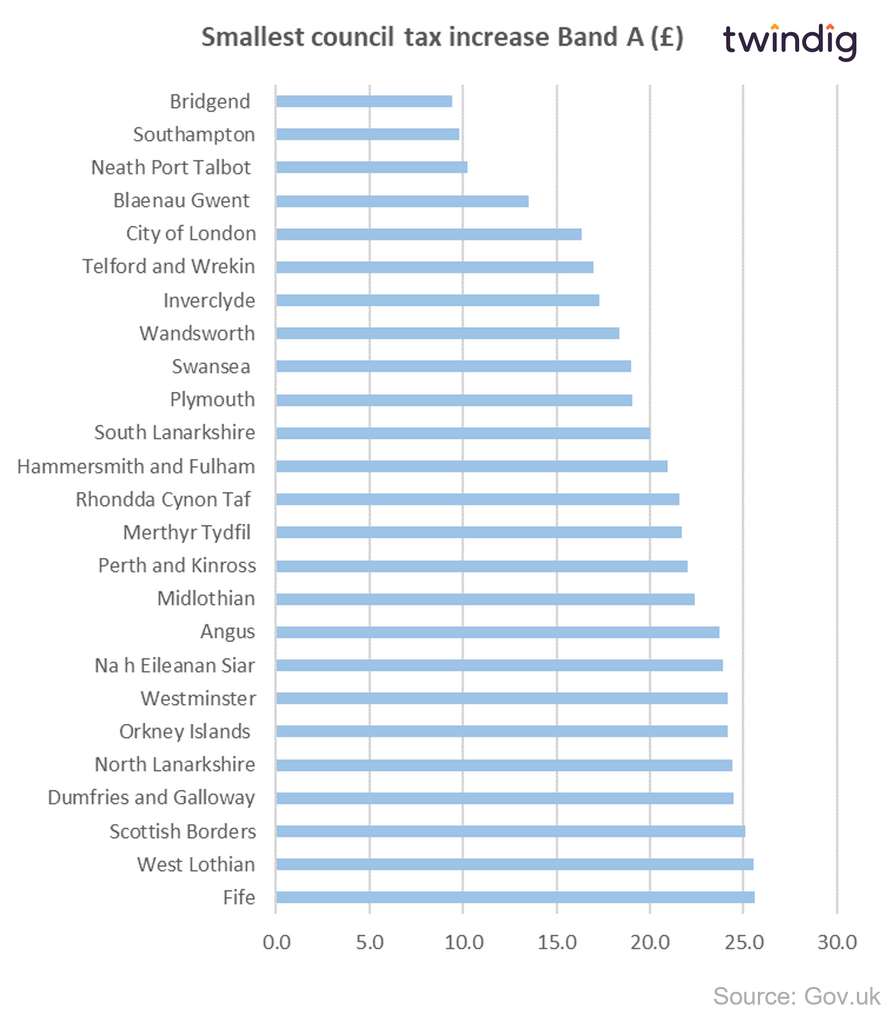

UK's smallest increase in Council Tax bills

Wales is also well represented in the league table of the smallest actual increases in Council Tax this year in monetary terms, although it only secures four of the top spots compared to six in the percentage increase table above.

Bridgend sees its Band A Council Tax increase by just £9.45; Southampton saw its Band A Council Tax bills rise by £9.81 and in third place Neath Port Talbot where Band A Council Tax bills increased by £10.23.

We show the local authorities with the smallest absolute increases in Council Tax this year for Band A properties in the chart below, which shows the annual increase in £ per year.

What is Council tax?

Council Tax is a charge raised by your local authority. Council Tax is used to pay for all the services provided by your local authority, such as libraries, rubbish collection, street cleaning and street lighting.

The amount of Council Tax you pay is determined by two main factors:

How much money the council needs to raise to pay for all the services it provides, and

the value of the home you live in.

The higher the value of the home you live in, the higher your council tax bill will be.