House prices rise by £1m per minute

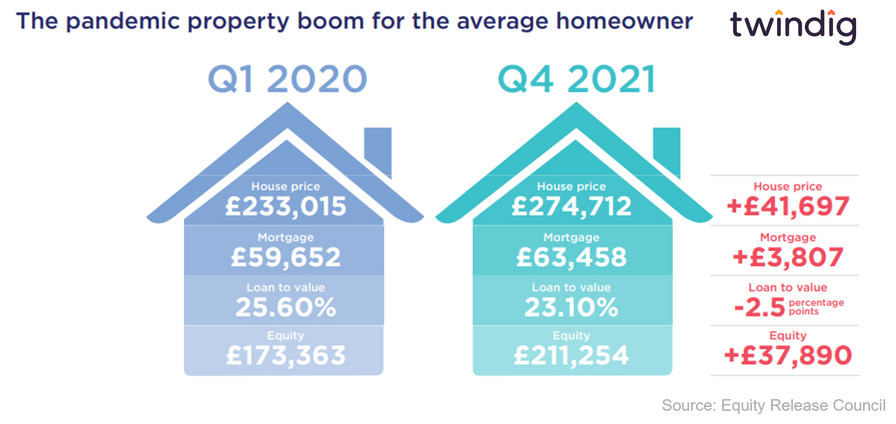

According to the Equity Release Council, the total value of UK housing rose by more than £1m every minute during 2021, increasing the value of housing equity across the UK to £5.2 trillion. Rising house prices have seen the average loan to value fall from 25.6% before the pandemic to 23.1% at the end of 2021. The housing market is a very equity rich market.

Equity release at record levels

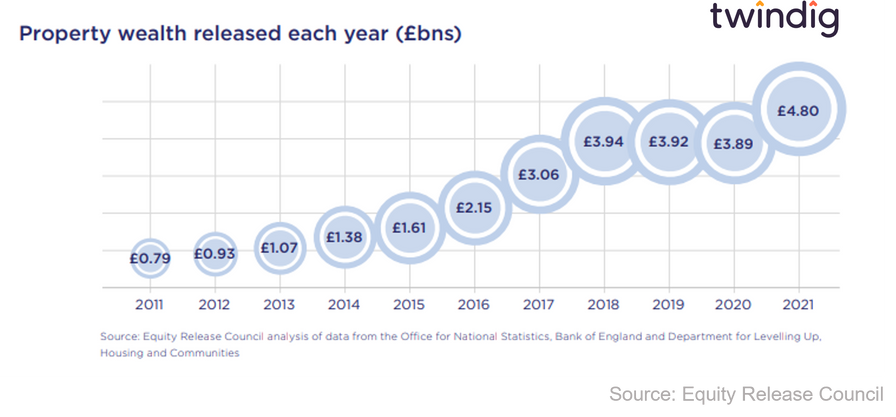

In 2021 homeowners released £4.8 billion of housing equity as house prices rose, which is £4bn or six times more than the £0.8bn released in 2011.

The number of equity release products has increased

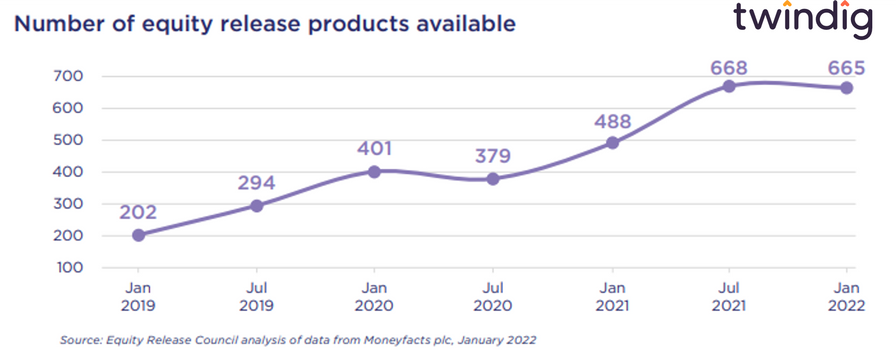

In January 2019, there were 202 equity release products available, and this had increased to 665 by January this year

Equity Release mortgage rates on the rise

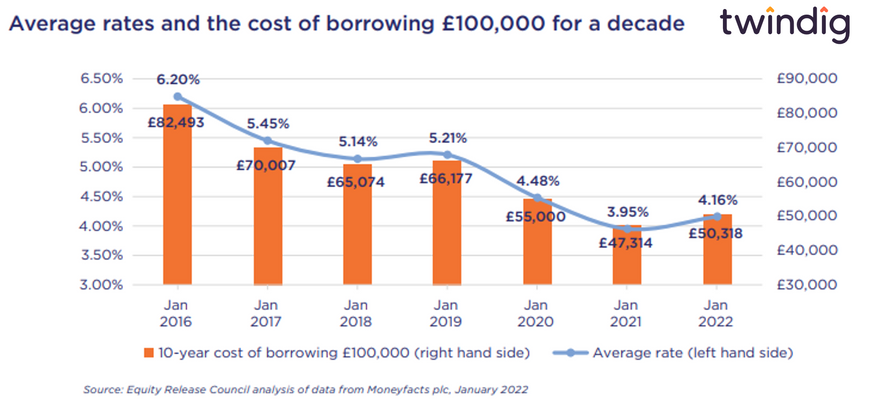

Mortgage rates on equity release mortgages are starting to rise as the impact of rising underlying Bank Rate is felt across the mortgage market.

Average Equity Release Mortgage rates hit a low of 3.95% in January 2021 and have now increased to 4.16%. This means that the cost of releasing £100,000 of housing equity over a ten year period is just over £50,000.

Equity Release Customer Trends

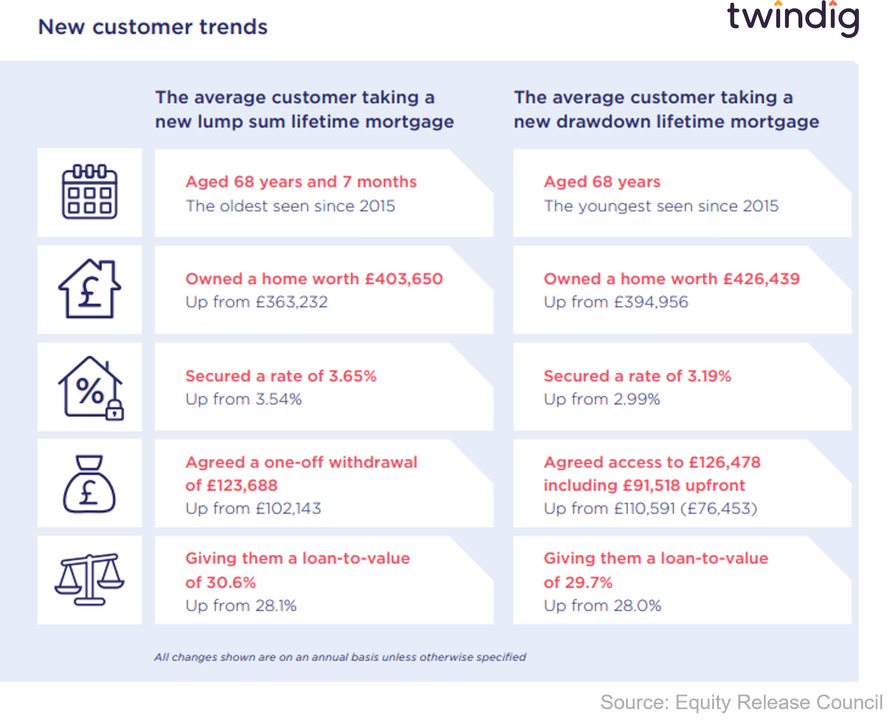

The average age of a equity release mortgage customer taking out a new lump sum lifetime mortgage is 68 years and seven months, the highest it has been since 2015, whereas the average age of a customer taking out a new drawdown lifetime mortgage, also 68, is the youngest it has been since 2015.

The average person using equity release has a home with a value of more than £400,000 and took a lump sum of £123,688 through a lifetime mortgage and agreed a drawdown facility of £126,478 with an initial drawdown of £91,518.

Is equity release right for me?

With rising energy costs compounding the cost of living crisis it is easy to see what equity release looks attractive, but we would caution that it is in fact a wolf in sheep's clothing. For a start we do not like the name 'Equity Release' - suggests freeing up money that is tied up in your house, when in fact what equity release really means is taking on debt. Taking on debt is a very different kettle of fish than releasing equity, in our view.

You can read in more detail why we think equity release is a wolf in sheep's clothing by clicking on the link below

Fractional ownership a better alternative to equity release?

We believe that fractional homeownership is a better alternative to traditional equity release mortgage products. With fractional ownership, you can really do release equity without taking on any debt. Fractional homeownership products allow you to sell a portion of your home rather than take on debt. This allows you to supplement your retirement income or help a family member get on to the housing ladder themselves whilst allowing you to stay in your home.

You can read more about the case for fractional homeownership by clicking the link below