Houselungo 5 Mar 23

House price inflation weakest since November 2012

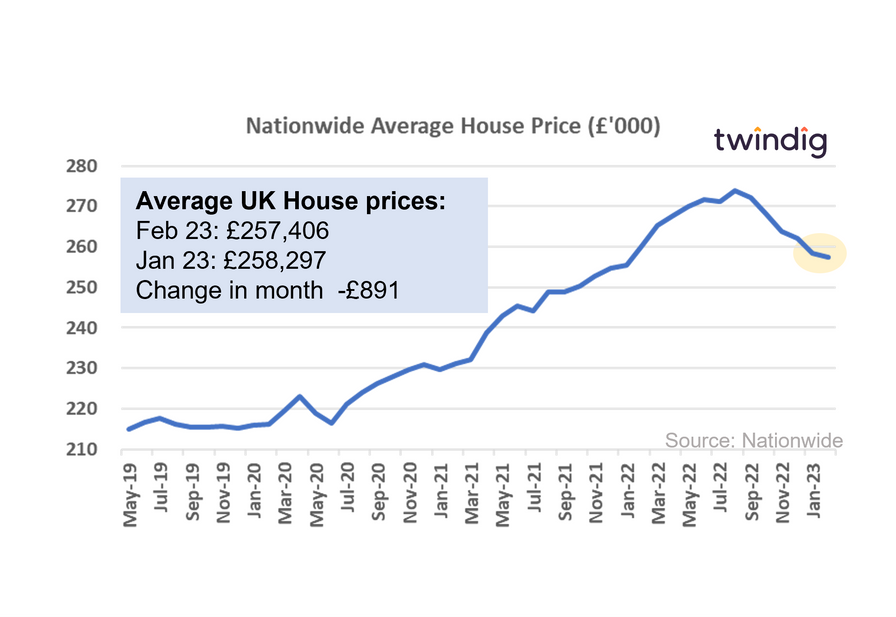

The Nationwide released its house price index for February today

What the Nationwide said

Average house price in February 2023 was £257,406

House prices £891 February 2023

Over the last year house prices fell by 1.1% the first annual decline since June 2020 and the weakest since November 2012

Twindig take

Annual house price inflation slipped into negative territory for the first time since June 2020 during February 2023. House prices peaked in August and have fallen every month since the Truss Kwarteng mini-budget in September last year.

The impact of the mini-budget on the housing market has been anything but 'mini', as rising mortgage rates compounded with the cost of living crisis taking the wind out of the housing market's sails as significant numbers of homebuyers chose to sit on their hands rather moving home.

Mortgage rates rising

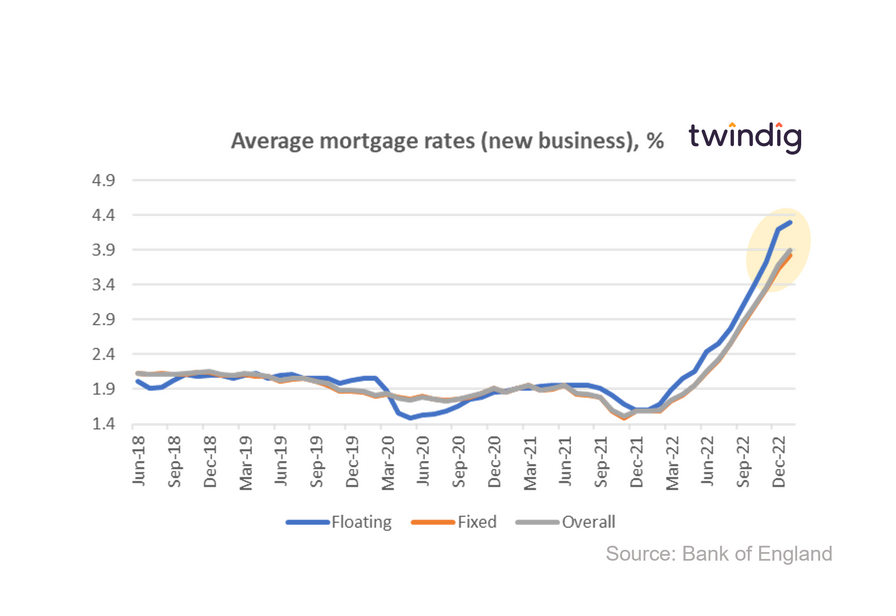

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in January 2023, but the rate of increase slowed significantly.

What the Bank of England said

The average floating mortgage rate for new business was 4.29%

The average fixed mortgage rate for new business was 3.82%

The average overall mortgage rate for new business was 3.89%

Twindig take

Mortgage rates did increase in January, but there was good news within the increase. The rate of increase slowed, as you can see from the graph above, the increase in January was less steep than in the preceding months.

We expect to see mortgage rates increase as Bank Rate rises, but we have seen more stability in swap rates of late suggesting that the financial markets are seeing less risk than they were before. Lower risk will mean lower spreads (a smaller gap between swap rates and Bank Rate), and smaller spreads mean lower mortgage rates).

Mortgage approvals falling

The Bank of England released mortgage approval data for January this week

What the Bank of England said

Mortgage approvals for January 2023 were 39,637

This was 2.2% lower than the 40,540 mortgages approved in December 2022

This was 46.3% lower than the 73,879 mortgages approved in January 2022

Twindig take

Mortgage approvals data released today was much better than we had hoped for. Firstly the Bank of England revised up its mortgage approval data for December 2022 up from the 36,612 originally reported last month to 40,540 today an increase of 11%. Secondly, the January 2023 mortgage approvals at 39,637, whilst low, and lower than they were in December have not fallen off a cliff and the rate of decline has slowed.

We are wary of reading too much into one month's data, but our initial thoughts are that January 2023 may be the low point for mortgage approvals, and this will be welcome news for all businesses linked to the level of housing market activity.

Property Market Insights Podcast

In this week's podcast, Daniel and I discuss the Nationwide house price Index, mortgage approvals, mortgage rates what the housebuilders are saying about the UK housing market.

Watch the video by clicking on the image above or to listen to the podcast click the button below

Twindig Housing Market Index

In the week that saw house prices fall for the sixth month in a row, housebuilders report financial results, mortgage approvals drop and mortgage rates rise, the Twindig Housing Market Index (a measure of investor confidence in the housing market) fell by 0.1% to 73.4.

Housebuilders subdued

Housebuilders Taylor Wimpey and Persimmon reported this week that market conditions have improved during the first 8 weeks of the year compared to Q4 2022. However, it is fair to say that activity levels are lower than they were in the first 8 weeks of 2019.

Residential investors cautious

Most investors were, if not happy, accepting of the fact that housebuilding volumes will be lower this year, but some voiced concerns that interest rate and therefore mortgage rate expectations were on the rise again following comments by the Bank of England Governor. However the change in interest rate expectations subdued rather than reduced residential investors' confidence in the housing market, and few have pencilled in a housing market crash.