Houselungo 7 November 21

A lungo length look at this week's housing market news

Can you polish a brick

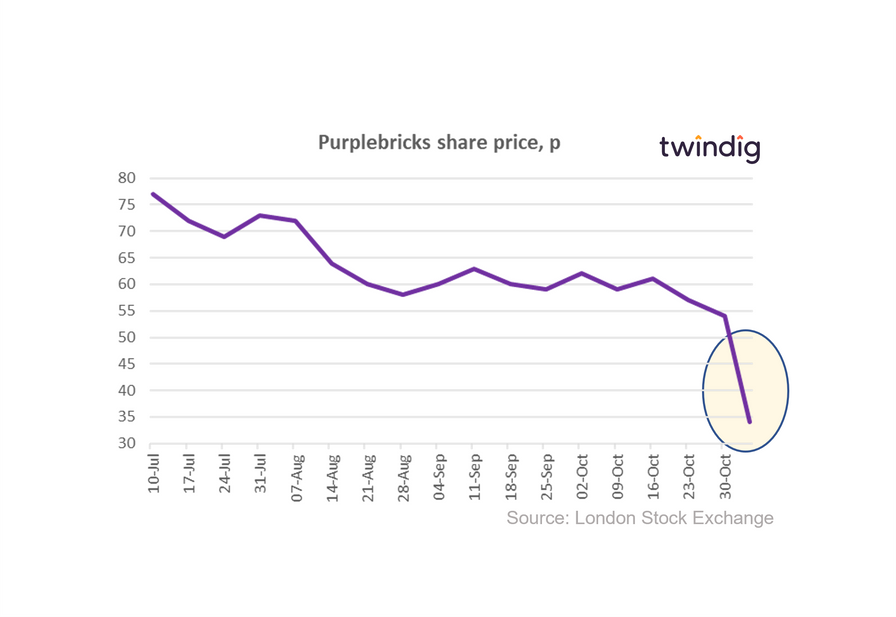

Purplebricks latest trading update sent shockwaves through its share price. Coming just one week after a confident, front footed trading update from Foxtons, Purplebrick’s statement was barely on its back foot. This leads to the question is Purplebrick's model being challenged by changes in the wider housing market or is it just challenged?

What happened to the Purple patch?

Purplebricks enjoyed an exceptionally strong housing market in FY2021 (the year to 30 April 2021), which was buoyed by the Stamp Duty Holiday. We are surprised that Purplebricks has found the last six months more challenging, because the Stamp Duty Holiday was in force for five of those six months.

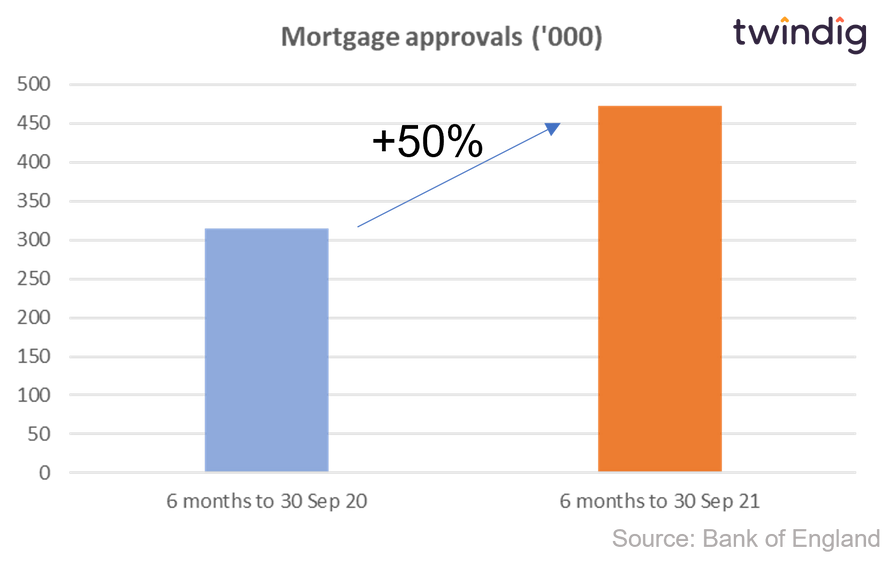

In the six months to 30 September 2021, the six months leading up to the end of the Stamp Duty Holiday there were 474,000 mortgage approvals up from 315,000 in the same period last year.

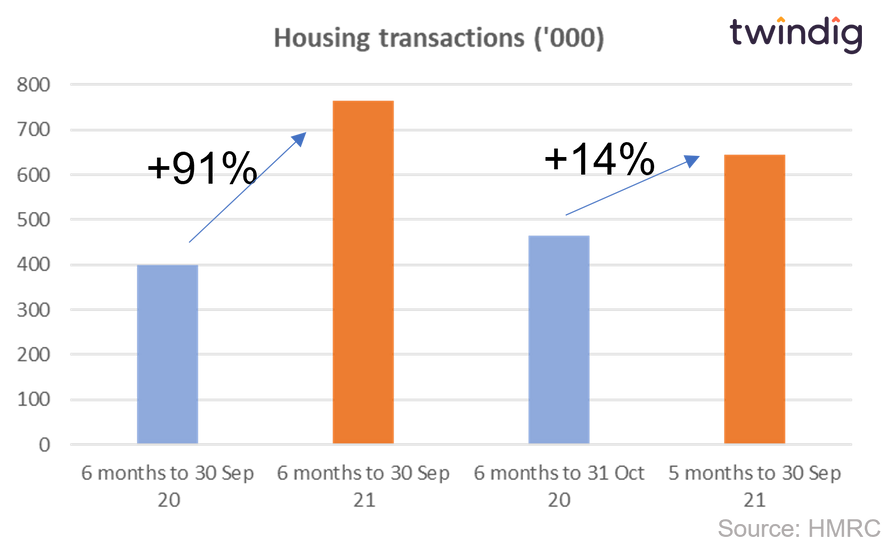

Turning to completed housing transactions in the six months to 30 September 2021, there were 765,570 completed housing transactions, up from 400,200 in the same period last year.

Mortgage approvals are up 50% and housing transactions are up 91%.

We do not yet have the market data for October 2021, but even if we assume there were no housing transactions in October 2021, the number of housing transactions in the five months to 30 September 2021 will still have significantly trumped the six months to 31 October 2020.

Against this backdrop of a very strong housing market, Purplebricks expects to report around 13,000 fewer instructions (unlucky for them) in the six month period to 31 October this year when compared to last, a reduction of 38%. A very big swing in the opposite direction.

UK House prices reach another new record high

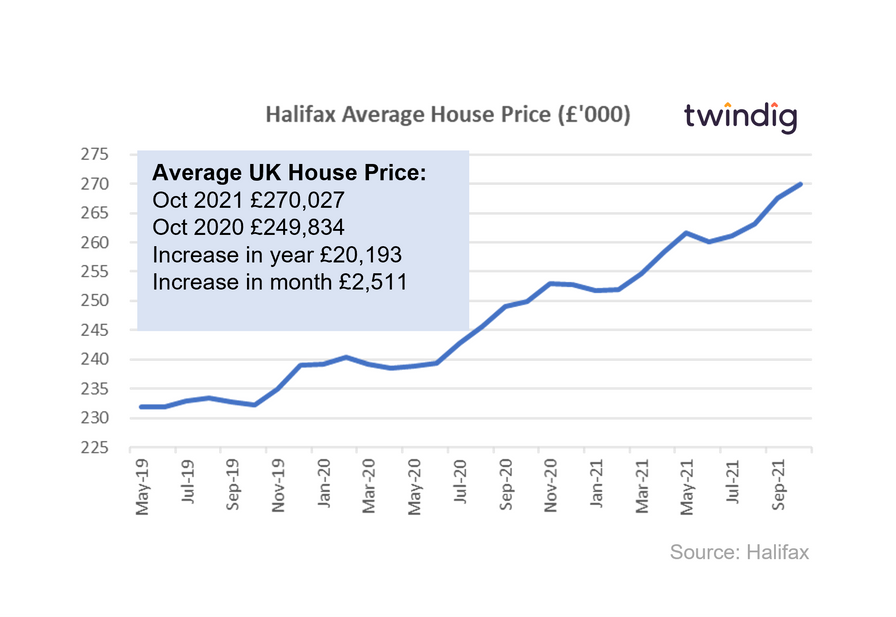

The Halifax published their house price index for October on Friday

What they said

Yet another record high for UK house prices

Average UK house prices £270,027

Annual house price inflation 8.1% or £20,193

Twindig take

Following on from the Nationwide House Price Index published earlier this week, the Halifax House Price index adds further weight to the argument that there is life after the end of the Stamp Duty holiday, and with Bank Rate remaining at its all-time low of 0.1% for at least another month the direction of travel of house prices is likely to continue upward, in our view.

The Halifax reported that average UK house prices hit a record high of £270,027 in October up 0.9% or £2,511 in the last month and up 8.1% or £20,193 over the last year.

Whilst the Stamp Duty Holiday has, in our view, stimulated house prices the race for space, where buyers seek homes with more inside and outside space to make working from home and lockdowns more bearable, has also contributed to the increase.

House price increases are not good news for everyone, affordability has got worse, especially for first-time buyers desperately trying to secure a foot on the housing ladder. The Halifax reports that annual first-time buyer house price inflation has reached 9.2%. Further evidence, in our view, of the growing importance and reliance on the bank of mum and dad whose help is increasingly needed to realise the home buying dreams of their children and grandchildren.

Bank Rate held, for now

The MPC voted 7-2 in favour of maintaining Bank Rate at 0.1% on Thursday.

However, expect rises in the future

The Monetary Policy Committee did say that:

We expect interest rates will need to rise modestly to return inflation to our 2% target

When the Covid pandemic struck, we needed to take immediate and substantial action to meet our inflation target.

That action included a cut in interest rates to 0.1% in March 2020.

The outlook has now changed.

The UK economy is recovering, unemployment has fallen, and we expect inflation to rise further to around 5% by spring next year.

We now expect interest rates will need to rise modestly to return inflation to our 2% target.

By making sure that inflation returns to target we are continuing to support people’s jobs and incomes, and helping the UK economy grow.

Twindig take

With rising living costs and the changes announced in last week's Spending Review, a rise in Bank Rate would have added salt to the wounds and we understand why the Monetary Policy Committee was so in favour of keeping Bank Rate in check.

However, a consequence of a recovering economy (a good thing) and rising wages (another good thing) is that positive moves in the economy can lead to increases in inflation (which can become a bad thing) and it seems likely that Bank Rate will rise in 2022 to keep inflation in check, in our view.

Why rising mortgage rates might not hurt you

There was a lot of speculation that the Bank of England might have increased the Bank Rate this week and further speculation that after a period of record lows, mortgage rates are about to rise. Rising mortgage rates are viewed as a bad thing, but in this article, we look at why the bark of rising mortgage rates may be worse than their bite and for many a rise in mortgage rates might not hurt at all.

What next for mortgage rates?

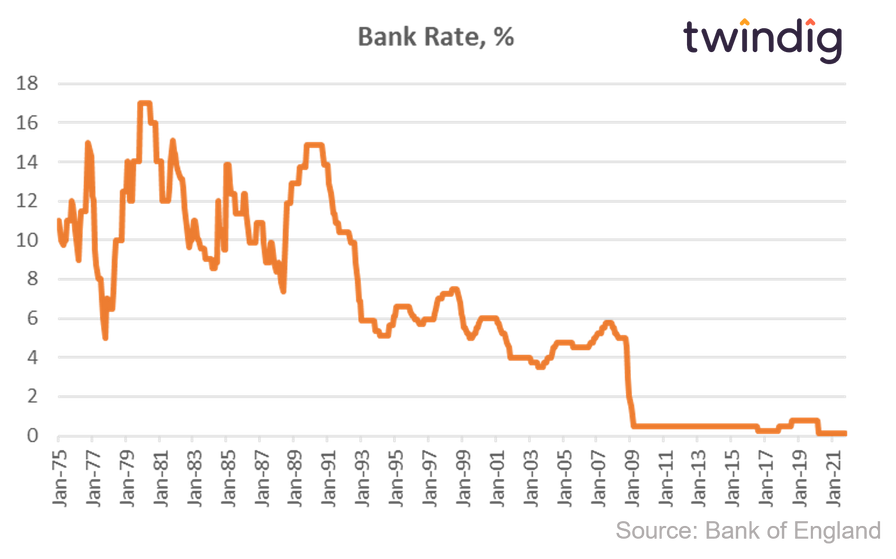

Bank Rate is the most important interest rate in the UK because the level of Bank Rate influences all other interest rates. The current Bank Rate is 0.1%, the lowest level since records began in 1694. From here, it seems Bank Rate is more likely (although not certain) to go up than down.

To put Bank Rate in context, it is currently more than 60x below its long-run average. The average Bank Rate since 1975 is 6.35%.

What will a rise in Bank Rate mean for my mortgage?

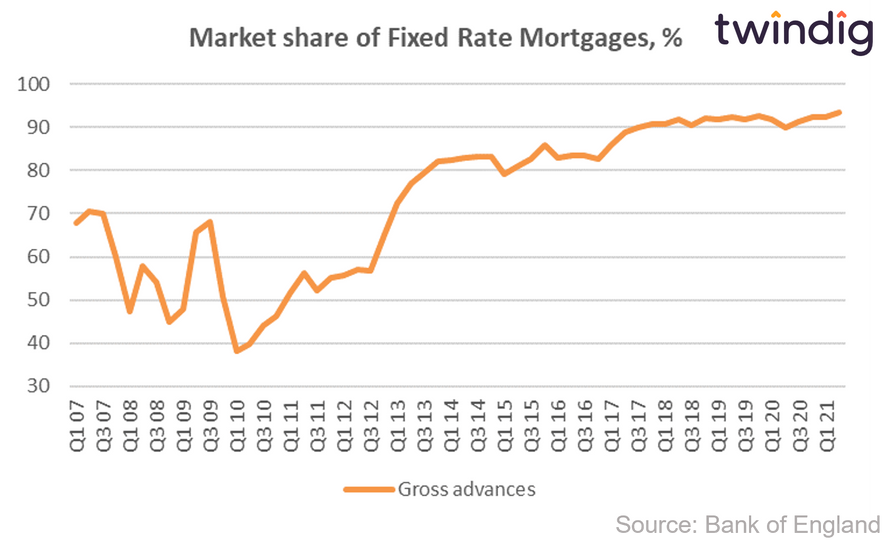

In the very short term not very much. Since 2017, on average, more than nine out of every ten (90%) of mortgages agreed have been fixed-rate mortgages. The mortgage rate on a fixed-rate mortgage cannot change during the fixed-rate period.

The most popular mortgage products are currently two year and five-year fixed-rate mortgages. In 2020 research from the Bank of England Blog Bank Overground showed that more than half of new mortgages in 2020 were fixed-rate mortgages with a fixed term of five years or more.

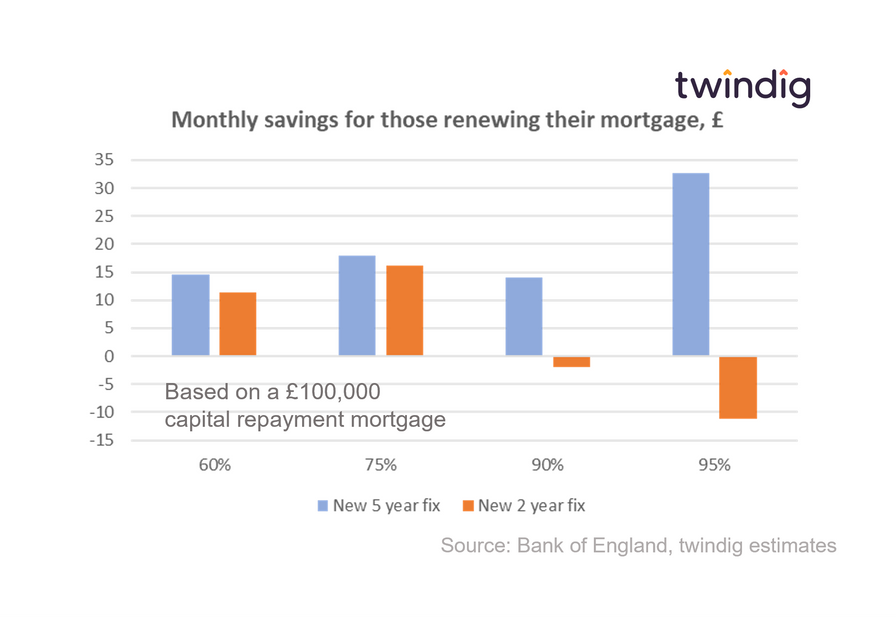

The key to whether or not a rise in mortgage rate will hurt is therefore not by how much the mortgage rates may increase by tomorrow, but

How long you have left of your fixed-rate period, and

How the mortgage rate you are offered compares to the mortgage rate you are currently paying.

Twindig Housing Market Index

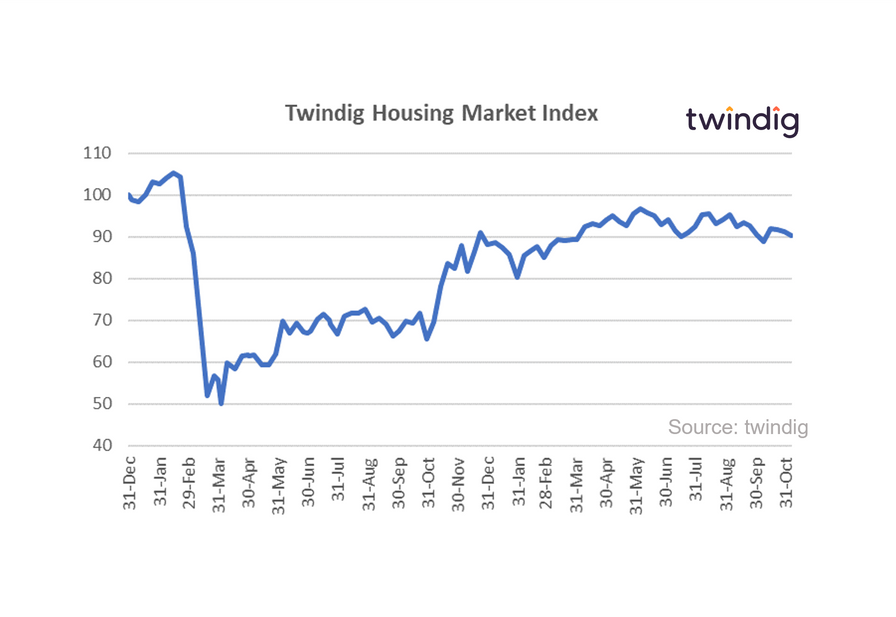

The Twindig Housing Market Index fell by 1.2% to 90.2 this week as both the Nationwide and the Halifax reported that house prices reached record highs in October and the Bank of England held Bank Rate at 0.1% for at least another month. Fear of rising mortgage rates was on the minds of some investors and they had concerns that the combination of the end of the Stamp Duty holiday, rising living costs and rising mortgage rates could lead to the softening of the housing market and house prices retracing their recent steps.

We continue to believe that whilst housing transactions may fall in the short term as the impact of the stamp duty holiday unwinds, house prices will not as demand will continue to outstrip supply, in our view.