Will the Stamp Duty Holiday be extended?

Stamp Duty Holidays – all good things must come to an end

The COVID Stamp duty Holiday is set to end on 31 March 2021. Many are calling for an extension to the Stamp Duty Holiday. We think that an extension is very unlikely because the symptoms that led to the Stamp Duty Holiday (falling housing transactions and falling house prices) have gone away. Both house prices and housing transactions are rising. However, those in fear of missing the Stamp Duty Holiday deadline can take action now to protect themselves.

Why did we have the COVID Stamp Duty Cut?

When Chancellor Rishi Sunak announced the Stamp Duty Holiday on 8 July 2020 he said it was needed because:

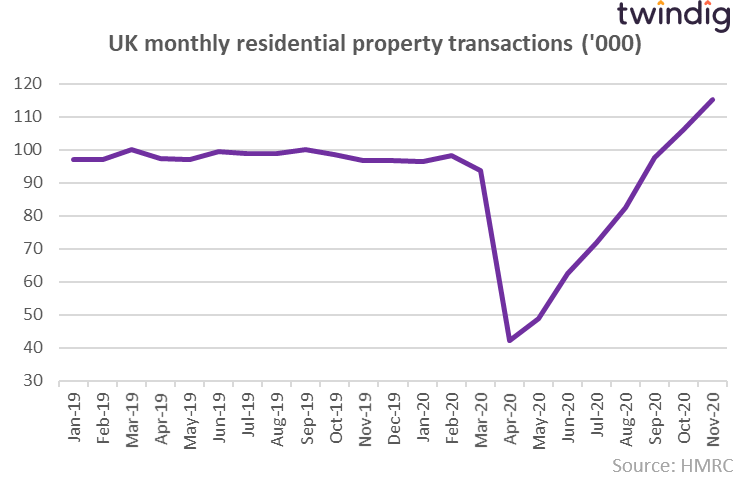

Property transactions fell by 50% in May 2020

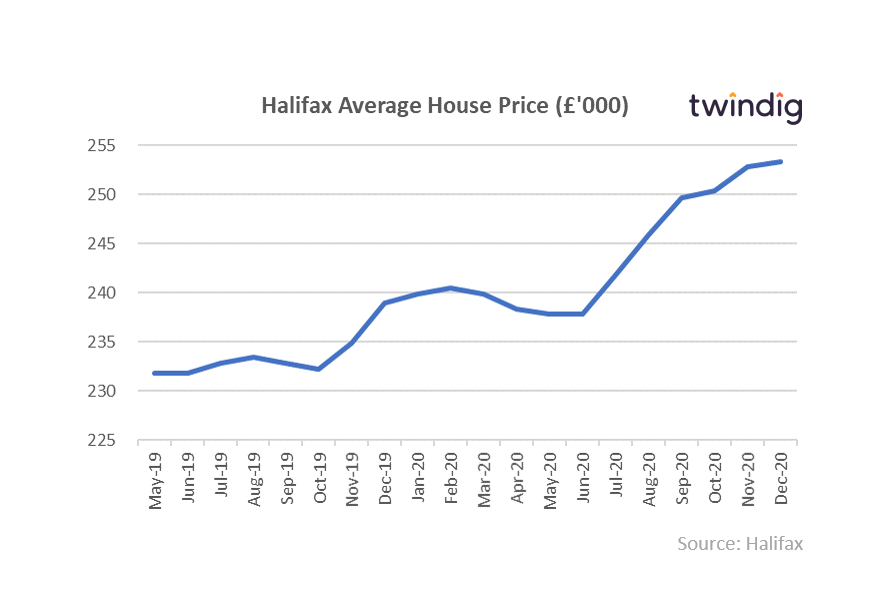

House prices had fallen for the first time in eight years

Uncertainty abounds in the [housing] market – a market we need to be thriving

We need people feeling confident – confident to buy, sell, renovate, move and improve.

The Chancellor said: “So to catalyse the housing market and boost confidence, I have decided to cut stamp duty. Right now, there is no stamp duty on transactions below £125,000. Today, I am increasing the threshold to half a million pounds. This will be a temporary cut running until 31st March next year.

Housing transactions have recovered

Since 8 July 2020 property transactions have increased every month. A housing transaction typically takes between three to six months to complete depending on the complexity of the transaction itself and the length of the chain it is part of. This implies that housing transactions were already increasing before the announcement of the Stamp Duty Holiday.

In November 2020 according to provisional data from the HMRC housing transactions reached 115,000, their highest level since March 2016 (which itself was skewed by transactions racing to complete before the start of the Stamp Duty premium on Additional Homes). If we exclude this one unusual month, the last time housing transactions were as high was in November 2007.

In our view, the level of housing transactions is no longer an issue, although we are likely to see housing transactions being pulled forward to benefit from the COVID Stamp Duty Holiday.

House prices have risen

The Chancellor’s second concern was that house prices were falling, but UK house prices rose significantly n the second half of 2020, both the Halifax and Nationwide House Price Indices reported that UK house prices finished 2020 at record highs.

The house price fears, therefore, appear to have been allayed

The UK housing market is thriving

With house prices at record levels and housing transactions having bounced back, it is difficult to make the case that the Stamp Duty Holiday should be extended. It was certainly good for morale when it was announced, but we question whether it was needed.

Will the end of the Stamp Duty Holiday cause problems?

It is likely in our view that housing market activity will slow for a time once the Stamp Duty Holiday comes to an end. We would be very surprised if the level of housing transactions did not fall. Housing transactions have fallen after every other Stamp Duty holiday and we see no reason why they won’t again because of households pulling forward their home-buying plans to benefit from the Stamp Duty Cut.

There will always be homebuyers caught in the middle who will just miss out as they miss the end of the Stamp Duty Holiday, but this will be true whenever the Stamp Duty Holiday ends, an extension merely pushes the problem further down the road.

What has the Government said?

In response to a petition to extend the Stamp Duty Holiday on 14 December, 2020 a UK Government spokesperson said

“The SDLT holiday was designed to be a temporary relief to stimulate market activity and support jobs that rely on the property market. The government does not plan to extend this temporary relief.”

Never say never...?

Since the 14 December 2020, those looking for an extension to the Stamp Duty Holiday have remained vocal and are voicing concerns that the ending of the Stamp Duty Holiday on 31 March 2021 will cause significant problems for the UK housing market. Especially for those homebuyers who for no fault of their own fail to complete their house purchase and miss the end of the Stamp Duty Holiday.

Can I protect myself against missing the Stamp Duty Holiday?

Yes, you can. Firstly, you could stipulate in your offer that if the completion date falls after the end of the Stamp Duty holiday you will reduce your offer by the amount of the additional Stamp Duty you have to pay. You could also come to a contractual agreement that you share these costs if they become payable.

You can of course pull out, walk away or change your offer at any point until you and the seller exchange contracts for the purchase and sale of the property in question without any major financial implications. However, the time, emotional and goodwill implications are very much higher. Whilst we would not advise such a course of action it is an option that remains on the table until the point of exchange.

After contracts have been exchanged you can pull out of the transaction, but you will lose your 10% deposit, which is almost certainly more than the Stamp Duty you will save from not completing the transaction.

Will the Stamp Duty Holiday be extended?

We reiterate that, in our view, the Stamp Duty holiday will not be extended. The underlying housing market appears to be strong and any extension would not solve any problems it may cause, but merely defer them.

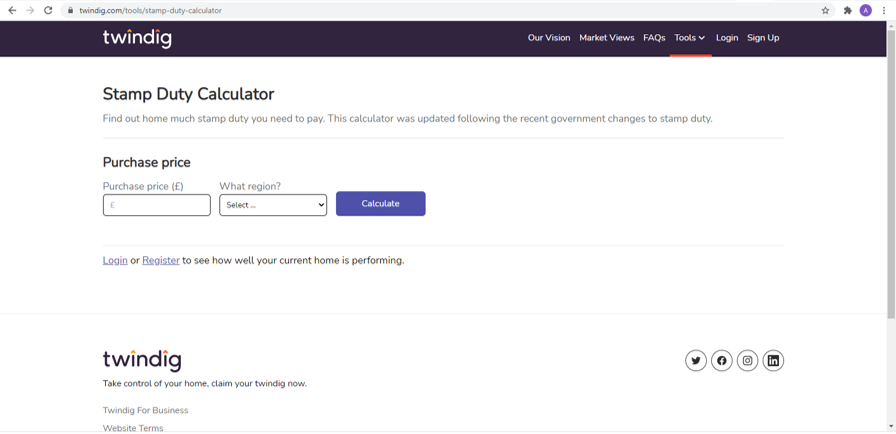

How much Stamp Duty do I have to pay?

The amount of Stamp Duty you have to pay depends on:

How much the home you are buying costs (the rates of Stamp Duty Tax increase as the price of the home you are buying increases

Where in the UK the home is that you are buying. The Stamp Duty rates differ across England, Scotland, Wales and Northern Ireland

Whether the home you are buying is your primary residence or an additional property

Whether or not you are a First Time Buyer

You can use our Stamp Duty Calculator to work out how much Stamp Duty you will have to pay

What happened at the end of previous Stamp Duty Holidays?

For those who may be interested, we have looked at the empirical evidence behind previous Stamp Duty Holidays and we set out our forecast for what might happen at the end of this one. You can read what we found here: Stamp Duty Holidays past and present

How have Stamp Duty Rates changed over time?

We have put a schedule together showing how Stamp Duty Rates have changed since August 1972 to the current time and what they are scheduled to change to on 1 April 2021