Houselungo 6 March 22

House price inflation accelerates in February

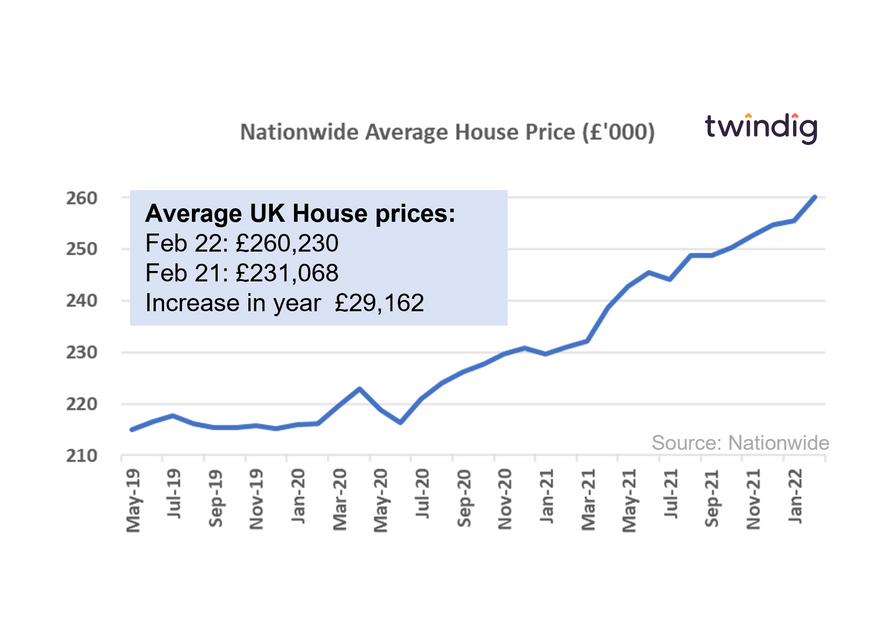

The Nationwide released their house price index for February 2022 this week

What they said

Average UK house prices exceed £260,000 for the first time

House price growth accelerating, increasing to 12.6% in February

Price of a typical home 20% (£44,000) higher than in February 2020

Twindig take

That house prices rose in January, after the bumper year of 2021, was a surprise, but the fact that they have risen again, at a faster rate in February is perplexing. No one seems to have told the housing market that interest rates and the costs of living are also rising.

The annual increase of £29,162 is the largest annual increase reported by the Nationwide since the start of their monthly index in 1991.

We had thought that it was the stamp duty holiday that fuelled the recent house price growth, but the stamp duty holiday exited stage left in October last year. The holiday was certainly a catalyst, but has it created an unstoppable monster?

Mortgage approvals increase in January

The Bank of England released the mortgage approval data for January 2022 this week.

What they said

Mortgage approvals in January 2022 were 73,992

This was 3.9% higher than December's figure of 71,219

Mortgage approvals in January 2022 were 23.1% below the 96,236 recorded in January 2021, but is still 12% higher than the 10-year average.

Twindig take

Mortgage approvals started the year on a positive note, up 3.9% on December 2021. Mortgage approvals have risen every month since October 2021. Increasingly, it is looking likely that the feared post stamp duty holiday housing market lull will not materialise. It seems that as COVID restrictions are scaled back the housing market is moving forward.

It is early days but the anticipated increases in the cost of living do not appear to be dampening the spirits of homebuyers, although we appreciate that those in the fortunate position to be able to buy a home probably have sufficient financial resources to accommodate rising prices of food, fuel and energy.

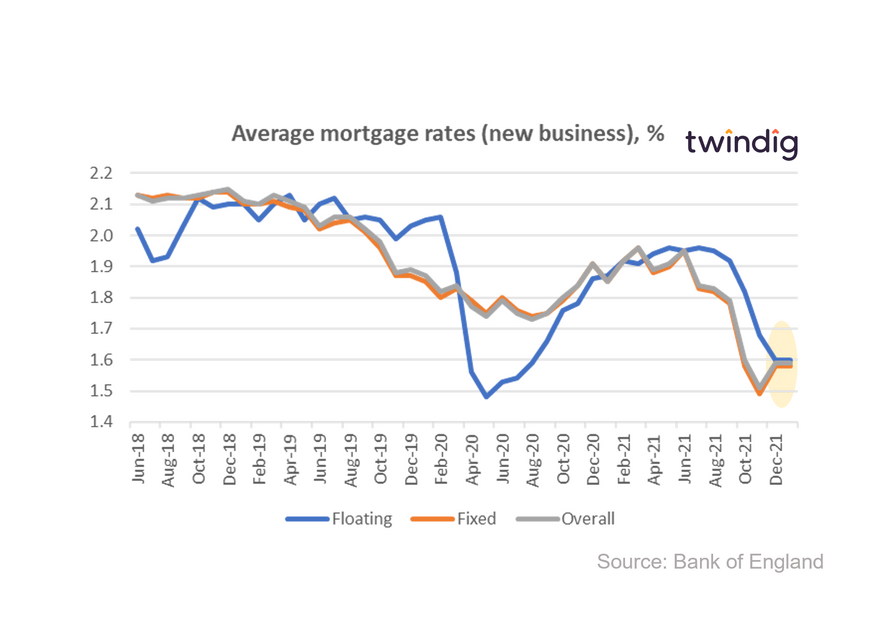

Mortgage rates flatline in January

The latest data from the Bank of England revealed that overall average mortgage rates for new business were flat in January 2022, neither up nor down.

What they said

The average floating mortgage rate for new business 1.60%

The average fixed mortgage rate for new business 1.58%

The average overall mortgage rate for new business 1.59%

Twindig Take

This is the first time that we can recall that average mortgage rates for new business were unchanged from one month to the next, what makes this all the more remarkable is that it comes at a time when Bank Rate is rising. The Bank of England's Bank Rate is the interest rate on which all the other UK interest and mortgage rates are based on or set with reference to. You may have a fixed-rate mortgage, but that rate was fixed based on the financing costs (underlying interest rates and expected interest rates) at the time the rate was fixed.

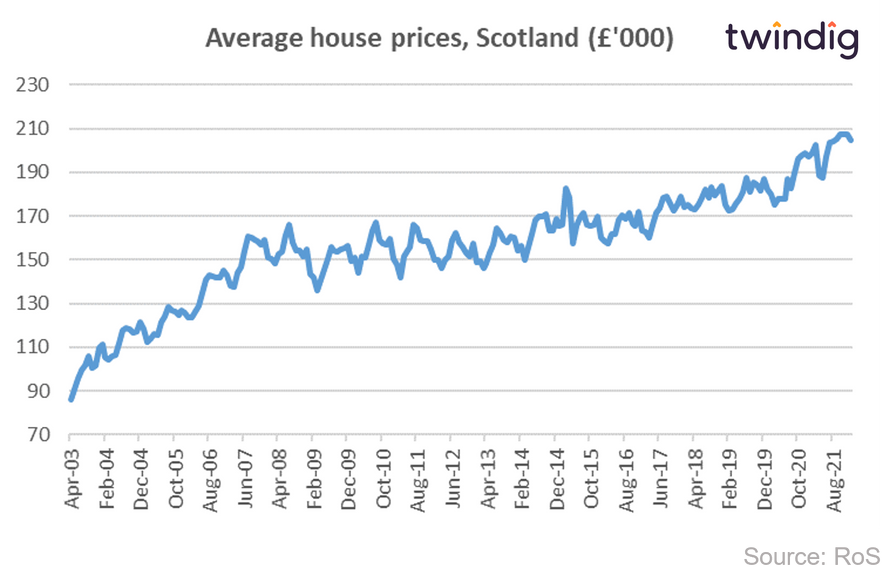

Scotland's house price winners and losers

The latest data from the Register of Scotland suggests that the average house price in Scotland is £204,718.

House prices in Scotland fell on average by 1.3% or £2,590 in January 2022

Over the last 12 months, average house prices in Scotland increased by 3.9% or £7,750.

The average house price chart below shows a picture as craggy as the Cairngorms with many peaks and troughs. However, the thrust of house prices in Scotland is up and not down.

Scottish house price winners this month

The biggest house price winners in Scotland this month in relative (%) terms were:

Dumfries and Galloway up 14.0% or £23,800

East Dunbartonshire where house prices rise by 13.2% or £34,400

The Shetland Islands where house prices rose by 8.6% or £15,200

Turning to the absolute monetary house price winners, the podium comprised

East Dunbartonshire up £34,400

Dumfries and Galloway up £23,800

East Renfrewshire up £21,400

Twindig Housing Market Index

This week was a stark reminder that the UK housing market does not operate in isolation from the wider, global economy.

In the week that surprisingly saw house price inflation accelerate, the Twindig Housing Market Index fell by 4.3% to 76.8, its lowest level since 6 November 2020 as the potential housing market implications of the war in Ukraine weighed on property market investor's minds.

Aside from the ramifications of Russia's war on Ukraine, this week was a positive week for the UK housing market, more positive, in our view, than investors gave it credit. Foxtons, the bell-weather of the London housing market was so much on the front foot that its feet outpaced its brace of brightly coloured minis. With lockdown in the rearview mirror, the London housing market is full steam ahead.

Housebuilders Persimmon, Taylor Wimpey and Vistry all released their full-year results this week, and whilst the results themselves had been heavily flagged in their earlier trading updates, all were positive about current trading and the outlook for the housing market. All three were also buying more land, so their walk was definitely matching their talk.