Mortgage rate rises slowing

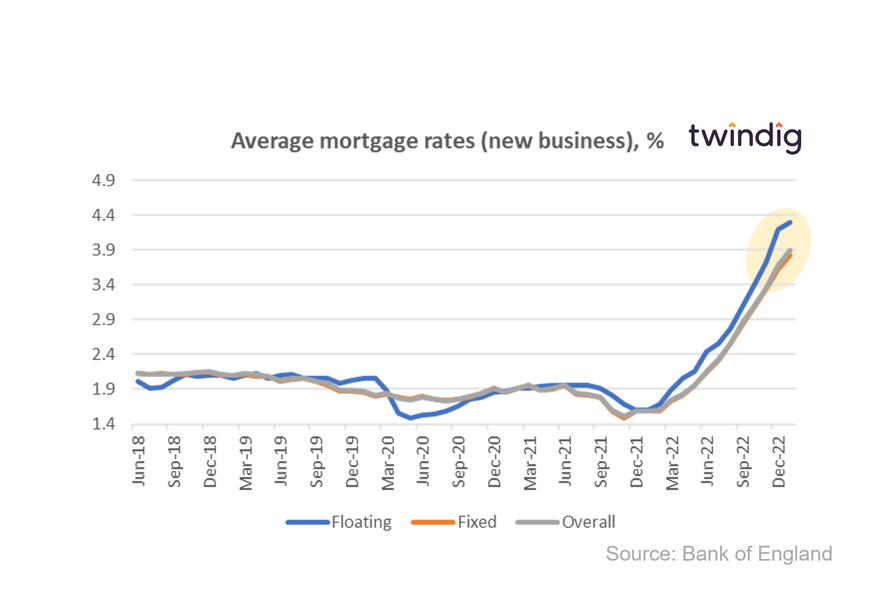

The latest data from the Bank of England revealed that overall average mortgage rates for new business increased again in January 2023, but the rate of increase slowed significantly.

What the Bank of England said

The average floating mortgage rate for new business was 4.29%

The average fixed mortgage rate for new business was 3.82%

The average overall mortgage rate for new business was 3.89%

Twindig take

Mortgage rates did increase in January, but there was good news within the increase. The rate of increase slowed, as you can see from the graph above, the increase in January was less steep than in the preceding months.

We expect to see mortgage rates increase as Bank Rate rises, but we have seen more stability in swap rates of late suggesting that the financial markets are seeing less risk than they were before. Lower risk will mean lower spreads (a smaller gap between swap rates and Bank Rate), and smaller spreads mean lower mortgage rates).

During the month average floating mortgage rates for new business increased from 4.19% to 4.29% and average fixed rates increased from 3.63% to 3.89%.

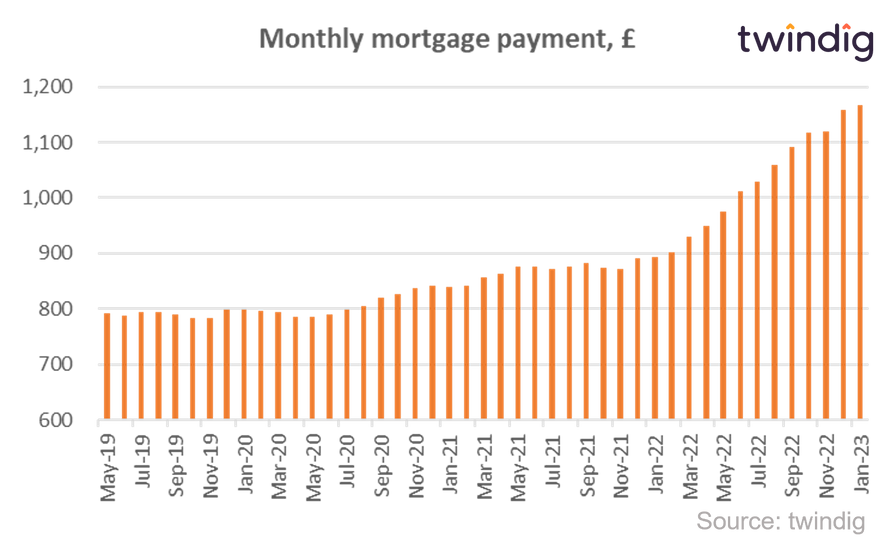

We show the impact of these latest mortgage rate changes on average mortgage payments in the chart below:

In January 2023 based on average house prices and average mortgage rates the monthly mortgage payment was £1,167 an increase of £8 on the month.